Xendit

Founded Year

2014Stage

Option/Warrant - II | AliveTotal Raised

$515.01MLast Raised

$16.2M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-40 points in the past 30 days

About Xendit

Xendit is a financial technology company that specializes in payment solutions within the fintech sector. The company offers a range of services, including a payment gateway that enables businesses to accept various payment methods, disburse funds through automated and on-demand systems, and manage operations with tools for marketplaces, financing, and mobile applications. It was founded in 2014 and is based in South Jakarta, Indonesia.

Loading...

Xendit's Products & Differentiators

xenplatform

A solution for marketplaces and platforms, where customers can manage payments for sub-merchants, franchises or different branches. The feature allows Platform businesses to more simply monetize when offering payments. Merchants can charge a flat or percentage fee that will be automatically transferred to their platform account when payment has settled. Xendit is the first company in Indonesia to provide this feature, enabling marketplaces and platforms to launch and scale very quickly. For example, Xendit’s customer launch for xenplatform saw 100,000 sub-merchants in one weekend.

Loading...

Research containing Xendit

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Xendit in 1 CB Insights research brief, most recently on Mar 14, 2023.

Mar 14, 2023 report

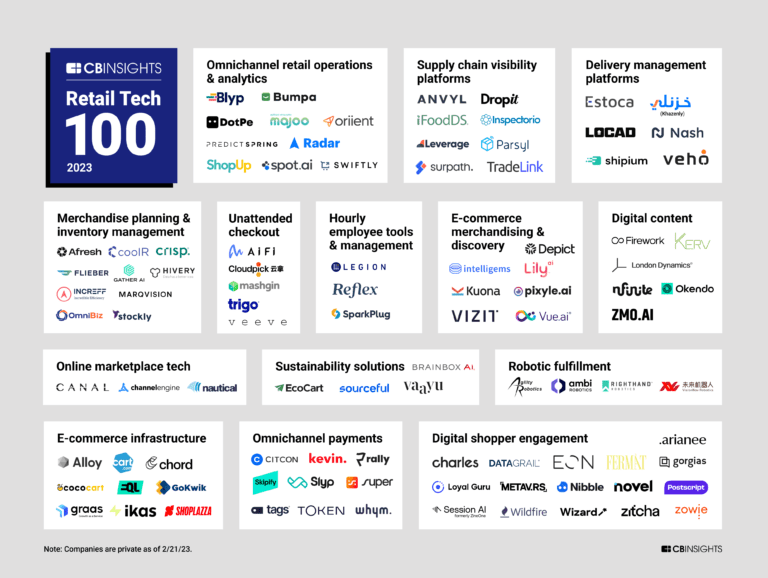

Retail Tech 100: The most promising retail tech startups of 2023Expert Collections containing Xendit

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Xendit is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Latest Xendit News

Nov 10, 2025

Nov 10, 2025 Dear subscriber, The past week have brought a wave of momentum across Indonesia’s innovation and digital economy. New cross-border partnerships and funding—from Living Lab Ventures’ Japan Thematic Fund to VENTENY’s social-impact investments—highlight how collaboration and purpose are shaping the next phase of growth. At the same time, companies like Grab, Blibli, and Telkomsel are proving that scale and technology remain central to market leadership, from profitability milestones to AI integration. The fintech, e-commerce, and digital infrastructure sectors continue to attract global attention, while online consumption shows no signs of slowing—BPS reported a 6.19% rise in e-commerce spending in Q3, with record-breaking campaigns already setting the tone for year-end optimism. Best regards, 1. Living Lab Ventures launches Japan‐Thematic Fund Living Lab Ventures, based in Indonesia, has launched a new “ Japan Thematic Fund ” in partnership with Japan’s Cool Japan Fund and other backers. The fund is designed to help startups from Japan and Southeast Asia access capital, cross-border business connections, and real-world trial opportunities. For the Indonesian market this means more chances for local ventures to link up with Japanese firms, transfer technology, and expand beyond domestic boundaries. 2. Grab Holdings posts strong Q3 2025 revenue growth Grab recorded Q3 2025 revenue of US$873 million, a 22% increase from last year, marking another profitable quarter with US$17 million in net profit. Growth was fueled by strong demand across its ecosystem — on-demand services rose 24%, deliveries jumped 23% to US$465 million, and financial services surged 39%. The company also achieved US$136 million in adjusted EBITDA, up 51% year-on-year, supported by steady operational efficiency. With US$7.4 billion in cash reserves, Grab continues to strengthen its position as one of Southeast Asia’s leading digital platforms, reflecting the region’s growing reliance on ride-hailing, delivery, and payment services. 3. Grab–GoTo Merger Talks: State Palace Confirms Negotiations Indonesia’s State Secretary Minister Prasetyo Hadi confirmed that Grab and GoTo are in the process of negotiating a potential merger , which could lead to the creation of a single entity combining both platforms. The state-owned investment management agency Danantara is reportedly involved in the discussions to oversee the corporate asset arrangements. The merger plan is also being reviewed as part of a draft Presidential Regulation that will set clearer rules on the status, protection, and fare structure for online drivers and delivery partners. 4. VENTENY Secures Dual Funding to Advance Financial Inclusion and Women’s Empowerment VENTENY Fortuna International (VTNY) has secured two new funding rounds to strengthen its mission of promoting financial inclusion and worker welfare in Indonesia. The company received US$5.5 million from the Women’s Livelihood Bond 7 (WLB7), managed by Impact Investment Exchange (IIX), to expand working-capital financing for women-led MSMEs in underserved regions. Around the same time, VENTENY also gained strategic investment from Japan’s Better Place Co. Ltd., aimed at enhancing its B2B financing services and employee well-being programs through the VENTENY Employee Super App. With this support, the company plans to scale up financing for MSMEs, improve employee wellness benefits, and build a more inclusive and sustainable business ecosystem. 5. Living Lab Ventures Invests in INCREASE to Strengthen Indonesia’s Clinical Research Ecosystem Living Lab Ventures (LLV), the corporate venture arm of Sinar Mas Land, has made a strategic investment in INCREASE Laboratorium Indonesia, a clinical research and laboratory services company based in BSD City. The funding will help INCREASE expand operations, build global partnerships, and obtain international certifications such as CAP and ISO standards. INCREASE already works with partners in Singapore, Australia, China, and Japan, including Tsinghua University and Osaka University, to advance technology transfer and local talent development. What’s Exciting 1. Telkom Indonesia earns from data-centre business with high utilisation Telkom Indonesia’s subsidiary has reported strong demand in its data-centre business, with utilisation reaching 89 % in the third quarter. Although revenue was slightly down compared to the year before, the high utilisation suggests robust growth potential for Indonesia’s digital infrastructure sector. It offers local companies opportunities in services, infrastructure, partnerships and talent development. 2. YouTube Festival 2025 proclaims Indonesia as growth hub YouTube’s Festival 2025 has declared Indonesia as its next growth centre, recognising the large audience, creator ecosystem and market potential. For Indonesia this is significant: it underlines that digital content creation, influencers, video marketing and creator economy are sectors to watch and invest in. It creates new opportunities for local talent, brands and platforms to tap into global attention from within Indonesia. The festival’s focus may also bring more tools, initiatives and partnerships for Indonesian creators. 3. Xendit appoints former JPMorgan executive to boost growth Southeast Asian fintech leader Xendit has appointed a former JP Morgan executive as its Chief Revenue Officer, marking a key move to accelerate growth across Indonesia, the Philippines, and regional markets. The new executive brings deep experience in global finance and revenue strategy, which will help the company expand partnerships with banks and enterprises. This leadership change comes amid rapid fintech growth in Southeast Asia, as digital adoption and e-commerce continue to rise. 4. CloudMile raises US$20 million to expand AI footprint in Southeast Asia CloudMile , a Taiwan-based AI firm, has raised US$20 million to expand its cloud and AI services across Southeast Asia, including Indonesia. It suggests local businesses may gain access to more advanced AI tools, infrastructure and partnerships. As Indonesia further embraces digitalisation, such regional initiatives can accelerate the pace of adoption. 5. Lazada invests US$25 million for 11.11 programme in Southeast Asia Lazada has committed US$25 million to its 11.11 shopping campaign across Southeast Asia, which includes Indonesia. This signals a strong push into e-commerce growth and consumer engagement in the region. For Indonesia, a large market for online shopping, this kind of investment boosts promotional activity, brand presence and competition — which may bring benefits for consumers and merchants alike. It also indicates confidence from global platforms in Indonesia’s e-commerce potential. 6. Influencer regulation under study by Kominfo (Indonesia’s Ministry of Communication & Informatics) Indonesia is exploring the idea of certifying influencers —similar to what China has done—as the influencer economy grows rapidly. The potential regulation could bring more professionalism, transparency and structure to the creator economy. It may also mean new opportunities for training, certification, compliance and value-added services for influencers, which could attract brand partnerships and investment. At the same time, it signals that the regulator is taking the creator economy seriously as part of digital economy policy. 7. LG CNS launches a cloud ERP project in Indonesia LG CNS , a global IT services firm, is implementing a cloud ERP project in Indonesia as part of its global expansion. This shows global tech firms recognise Indonesia as a viable market for enterprise software and digital transformation. For Indonesian businesses, it means improved access to advanced enterprise tools, better cloud adoption and potentially stronger local IT services ecosystems. It highlights Indonesia as a location for investment and partnership in enterprise-software infrastructure. 8. Telkomsel pairs with ChatGPT‑pro to bundle services targeting half of Indonesian mobile users Telkomsel has partnered with OpenAI to launch the Telkomsel × ChatGPT Go bundle, marking OpenAI’s first collaboration in Southeast Asia. The promo targets around 157 million users, offering special data packages and access to ChatGPT Go, OpenAI’s new affordable subscription tier. Priced from Rp 50,000, users get data quotas dedicated to ChatGPT plus subscription access for up to two months through the MyTelkomsel app or Telkomsel Poin redemption. Telkomsel said the initiative reflects its push to become a “digital lifestyle enabler,” while OpenAI highlighted Indonesia as a key entry point for expanding AI adoption across the region. Whats next Online Shopping Grows 6.19% in Q3, Boosted by Discount Campaigns Indonesia’s online spending continued to rise in the third quarter of 2025, with Badan Pusat Statistik ( BPS ) reporting a 6.19% quarter-on-quarter growth in e-commerce transactions. Bank Indonesia recorded total e-commerce value reaching Rp 134.7 trillion, up 4.93% from Q2 and 3.74% year-on-year, while transaction volume climbed 7.72% quarterly to 1.44 billion. The growth was driven by major discount events such as 7.7, 8.8, and 9.9, signaling strong consumer participation across platforms including Tokopedia, Shopee, Lazada, and TikTok Shop ahead of the highly anticipated 11.11 campaign. Top-Selling Commodities on Marketplaces Data from Tokopedia and TikTok Shop showed strong performance during the 10.10 sale period, with sellers increasing by 46.8% and average orders rising 45%. Popular categories included electronics and automotive products (+75.5%), food and beverages (+58.4%), and beauty and personal care. Interestingly, the fastest growth came from Eastern Indonesia, notably Papua Barat, Gorontalo, Maluku, and Sulawesi Tenggara, showing that e-commerce penetration is expanding beyond Java. This broad-based participation reflects how digital platforms are deepening access to commerce and boosting regional economies. Consumption Remains Steady Amid Seasonal Shifts While overall household consumption growth slightly eased in Q3 due to the absence of major holidays, BPS noted that domestic demand remains strong, led by spending on personal care (17–18%), home goods (14%), and transport and recreation (13%). Officials emphasized that the slowdown is seasonal, not a sign of weakening purchasing power. With disposable income and optimism holding up, Indonesia’s digital economy continues to benefit from resilient household consumption and nationwide enthusiasm for online retail. Share

Xendit Frequently Asked Questions (FAQ)

When was Xendit founded?

Xendit was founded in 2014.

Where is Xendit's headquarters?

Xendit's headquarters is located at Jalan Sultan Hasanudin No.47, South Jakarta.

What is Xendit's latest funding round?

Xendit's latest funding round is Option/Warrant - II.

How much did Xendit raise?

Xendit raised a total of $515.01M.

Who are the investors of Xendit?

Investors of Xendit include Accel, Tiger Global Management, Amasia, Goat Capital, EV Growth and 17 more.

Who are Xendit's competitors?

Competitors of Xendit include LinkAja, Maya, Shinhan Indonesia Bank, Red Dot Payment, PayMongo and 7 more.

What products does Xendit offer?

Xendit's products include xenplatform and 4 more.

Who are Xendit's customers?

Customers of Xendit include Papaya Tree Farms, KESAN and IndonesiaPastiBisa.

Loading...

Compare Xendit to Competitors

Boost is a financial technology company that offers a spectrum of digital financial services across various sectors. The company provides an application for personal finance management, business financing, and enterprise payment solutions. Boost primarily serves the e-commerce industry and small and medium businesses and aims to expand its footprint in the digital banking sector. It was founded in 2017 and is based in Kuala Lumpur, Malaysia.

Durianpay is a payment platform and aggregator specializing in providing digital payment solutions for businesses. The company offers a suite of services that enable online businesses to accept and process payments through various channels such as credit cards, debit cards, e-wallets, and virtual accounts with a simple low-code integration. Durianpay primarily serves businesses looking to streamline their payment operations and financial management through a unified platform. It was founded in 2020 and is based in Jakarta, Indonesia.

GCash is a mobile financial services provider in the fintech industry, offering a range of services including e-money issuance, remittance, bill payments, and online shopping. The company serves individual consumers and businesses engaging in cashless transactions and financial management. It was founded in 2004 and is based in Taguig, Philippines. GCash operates as a subsidiary of Mynt. GCash was founded in 2004 and is based in Taguig, Philippines.

DOKU is a technology company that provides payment solutions within the financial services industry. The company offers services including payment gateway solutions, secure payment processing, and digital wallet creation for different business sizes. DOKU serves sectors such as e-commerce, logistics, financial services, travel and hospitality, insurance, and retail. DOKU was formerly known as PT. Nusa Satu Inti Artha. It was founded in 2007 and is based in Jakarta, Indonesia.

Maya is a financial services platform operating in the digital banking and payments sector. The company offers services including digital banking, cryptocurrency trading, personal loans, and a credit card. Maya serves consumers and businesses seeking financial services and digital payment options. Maya was formerly known as Voyager Innovations. It was founded in 2013 and is based in Mandaluyong City, Philippines.

PayTabs is a payments infrastructure company providing payment solutions across various sectors. The company offers services including payment gateway platforms, onboarding, invoicing, QR code payments, social media payments, point of sale, and switching platforms. PayTabs serves the ecommerce industry and offers payment orchestration solutions for banks, financial institutions, and fintechs. It was founded in 2014 and is based in Riyadh, Saudi Arabia.

Loading...