Vise

Founded Year

2016Stage

Series C | AliveTotal Raised

$126.55MValuation

$0000Last Raised

$65M | 5 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+9 points in the past 30 days

About Vise

Vise is an asset manager that creates and manages investment portfolios for financial advisors. The company provides portfolio management solutions that include tax-loss harvesting, investment strategies, and insights to inform investment decisions. Vise serves independent Registered Investment Advisors (RIAs) and RIA aggregators, providing them with tools for their practices. It was founded in 2016 and is based in New York, New York.

Loading...

Vise's Product Videos

_thumbnail.png?w=3840)

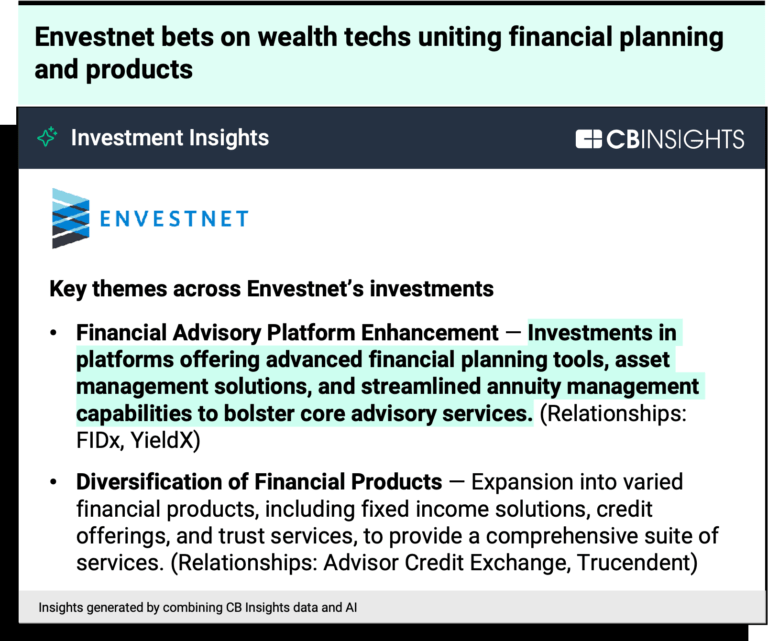

ESPs containing Vise

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The B2B robo-advisors market offers automated portfolio creation services to financial institutions, such as banks, wealth managers, and other financial advisors. The robo advisor-as-a-service market is driven by the growing demand for low-cost, automated investment solutions that can help individuals and institutions manage their portfolios more efficiently and effectively. These solutions need m…

Vise named as Outperformer among 13 other companies, including DriveWealth, Betterment, and Wealthfront.

Vise's Products & Differentiators

Portfolio Construction and Transition Analysis

Vise gives financial advisors a high level of control, flexibility, and automation to build fully customized portfolios. At its core is Portfolio Creator—a guided workflow that supports onboarding via integrations with all major custodians (e.g., Schwab, Fidelity, etc.), third-party systems like Orion, or AI-powered PDF parsing. Advisors can lock holdings, set restrictions, define cash allocations, and build portfolios using ETFs, direct indexing, structured products, or Vise’s proprietary factor models. The platform supports home office and custom models with granular customization, including exclusions by company, sector, or values. Advisors can then create tax efficient transition scenarios & generate client ready PDF's comparing the existing vs. target portfolio.

Loading...

Research containing Vise

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Vise in 2 CB Insights research briefs, most recently on Sep 27, 2024.

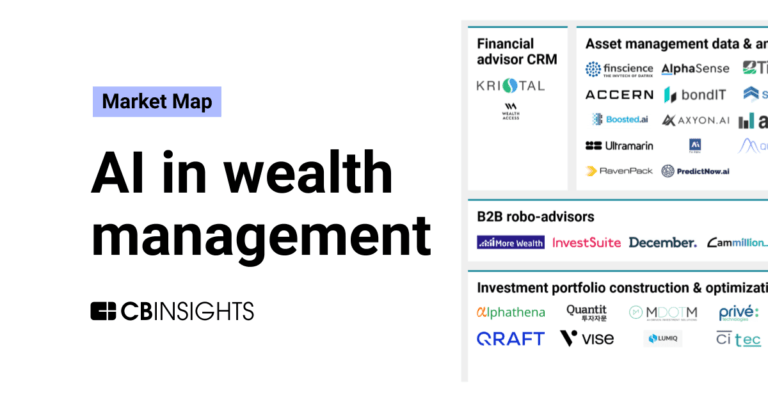

Oct 6, 2023

The AI in wealth management market mapExpert Collections containing Vise

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Vise is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Artificial Intelligence (AI)

20,629 items

Latest Vise News

Sep 30, 2025

NEW YORK--(BUSINESS WIRE)--Vise surpasses $30B and partners with Bitwise to bring crypto to RIAs in one unified investment platform.

Vise Frequently Asked Questions (FAQ)

When was Vise founded?

Vise was founded in 2016.

Where is Vise's headquarters?

Vise's headquarters is located at 521 Broadway, New York.

What is Vise's latest funding round?

Vise's latest funding round is Series C.

How much did Vise raise?

Vise raised a total of $126.55M.

Who are the investors of Vise?

Investors of Vise include Sequoia Capital, Ribbit Capital, Michael Ovitz, Greenoaks, Nikesh Arora and 25 more.

Who are Vise's competitors?

Competitors of Vise include GeoWealth, Brooklyn Investment Group, Fundment, Aisot Technologies, Pebble and 7 more.

What products does Vise offer?

Vise's products include Portfolio Construction and Transition Analysis and 2 more.

Loading...

Compare Vise to Competitors

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

Advisor360 is a company that provides digital wealth management software for the financial services industry. Their main services include a wealth management platform that supports operations for financial advisors, facilitates client-advisor interactions, and addresses regulatory compliance. The company serves sectors including bank wealth management, insurance broker-dealers, independent broker-dealers, and RIA aggregators and roll-ups. It was founded in 2019 and is based in Weston, Massachusetts.

Magnus is a company operating in the financial technology sector that provides investment management services. It offers a platform that includes portfolio optimization, construction, rebalancing, and reporting, designed for individual and institutional investors. Magnus serves individual investors, portfolio advisors, and banks with quantitative tools. Magnus was formerly known as Akıllıfon. It was founded in 2018 and is based in Izmir, Turkey.

FNZ operates in the wealth management sector, providing a platform that combines technology with business and investment operations within the financial services industry. The company offers a wealth management platform that aims to facilitate the investment process for financial institutions and wealth managers. FNZ serves the wealth management sector, partnering with financial institutions and wealth managers to manage a substantial amount of assets under administration. It was founded in 2003 and is based in Edinburgh, United Kingdom.

Wealthfront specializes in wealth management and robo-advisory services. The company offers automated investing portfolios, cash accounts, and direct stock investing. Wealthfront serves individual investors looking for financial management and investment options. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Ellevest is a financial services company that focuses on wealth accumulation and financial guidance with a specialization in serving women. The company offers online investing services, financial planning, and private wealth management tailored to address gender-specific financial challenges and goals. Ellevest primarily caters to individuals seeking personalized investment strategies and financial planning, with a particular emphasis on the unique financial needs of women. Ellevest was formerly known as Ellevate Financial, Inc.. It was founded in 2014 and is based in New York, New York.

Loading...