Venteur

Founded Year

2020Stage

Series A | AliveTotal Raised

$27.72MLast Raised

$20M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-3 points in the past 30 days

About Venteur

Venteur specializes in health insurance solutions with a focus on Individual Coverage Health Reimbursement Arrangements (ICHRA) within the healthcare industry. The company offers platforms that allow employers to provide health benefits to their employees and assist employees in creating health portfolios. Venteur's services integrate with payroll systems, providing options for businesses. Venteur was formerly known as BeneSwyft. It was founded in 2020 and is based in San Francisco, California.

Loading...

Venteur's Product Videos

ESPs containing Venteur

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The ICHRA platforms market consists of companies that offer software to provide individual coverage health reimbursement arrangement (ICHRA) plans. Most ICHRA platforms facilitate payments between employees (sponsored by their employers) and health insurers. ICHRA platforms typically offer employers online portals to administer ICHRA plans, with many companies also offering complimentary portals f…

Venteur named as Highflier among 13 other companies, including Gravie, Sureco, and Thatch.

Loading...

Research containing Venteur

Get data-driven expert analysis from the CB Insights Intelligence Unit.

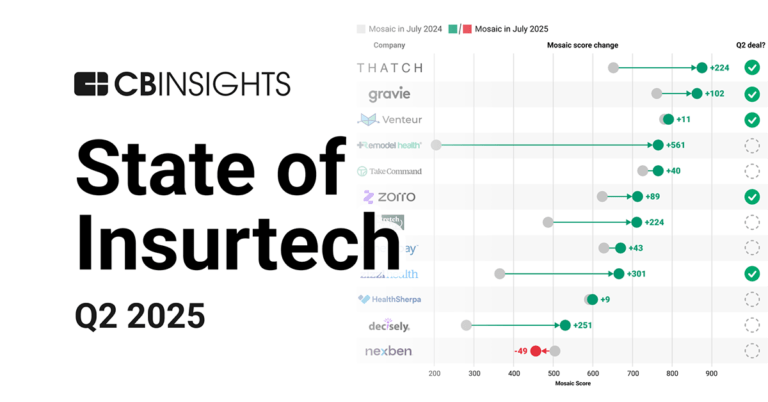

CB Insights Intelligence Analysts have mentioned Venteur in 2 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Aug 7, 2025 report

State of Insurtech Q2’25 ReportExpert Collections containing Venteur

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Venteur is included in 7 Expert Collections, including HR Tech.

HR Tech

6,137 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Insurtech

3,403 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50

100 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Artificial Intelligence (AI)

20,894 items

Latest Venteur News

Oct 20, 2025

Dan Mendelson is expert in business and policy in healthcare. Follow Author Share Save Employers in the U.S. are facing the steepest health care cost spike in 15 years – with a wave of actuarial reports predicting an average 9 to 9.5 percent jump next year. This trend is starting to feel inevitable for many employers, and several factors are making it more severe for 2026. Demand for innovative (yet expensive) medications, such as GLP-1 drugs for weight loss and specialty drugs in cancer therapy, is soaring. Hospital and provider prices continue to climb, and health care inflation is accelerating. Utilization is up, too, as more working-age Americans seek care for chronic conditions. And the pain doesn’t stop at the company ledger. For the first time ever, the average employee’s share of health care costs – including premiums, deductibles, copays, and other out-of-pocket expenses – could surpass $5,000 next year. That’s the equivalent to five months of groceries for the typical American family. This cycle is not sustainable. Employers have largely absorbed these costs and considered passing them off to employees as a last resort. This year, many are signaling a shift: higher paycheck deductions, increased cost-sharing, and reduced benefits are on the horizon for millions of American workers. This is compounded by an already complex labor environment, where many businesses are facing difficulties in filling jobs or retaining talent. However, cost increases without commensurate improvements to quality or access cannot be accepted by employers as the norm. Employers do have options and can mitigate these costs while prioritizing higher quality care for employees. Take JPMorganChase. The firm invests nearly $3 billion annually in health care for approximately 285,000 employees and families. Even with this scale and reach, we anticipate a 10% increase in costs for 2026. To help manage these expenses, the company is focused on connecting employees with primary care and preventive screenings, aiming to reduce emergency room visits, curb chronic disease, and achieve long-term savings. Because this longer-term approach may not be realistic for every business, especially those feeling the immediate squeeze of rising health care costs, there are a range of other options. Consider smaller businesses, which employ 45-50% of the private-sector workforce and are so critical to the U.S. economy. For them, the health care cost trend presents far more than a budget issue. With less bargaining power and fewer options, smaller employers are especially vulnerable to these surges. What’s more, an increasing number of small business leaders report that the ability to offer affordable, quality health benefits is core to their culture and ability to grow and compete with larger counterparts. MORE FOR YOU These businesses require health care choices that offer immediate flexibility and stabilize costs. Alternative health plan design can address that need – and offer near-term results. For example, Morgan Health portfolio company Centivo offers employees access to a curated, narrower network backed by high-performing providers (thereby controlling costs for employers). Venteur, another Morgan Health portfolio company, allows employers to set a health care contribution through an ICHRA, or individual coverage health reimbursement arrangement, that fits their budget, rather than leaving them to absorb cost increases year after year. The typical small business leader is responsible for product, compliance and people management and typically doesn’t have a dedicated benefits team. We also hear that they often don’t know how to navigate health care and need more tailored support in researching and vetting new innovations, like ICHRAs. Recognizing this gap, Morgan Health created the Small Business Health Care Hub in collaboration with Chase for Business, which serves 7 million small businesses nationwide. Our goal is to help small and mid-sized businesses demystify health insurance and empower them to confidently understand their options. Now, more than ever, it’s critical for business leaders to understand their options. Don’t simply default to cost-shifting or benefit reductions. Explore innovative plan designs, scrutinize vendor contracts, and seek out solutions that balance affordability with quality care. Our health care choices shape the well-being and financial security of the American workforce and the next generation.

Venteur Frequently Asked Questions (FAQ)

When was Venteur founded?

Venteur was founded in 2020.

Where is Venteur's headquarters?

Venteur's headquarters is located at 595 Pacific Avenue, San Francisco.

What is Venteur's latest funding round?

Venteur's latest funding round is Series A.

How much did Venteur raise?

Venteur raised a total of $27.72M.

Who are the investors of Venteur?

Investors of Venteur include Plug and Play, Houghton Street Ventures, Revelry Venture Partners, Informed Ventures, Catalyst by Wellstar and 13 more.

Who are Venteur's competitors?

Competitors of Venteur include BenefitBay and 5 more.

Loading...

Compare Venteur to Competitors

Take Command Health specializes in health reimbursement arrangements (HRAs) within the financial technology sector. The company provides HRA administration software that enables businesses of various sizes to reimburse employees for health insurance tax-free. Take Command Health's main offerings include QSEHRA administration for small businesses and ICHRA administration for companies of any size, aiming to offer flexible and affordable health benefits. It was founded in 2014 and is based in Richardson, Texas.

zizzl health specializes in providing Individual Coverage Health Reimbursement Arrangement (ICHRA) solutions within the health insurance sector. The company offers a platform that assists employers in managing health benefits, enabling them to provide customizable health insurance options to their employees without the administrative burden typically associated with traditional plans. zizzl health was formerly known as zizzl. It was founded in 2016 and is based in Milwaukee, Wisconsin.

Zorro is a company that provides solutions within the health benefits industry. The company offers a platform that allows employers to set individual benefits budgets for employees, who can then choose their health benefit bundles. Zorro primarily serves the employer and employee sectors, focusing on a health benefits system. It was founded in 2022 and is based in Beachwood, Ohio.

BenefitBay provides a range of ICHRA administration platforms within the health benefits sector. Its offerings include a platform that allows employers to reimburse employees for individual health plans while maintaining tax advantages and tools to support simplified benefits deployment and compliance. Its services are primarily utilized by brokers and their clients in the health benefits industry. It was founded in 2021 and is based in Omaha, Nebraska.

StretchDollar focuses on providing health benefits solutions for small businesses within the insurance industry. The company offers a platform where small businesses can set a budget and match their employees with personalized health plans, simplifying the process of obtaining small business health insurance. StretchDollar primarily serves the small business sector with its health benefits services. It was founded in 2023 and is based in San Francisco, California.

The ICHRA Shop Insurance Agency is a company that specializes in the insurance sector, with a particular focus on Individual Coverage Health Reimbursement Arrangements (ICHRA). The company offers services such as ICHRA consulting, enrollment support, and compliance tools, helping employers reimburse employees for individual health insurance premiums and medical expenses in a tax-free manner. The ICHRA Shop Insurance Agency primarily serves the insurance industry, with a specific focus on employers and insurance brokers. It was founded in 2019 and is based in Denver, Colorado.

Loading...