Wonder

Founded Year

2018Stage

Series B - III | AliveTotal Raised

$2.4BValuation

$0000Last Raised

$600M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+71 points in the past 30 days

About Wonder

Wonder operates as a food delivery service providing a selection of restaurants delivering meals to customers' doors. Customers have the option to order from multiple restaurants in a single order. Wonder was formerly known as Remarkable Foods. It was founded in 2018 and is based in New York, New York.

Loading...

ESPs containing Wonder

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The ghost kitchen providers market, also known as virtual kitchens, cloud kitchens, or dark kitchens, offers infrastructure, technology, and operational services for delivery-only food businesses. These companies provide kitchen facilities in diverse locations (warehouses, parking lots, industrial spaces) with technology platforms that optimize food preparation, order management, and delivery logi…

Wonder named as Highflier among 15 other companies, including Rebel Foods, Kitchen United, and Kitopi.

Loading...

Research containing Wonder

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Wonder in 1 CB Insights research brief, most recently on May 16, 2024.

May 16, 2024 report

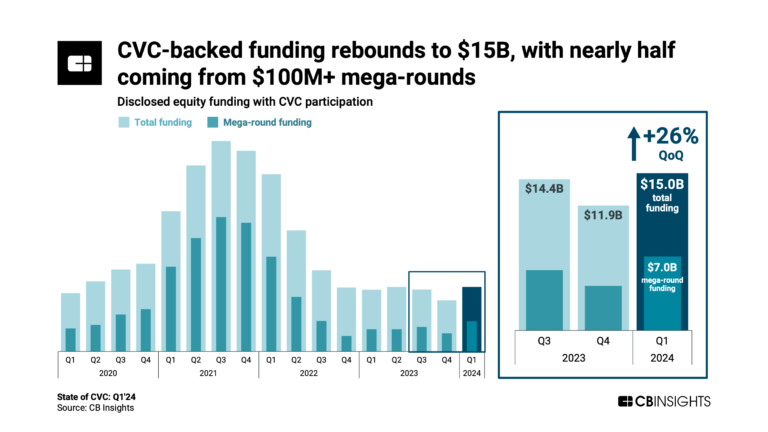

State of CVC Q1’24 ReportExpert Collections containing Wonder

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Wonder is included in 5 Expert Collections, including Restaurant Tech.

Restaurant Tech

1,075 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, cloud kitchens, and more. On-demand food delivery services are excluded from this collection.

Unicorns- Billion Dollar Startups

1,297 items

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

Food & Meal Delivery

1,605 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Supply Chain & Logistics Tech

586 items

Latest Wonder News

Nov 10, 2025

Tech Check: CEO Marc Lore says the robotics company will allow Wonder to automate much of the kitchen while also expanding its restaurant selection and lowering prices. It's part of the company's goal to "make great food more accessible." By Joe Guszkowski on Nov. 10, 2025 Wonder just took a key step in its plans to automate more of its restaurant business. With its deal to acquire robotics company Spyce from Sweetgreen , the ever-expanding “mealtime platform” is adding a bowl-making robot to its collection of products and services. That list also includes Grubhub, Blue Apron, the food media company Tastemade, and a chain of 83 brick-and-mortar stores that serve food from 29 different restaurant concepts. Spyce’s robot, which is currently churning out salads and grain bowls at more than 20 Sweetgreen locations, will make its way into Wonder’s kitchens starting with a test in New York City next year, followed by 50 to 100 installations in 2027. The bot will produce the salads, burrito bowls and Greek bowls that Wonder sells under brands like Royal Greens and Limesalt. But that robot, a high-tech conveyor belt that Sweetgreen calls the Infinite Kitchen , is just the tip of the iceberg in terms of what Wonder believes Spyce will do for its business long-term. “The thing that excites us more than just the technology as it is, is the team,” said Marc Lore, Wonder’s founder and CEO, in an interview. Spyce was founded in Cambridge, Massachussetts, in 2015 and is still run by its co-founders, Michael Farid, Kale Rogers, Brady Knight and Luke Schlueter. They will join Wonder as part of the acquisition. “They’re going to help us create new equipment in the back-of-house that not only will be more efficient, more accurate, more consistent, but equally as important, allow us to, instead of having 30 restaurants in a 21,000-square-foot kitchen, to have 100 or more restaurants, and instead of 540 unique meals, to have literally thousands of unique meals,” Lore said. A wide selection has always been part of Wonder’s playbook because it expands the company’s potential audience and helps cancel out veto votes from groups and families. But there are only so many different recipes a single restaurant can serve without automating, Lore said. For instance, with Spyce’s help, Wonder plans to build a sauce machine that will be able to produce “close to 90% of sauce recipes on the market,” allowing it to offer more cuisine types and also give customers more degrees of customization. In a traditional restaurant, "being able to make a sauce on demand is not possible, right?" Lore said. "You can't have thousands of different sauce combinations and ask people to do that on the fly." Wonder is already using conveyor belts and robotic arms to move meals from the kitchen to the front-of-house for delivery or pickup. Down the line, Wonder wants to use Spyce to automate almost everything else in the back, including woks, beverages, fryers and even its high-speed ovens. Much of Wonder’s food is prepped in a commissary and delivered to its restaurants, but from there, Lore envisions robots picking items out of cold storage and moving them to the specified appliance for cooking. The addition of all of those robots will not mean fewer humans in Wonder’s kitchens, Lore said. There will still be jobs for them to do, but they’ll be different from the usual restaurant tasks like dropping fryer baskets or flipping burgers. “For example, you can imagine the employees standing still in front of a modified station, where a conveyor comes in front of the person and brings all the things that they need to do the final assembly,” he said. “So maybe on a conveyor track, you would see the burger and then the bun and the lettuce and the tomato, and the person would make the burger.” They’d then put the burger in a carton, and a robot would take it off the conveyor belt and place it in a cubby to be bagged and sent on its way. Lore said humans will also be needed to clean the robots and keep them stocked with ingredients, assuming they’re not being automatically refilled already. There may also be in-between steps, like opening packaging or putting a steak in a pan, that would be best suited for human hands. “It’s just going to be a trade-off where if we think we’re sacrificing consistency, accuracy or throughput, then we try to automate it,” he said. “But if it’s not, again, because it’s not about saving labor, I think we would prefer to have humans in there to stand in between certain areas.” Automation has long intrigued restaurant operators for its potential to lower labor costs and boost efficiency. But outside of Sweetgreen and a small handful of other brands, adoption has been limited. Cost is a factor, along with the slow progress of the technology itself and the operational disruption it can create. But Wonder likes to move fast. Acquiring technology that has already been commercialized, rather than developing robots on its own, has allowed Wonder to accelerate its automation timeline by five to seven years, Lore said. It now plans to have a fully automated prototype location by the first quarter of 2027. This level of automation would be a big step toward the company’s ultimate goal, which is to make high-quality food more accessible. As mentioned above, robots will allow Wonder to greatly expand its restaurant and food options in a way that would not be possible at a traditional restaurant. “So like that sauce machine as an example, we’re adding a tremendous amount of complexity without any errors,” he said. “And that’s always the trade-off with the restaurant. You add more complexity, you get more errors, right?” That vast restaurant selection in a single box will in turn enable Wonder to open locations where it otherwise wouldn’t, like in suburban areas that are less densely populated, Lore said, making its food available to more people. Automation will also allow the restaurants to stay open later—2 a.m. in the suburbs and 5 a.m. in the city—providing meal options for night owls or people who work late. “There’s a lot of people that are on different schedules, working at hospitals and things, and they’re forced to eat only fast food,” Lore said. “We think this has the opportunity to really impact the health of Americans through making great food more accessible.” But the biggest impact of robotics, he said, will be on Wonder’s prices. Spyce’s bowl-maker, for instance, will allow Wonder to produce bowls and salads with no labor. “We’re going to be able to lower the prices and give a lot of those labor savings back to the customer,” Lore said. At the same time, automation and a larger selection will allow Wonder to generate 3 times as much volume per location with the same number of employees, he said. Wonder also sees a market for Spyce’s robots outside of its own restaurants, in places like college campuses, hospitals, hotels and office parks. It will look to sell the robots to those venues, just as it will continue to do for Sweetgreen. As for manufacturing all of those robots, Lore said Sweetgreen/Spyce already has a strong system in place. “We could produce hundreds of these machines per year right now,” he said. Meanwhile, Wonder continues to open new storefronts at a rapid clip around the Northeast. It is on track to finish the year with 92 locations, two more than it originally expected. It plans to more than double that number next year, to 200. And it will also add six new restaurants to its lineup in 2026 for a total of 35. Lore acknowledged that it can be challenging to maintain food quality as a restaurant scales, especially at the pace Wonder is going. But he said the company has made improvements to the cooking process for its burgers and pizza, resulting in a “materially better” product that will begin rolling out next year. “The food quality, as we scale, is getting better, which is not always typical,” he said. Recently, Wonder partnered with New York-based sushi chain Happy Tuna to offer sushi from its Park Slope location. It’s the first brand on Wonder’s menu that the company does not own, and within a week, it had become that store’s top-seller. Lore said Wonder will pursue more partnerships like this for cuisines that don’t fit as naturally into Wonder’s model, like deli sandwiches, bagels and Indian dosas. Those would be in addition to the dozens of restaurants Wonder plans to add once it begins to outfit its kitchens with a team of robots. “People sometimes say 100 [concepts] sounds like a lot, but when you start going through it … there are a lot of different food concepts out there,” Lore said. “We don’t have sausage and hot dogs. We don’t have a Portillo’s competitor or anything like that. The list goes on and on.”

Wonder Frequently Asked Questions (FAQ)

When was Wonder founded?

Wonder was founded in 2018.

Where is Wonder's headquarters?

Wonder's headquarters is located at 150 Greenwich Street, New York.

What is Wonder's latest funding round?

Wonder's latest funding round is Series B - III.

How much did Wonder raise?

Wonder raised a total of $2.4B.

Who are the investors of Wonder?

Investors of Wonder include NEA, Accel, Google Ventures, Forerunner Ventures, American Express Ventures and 21 more.

Who are Wonder's competitors?

Competitors of Wonder include Bite, Hosted Kitchens, Kitopi, Zing, Georgie & Tom's and 7 more.

Loading...

Compare Wonder to Competitors

Nanuda Kitchen focuses on providing financial information and support services to small businesses and self-employed entrepreneurs. The company offers guidance on government subsidies, credit card fee refunds, and financial investment strategies without using technical jargon. Nanuda Kitchen also provides tools and consulting services for customer and reservation management, sales analysis, and marketing, particularly for beauty salons. It is based in Seoul, South Korea.

All Day Kitchens provides a solution for the restaurant and retail sectors, focusing on omnichannel food brands. Their offerings include a package that integrates technology, equipment, and supply chain management to facilitate food sales across multiple channels and dayparts. The company serves the restaurant and convenience store industries, offering automated cooking equipment, no-prep ingredients, and menus designed by professional chefs to support in-store and online operations. All Day Kitchens was formerly known as Virtual Kitchen Company. It was founded in 2018 and is based in South San Francisco, California.

SENTOEN develops Kitchen BASE, a shared cloud kitchen composed of independent kitchen facilities, cooking equipment and community space.

Jike Alliance is a shared kitchen operator out of Shanghai, China.

Kitchen United provides restaurant hub technology, streamlined logistics, and commercial kitchen space to empower food service operators. It also offers a value-driven, low-risk way for emerging and established restaurant brands to enter into new markets, grow revenue through off-premises dining, and expand delivery areas. It was founded in 2017 and is based in Pasadena, California.

Panda Selected is an internet catering service and shared-kitchen platform. Panda Selected provides kitchen facilities, operation management, supply chain and brand promotion for catering enterprises, enabling kitchens to cater exclusively for customers ordering in, and share facilities with others which greatly eliminates overhead costs.

Loading...