xAI

Founded Year

2023Stage

Series D - II | AliveTotal Raised

$42.437BLast Raised

$7.5B | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+25 points in the past 30 days

About xAI

xAI focuses on artificial intelligence, specifically in the domain of language learning models. The company's main product, Grok, is designed to answer questions and suggest potential inquiries, functioning as a research assistant that helps users find information online. xAI primarily caters to the artificial intelligence (AI) research community and the general public seeking AI tools for information retrieval and understanding. It was founded in 2023 and is based in Palo Alto, California.

Loading...

Loading...

Research containing xAI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

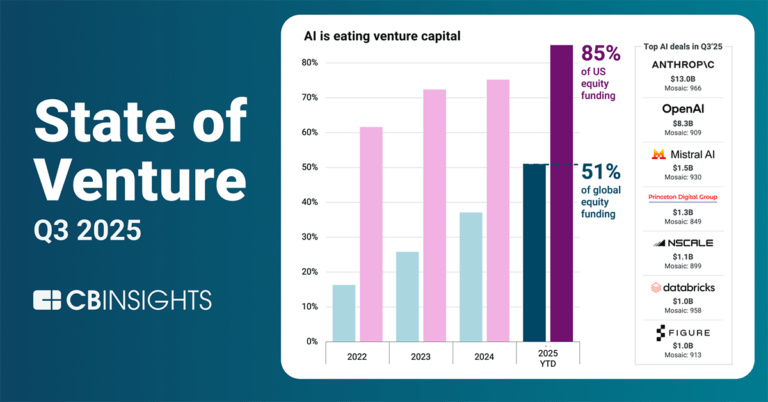

CB Insights Intelligence Analysts have mentioned xAI in 26 CB Insights research briefs, most recently on Nov 5, 2025.

Oct 15, 2025 report

State of Venture Q3’25 Report

Sep 10, 2025 report

Book of Scouting Reports: Industrial AI Agents & Copilots

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

Aug 14, 2025 report

Book of Scouting Reports: Enterprise AI Agents

Aug 14, 2025

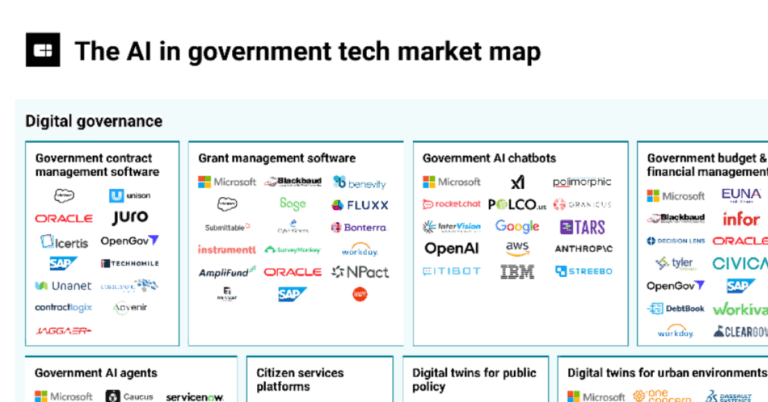

310+ AI companies transforming governmentExpert Collections containing xAI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

xAI is included in 5 Expert Collections, including Artificial Intelligence (AI).

Artificial Intelligence (AI)

37,333 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Unicorns- Billion Dollar Startups

1,297 items

AI agents (March 2025)

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

AI agents & copilots

1,771 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

xAI Patents

xAI has filed 1 patent.

The 3 most popular patent topics include:

- artificial neural networks

- bioinformatics

- classification algorithms

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/13/2024 | Machine learning, Classification algorithms, Statistical classification, Artificial neural networks, Bioinformatics | Application |

Application Date | 2/13/2024 |

|---|---|

Grant Date | |

Title | |

Related Topics | Machine learning, Classification algorithms, Statistical classification, Artificial neural networks, Bioinformatics |

Status | Application |

Latest xAI News

Nov 11, 2025

Big Tech AI Costs: Bond Market Fears Rise Big Tech’s AI Ambitions Fuel Debt Concerns and Bond Market Volatility A surge in artificial intelligence investment by major technology companies is triggering anxieties among investors, extending beyond equity markets and now impacting the bond market. Companies like Meta and xAI, owned by Elon Musk, are increasingly turning to off-balance-sheet financing to fund their ambitious AI projects, raising questions about long-term financial stability and the sustainability of the current AI boom. This shift towards debt is not merely a financial maneuver; it signals a potential recalibration of risk assessment in the tech sector. The escalating costs associated with building and maintaining the infrastructure required for AI – particularly massive data centers – are a primary driver of this trend. JPMorgan estimates that the AI data center boom could inject $5 trillion into debt markets, creating a widespread ripple effect. This demand for capital is coinciding with a period of higher interest rates, making debt financing more expensive and potentially more precarious for companies heavily reliant on it. The Rising Tide of AI Debt: A Deeper Look For years, Big Tech companies enjoyed a position of financial strength, fueled by substantial profits and relatively low borrowing costs. However, the current AI race demands unprecedented levels of investment. Developing and deploying advanced AI models requires not only cutting-edge hardware but also massive amounts of data and specialized talent – all of which come at a significant price. The move towards off-balance-sheet financing, as seen with Meta and xAI, allows companies to fund AI expansion without immediately impacting their reported debt levels. However, this practice doesn’t eliminate the underlying financial risk; it merely shifts it elsewhere. Investors are beginning to scrutinize these arrangements, fearing that they could mask a growing debt burden and potentially lead to financial strain down the line. Furthermore, the concentration of AI investment in a handful of companies raises concerns about systemic risk. If one or more of these companies were to encounter financial difficulties, the consequences could reverberate throughout the entire tech sector and beyond. This is particularly true given the interconnectedness of the modern financial system. The bond market’s reaction to these developments is a clear indication of growing investor unease. Increased borrowing costs and widening credit spreads reflect a heightened perception of risk associated with Big Tech’s AI spending. This trend could further constrain investment and potentially slow down the pace of AI innovation. What impact will this increased reliance on debt have on the long-term innovation cycle in the AI space? And how will regulators respond to the growing concerns about systemic risk in the tech sector? Pro Tip: Diversifying your investment portfolio can help mitigate the risks associated with concentrated exposure to the tech sector, especially during periods of heightened uncertainty. The implications extend beyond the financial realm. The energy demands of these data centers are substantial, raising environmental concerns and putting a strain on power grids. Addressing these challenges will require innovative solutions and a commitment to sustainable practices. External links to authoritative sources: What is off-balance-sheet financing and why are companies using it for AI investments? Off-balance-sheet financing allows companies to fund projects without directly increasing their reported debt levels, often through leasing or special purpose entities. Companies are using it for AI investments to maintain a favorable appearance on their financial statements while still pursuing ambitious projects. How does the AI data center boom impact debt markets? The AI data center boom requires massive capital investment, leading to increased demand for debt financing. JPMorgan estimates this could add $5 trillion to debt markets, potentially impacting interest rates and credit availability. What are the risks associated with Big Tech’s increasing reliance on debt? Increased debt levels raise concerns about financial stability, particularly if AI investments don’t generate sufficient returns. It also increases systemic risk, as difficulties for one company could impact the entire sector. Is the bond market reacting to the increased AI spending by tech companies? Yes, the bond market is showing signs of unease, with increased borrowing costs and widening credit spreads reflecting a heightened perception of risk associated with Big Tech’s AI investments. What role does sustainability play in the AI investment landscape? The energy demands of AI data centers are substantial, raising environmental concerns. Sustainable practices and innovative energy solutions are crucial to mitigating the environmental impact of the AI boom. The current situation underscores the need for careful financial management and a realistic assessment of the risks and rewards associated with AI investment. As the AI landscape continues to evolve, investors and regulators will need to remain vigilant and adapt to the changing dynamics of this rapidly growing sector. Share this article with your network to spark a conversation about the financial implications of the AI revolution. What are your thoughts on the sustainability of this level of investment? Leave a comment below and let us know! Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions. Share this:

xAI Frequently Asked Questions (FAQ)

When was xAI founded?

xAI was founded in 2023.

Where is xAI's headquarters?

xAI's headquarters is located at 1450 Page Mill Road, Palo Alto.

What is xAI's latest funding round?

xAI's latest funding round is Series D - II.

How much did xAI raise?

xAI raised a total of $42.437B.

Who are the investors of xAI?

Investors of xAI include Valor Equity Partners, NVIDIA, Apollo Global Management, Diameter Capital, Morgan Stanley and 35 more.

Who are xAI's competitors?

Competitors of xAI include OpenAI, Lila Sciences, Mistral AI, Aleph Alpha, Letta and 7 more.

Loading...

Compare xAI to Competitors

Anthropic focuses on artificial intelligence (AI) safety and research within the AI sector. It offers AI models, including Opus, Sonnet, and Haiku, for various applications such as coding, customer support, and education. The company primarily serves sectors that require AI solutions, including technology, education, and customer service industries. It was founded in 2021 and is based in San Francisco, California.

AI21 Labs focuses on the development of enterprise artificial intelligence (AI) systems and foundation models within the artificial intelligence sector. The company offers privately deployed models that ensure security, privacy, and reliability, providing artificial intelligence (AI) solutions to meet the needs of organizations. It was founded in 2017 and is based in Tel-Aviv, Israel.

Adept provides enterprise artificial intelligence (AI) solutions in the technology sector. The company offers tools that automate workflows across various software applications, allowing users to perform other tasks. Adept's AI is integrated into existing business processes, executing tasks while following company rules and procedures. It was founded in 2022 and is based in San Francisco, California.

Moondream AI develops open-source multimodal language models within the artificial intelligence and machine learning sectors. The company provides models that can understand and generate responses to images, including scene description, object detection, and location identification. These models operate across various devices, such as servers, personal computer, mobiles, and edge devices. It was founded in 2024 and is based in Seattle, Washington.

Fireworks AI is a company that provides a generative AI platform as a service within the technology sector. The company focuses on product iteration and cost reduction for its clients. It was founded in 2022 and is based in Redwood City, California.

Gen-AX focuses on AI transformation for businesses through generative AI technology, operating within the technology and software industry. The company provides SaaS solutions and consulting services that aim to optimize business operations and contribute to corporate management. Gen-AX serves sectors that utilize AI-driven strategies, including financial services, retail, and manufacturing. It was founded in 2023 and is based in Tokyo, Japan.

Loading...