Wayve

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$1.337BMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About Wayve

Wayve focuses on developing embodied AI for autonomous vehicles in the automotive technology sector. The company provides AI technology that allows vehicles to perceive, predict, and navigate dynamic environments, adjusting to human behavior and handling unexpected situations without relying on high-definition maps. Wayve serves the automotive industry, offering solutions to automakers for implementing various levels of driving automation. It was founded in 2017 and is based in London, England.

Loading...

ESPs containing Wayve

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The world model AI developers market refers to the segment of the artificial intelligence industry focused on building models that simulate and predict how environments change over time. These models enable AI systems to understand spatial relationships, physical interactions, and cause-and-effect, allowing them to plan ahead, and anticipate outcomes. This market is driven by the growing need for …

Wayve named as Leader among 15 other companies, including Microsoft, Meta, and NVIDIA.

Loading...

Research containing Wayve

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Wayve in 10 CB Insights research briefs, most recently on Oct 20, 2025.

Oct 20, 2025 report

Book of Scouting Reports: 2025’s Digital Health 50

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025

Expert Collections containing Wayve

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Wayve is included in 5 Expert Collections, including Auto Tech.

Auto Tech

2,663 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Supply Chain & Logistics Tech

4,664 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Artificial Intelligence (AI)

14,182 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

AI 100 (2025)

100 items

AI 100 (All Winners 2018-2025)

100 items

Wayve Patents

Wayve has filed 6 patents.

The 3 most popular patent topics include:

- casting (manufacturing)

- footwear

- plastics industry

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/14/2022 | 3/26/2024 | Social networking services, Social media, Video on demand services, Videotelephony, Virtual communities | Grant |

Application Date | 4/14/2022 |

|---|---|

Grant Date | 3/26/2024 |

Title | |

Related Topics | Social networking services, Social media, Video on demand services, Videotelephony, Virtual communities |

Status | Grant |

Latest Wayve News

Nov 13, 2025

Japanese Investors Pour $38 Billion Into European Tech Startups Dana LeighNovember 13, 2025 As Europe continues to evolve into one of the world’s most exciting startup hubs , capital is flowing in from all corners of the world. One of the most surprising? Japan. Whilst the UK and Europe have traditionally looked to raise funds from economies like the US, Japanese investors are slowly driving forward Europe’s deeptech sector. From AI to robotics and quantum computing, Japanese investors are piling in to get a piece of the action. But why? According to new research from NordicNinja VC and Dealroom, as reported by CNBC, Japanese investors have taken part in funding rounds worth more than €33 billion ($38 billion) since 2019. This increase is over 5 times more than before the 2019 trade deal between the EU and Japan came into play. The EU-Japan Economic Partnership Agreement (EPA) was designed to create one of the world’s largest free trade zones by reducing tariffs, making exports easier and facilitating movement of business people. At the time, Japan hadn’t invested much in European startups, but since then, a wave of corporates, including Mitsubishi, Sanden, Yamato Holdings and Marunouchi Innovation Partners, have started backing European startups directly according to CNBC. Japanese-linked VC firms like NordicNinja, Byfounders, and Toyota ’s Woven Capital have also come in for a piece of the action. And, according to Tomosaku Sohara, co-founder and managing partner at NordicNinja, SoftBank’s acquisition of Finnish gaming company Supercell was a turning point when it came to Japan playing a bigger role in Europe’s tech ecosystem. Japan’s interest in Europe comes at a time when it is grappling with its own economic growth. With an aging population and projected growth of less than 1% this year, it’s no surprise that investors are looking outwards. It’s also driven by geopolitical reasons. With political uncertainty between the US and China, Japan is looking to build its own alliances and potentially act at the main bridge to major Asian markets. One of the main sectors catching Japanese investors’ eyes is Europe’s deeptech scene. According to CNBC, in 2024, 70% of Japanese-linked deals in Europe were in deep tech and artificial intelligence, driving further interest in sectors like AI, energy and defence tech. Some of the top-funded companies with Japanese investment included: Wayve, the UK’s autonomous driving startup, which raised $1.05 billion in May 2024. Quantinuum, the Cambridge-based quantum computing firm, which secured €273 million in January 2024. Multiverse Computing, a Spanish company that applies quantum algorithms to finance and energy, which raised €189 million in June 2025. These rounds were backed by big Japanese named like Softbank, Mitsui and Toshiba. But one of the reasons that deeptech attracts so much capital is that it actually needs it. Deeptech startups need both capital and technical expertise to scale, this can be hard to find in Europe, but feels a natural match with Japan’s industrial giants. But with such big cultural differences between the two regions, securing investment isn’t always easy. Language barriers are one part of the equation, with only 20% – 30% of Japanese adults having some understanding of English. This can make negotiations difficult, especially when it comes to complicated investments. Japanese investors are also, in general, slightly more risk averse. As Europe has had longer to build trust in its startup ecosystem, investors are generally more at ease with taking risks. Japanese investors however, who have become more used to the predictable nature of big corporates, tend to be more methodical. This can mean slower fundraises and more time spent face-to-face, which can be very time intensive for founders. Japanese investment in Europe is expected to reach around €3 billion in 2025 according to Ninja and Dealroom’s report, although interest is definitely growing. With governments on both sides working on easier collaboration, founders across Europe could soon see even more capital coming in from Japanese funds. For Europe, it’s a great sign of confidence in its startup ecosystem and a way to diversify away from the US. For Japan, these investments could help them capitalise on European growth, especially as their economy struggles to grow. And who knows? Maybe the next generation of European deeptech startups will be built with Japanese capital. We will wait and see. Related Articles

Wayve Frequently Asked Questions (FAQ)

When was Wayve founded?

Wayve was founded in 2017.

Where is Wayve's headquarters?

Wayve's headquarters is located at 230-238 York Way, London.

What is Wayve's latest funding round?

Wayve's latest funding round is Series C - II.

How much did Wayve raise?

Wayve raised a total of $1.337B.

Who are the investors of Wayve?

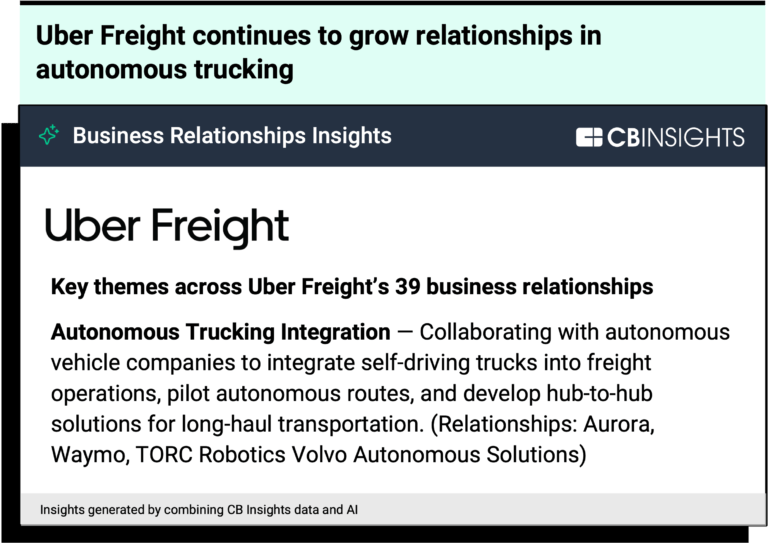

Investors of Wayve include Uber, Microsoft, NVIDIA, SoftBank, Tech Nation Future Fifty and 37 more.

Who are Wayve's competitors?

Competitors of Wayve include Forterra, Helm.ai, Applied Intuition, Imagry, Oxa and 7 more.

Loading...

Compare Wayve to Competitors

STRADVISION is a company specializing in AI-inspired perception technology within the automotive industry. Its main product, SVNet, employs deep learning to enable vehicles to detect and understand their surroundings in real-time, supporting a variety of Advanced Driver Assistance Systems (ADAS) across different chipsets. STRADVISION's technology is designed to operate with minimal computing power and energy consumption. It was founded in 2014 and is based in Pohang-si, South Korea.

Phantom AI specializes in autonomous vehicle technology and operates within the automotive industry. The company offers a modular, software-based stack for autonomous vehicles, which includes computer vision, sensor fusion, and control systems designed to enhance vehicle automation. Phantom AI primarily serves Tier 1 automotive manufacturers looking to implement advanced driver-assistance systems (ADAS) and prepare for full autonomy. It was founded in 2016 and is based in Mountain View, California.

Applied Intuition focuses on vehicle software development and simulation for the automotive and transportation industries. The company provides tools for developing, testing, and validating driver-assistance systems (ADAS) and automated driving (AD) technologies, along with a platform for managing vehicle software. Applied Intuition serves sectors including automotive, trucking, defense, construction, mining, and agriculture. It was founded in 2017 and is based in Mountain View, California.

Imagry is an autonomous driving software provider that specializes in HD-mapless, AI-based driving systems for the automotive industry. The company offers a software solution that enables vehicles to navigate roads autonomously without relying on high-definition maps, using real-time vision-based perception and deep neural networks to imitate human driving behavior. Imagry's technology is hardware agnostic, self-sufficient, and can be adapted to various locations and applications, including passenger vehicles, buses, and shuttles. It was founded in 2015 and is based in Haifa, Israel.

Comma specializes in artificial intelligence (AI) driven automotive technology within the transportation sector. The company offers an AI upgrade for vehicles, enabling features such as lane centering, adaptive cruise control, and dashcam recording. Their products provide compatibility with a wide range of car models. It was founded in 2016 and is based in San Diego, California.

Nauto provides Artificial Intelligence (AI)-powered safety and operations solutions for commercial fleets across industries. It offers products that include predictive collision alerts, real-time driver behavior alerts, and a platform for coaching. Its solutions focus on reducing collisions and costs while managing claims and ensuring driver privacy. It was founded in 2015 and is based in Sunnyvale, California.

Loading...