Xero

Founded Year

2006Stage

PIPE - V | IPOMarket Cap

24.08BStock Price

143.19Revenue

$0000About Xero

Xero operates as a cloud-based accounting software company that provides financial tools for small businesses and solopreneurs. The company offers tools for financial record keeping, invoicing, expense tracking, and payroll management. Xero's services cater to sectors such as construction, real estate, and retail. It was founded in 2006 and is based in Wellington, New Zealand.

Loading...

ESPs containing Xero

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

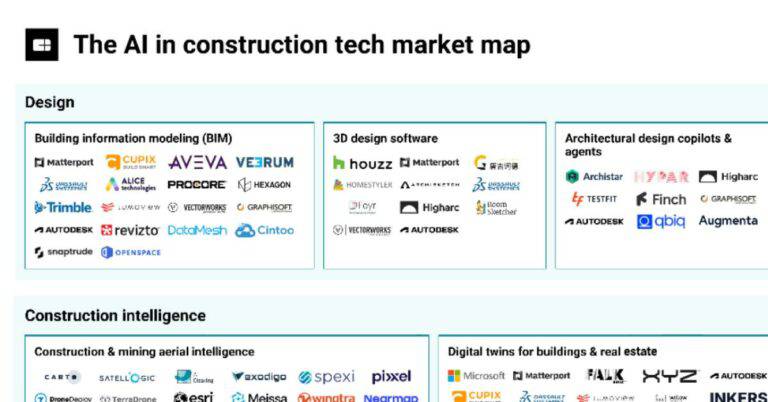

The construction accounting software market provides specialized financial management and accounting solutions designed for the unique needs of the construction industry. These platforms address project-based accounting requirements including job costing, progress billing, retention management, and multi-project financial tracking. Construction accounting software differs from general accounting s…

Xero named as Highflier among 15 other companies, including Sage, Procore, and Acumatica.

Loading...

Research containing Xero

Get data-driven expert analysis from the CB Insights Intelligence Unit.

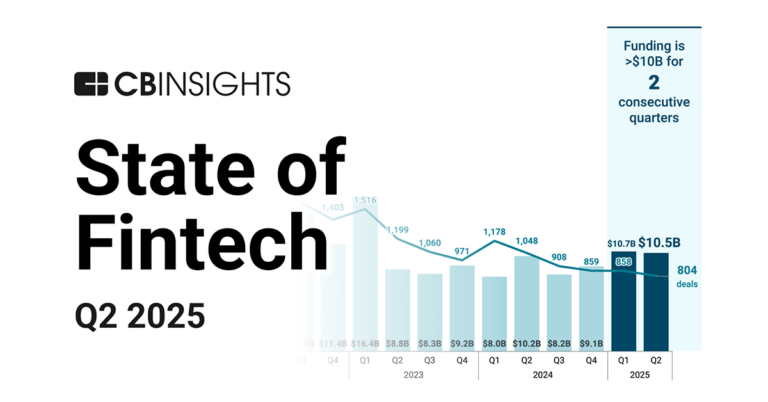

CB Insights Intelligence Analysts have mentioned Xero in 3 CB Insights research briefs, most recently on Aug 27, 2025.

Jul 17, 2025 report

State of Fintech Q2’25 ReportExpert Collections containing Xero

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Xero is included in 4 Expert Collections, including SMB Fintech.

SMB Fintech

1,648 items

Conference Exhibitors

5,302 items

Fintech

14,203 items

Excludes US-based companies

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Xero Patents

Xero has filed 85 patents.

The 3 most popular patent topics include:

- payment systems

- data management

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/11/2022 | 3/11/2025 | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, Dracula | Grant |

Application Date | 11/11/2022 |

|---|---|

Grant Date | 3/11/2025 |

Title | |

Related Topics | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, Dracula |

Status | Grant |

Latest Xero News

Nov 11, 2025

In the rapidly evolving landscape of co-working spaces, managing finances efficiently is critical for sustainable growth. Co-working space owners face unique challenges, including handling complex billing structures, managing multiple clients, and tracking operational costs. This calls for a robust accounting solution that is both affordable and tailored to meet specific business needs. Enter affordable accounting software—an essential tool for maintaining financial health without breaking the bank. This expert guide will explore the best accounting software options specifically designed for co-working space owners, helping you make an informed decision for your business. Why Does Accounting Software Matter for Growing Businesses? The importance of accounting software for growing businesses cannot be overstated. As a co-working space owner, your business model inherently deals with multiple clients, variable pricing plans, and diverse revenue streams. Effective accounting software not only streamlines these processes but also delivers a suite of benefits crucial for scaling your operations. First, accounting software enhances operational efficiency by automating tedious accounting tasks such as invoicing, transaction recording, and financial reporting. This automation reduces errors, saves time, and frees resources for more strategic initiatives. Furthermore, with features such as real-time financial monitoring and budget forecasting, accounting software provides critical insights into cash flow, helping you make informed financial decisions. Moreover, in an era where data security is paramount, modern accounting software ensures compliance and protects sensitive financial data from unauthorized access. Cloud-based solutions offer the additional benefit of remote access, allowing you to manage your finances from anywhere, at any time. By centralizing all financial activities in one platform, accounting software also facilitates better collaboration and communication within your team. Crucially, using an appropriate accounting solution can enhance customer satisfaction. With timely invoicing and transparent billing processes, you can provide your clients with a smooth and professional experience, ultimately building trust and encouraging long-term client relationships. Therefore, investing in the right accounting software is an investment in your business’s future success. Enerpize: The Best Choice for Co-Working Space Owners Enerpize stands out as the premier accounting software solution for co-working space owners. Designed with flexibility and affordability in mind, Enerpize offers a comprehensive set of tools that cater to the unique accounting needs of co-working spaces. Its cloud-based architecture enables seamless financial management and allows users to access their accounts from any location, ensuring optimal operational efficiency. Multi-Client Billing Enerpize simplifies the management of co-working spaces with its unique multi-client billing feature. This allows users to create and manage diverse client accounts effortlessly within a single platform. It supports variable pricing plans, ensuring that each client receives customized billing in line with their specific arrangements. This feature streamlines the billing process, significantly reducing administrative overhead and minimizing billing errors. Automated Invoicing With Enerpize, invoicing becomes a breeze. The software’s automated invoicing feature generates professional invoices based on pre-configured settings. This ensures clients receive timely and accurate invoices, reinforcing trust and professionalism. Automated reminders can also be set to notify clients of upcoming or overdue payments, improving cash flow and reducing the need for manual follow-ups. Real-Time Financial Analytics Enerpize provides an extensive suite of analytics tools, giving users real-time insights into their financial health. Dashboards and customizable reports offer detailed overviews of income sources, expenses, and key financial metrics, enabling better strategic decisions. These analytics help identify trends, optimize resource allocation, and forecast future financial performance. Expense Tracking Keeping track of operational expenses is essential for maintaining profitability. Enerpize’s expense tracking features allow users to record and categorize expenditures efficiently. By comparing expenses against budgets, co-working space owners can identify areas of overspending and implement cost-control strategies effectively. Tax Management Tax season can be daunting, but Enerpize simplifies the process with its comprehensive tax management tools. It automates tax calculations, generates necessary reports, and ensures compliance with local tax regulations. This not only reduces the risk of errors but also saves significant time and resources. Time Tracking Integration Enerpize integrates with popular time tracking tools, providing seamless management of billable hours. This is particularly beneficial for managing shared office resources and services. With accurate time tracking, users can ensure fair billing and optimize resource utilization effectively. Budget Planning Financial planning is crucial for growth, and Enerpize’s budget planning features empower users with the necessary tools. Business owners can set financial goals, monitor performance against budgets, and make data-driven adjustments to navigate financial hurdles effectively. Remote Access As a cloud-based platform, Enerpize offers unparalleled remote access capabilities. This ensures that users can manage their finances from anywhere, synchronizing across devices for consistent updates and accessibility. As a result, business owners can maintain oversight and control even while on the move. Collaborative Access With multiple user accounts, Enerpize promotes collaboration by allowing teams to access and manage financial data concurrently. This fosters better communication and coordination within the business, ensuring timely and informed decision-making. User-Friendly Interface Ease of use is a significant strength of Enerpize. Its intuitive interface ensures that users can navigate and utilize its features without requiring extensive training. This accessibility ensures that co-working space owners can quickly implement and benefit from the platform from day one. Pros & Cons Affordable pricing structure with a wide range of tools. Easy integration with third-party applications. Cons: May require initial customization for specific company needs. Pricing Enerpize offers flexible pricing plans starting at just $10 per month. Custom plans are available for larger teams and businesses with specific needs. Explore their pricing page for more options. User Review FreshBooks: A Reliable Alternative FreshBooks is a renowned accounting software solution praised for its user-friendly interface and robust features, tailored to meet the needs of small businesses and co-working space owners alike. Built to simplify financial management, FreshBooks offers several essential accounting tools that ensure effective billing, revenue tracking, and expense management, making it a reliable alternative to Enerpize. User-Friendly Invoicing FreshBooks excels in invoicing, with customizable templates that help create professional invoices quickly and easily. It supports automatic invoicing, enabling you to set up recurring invoices for regular clients while managing one-off projects seamlessly. Expense Tracking Keep tabs on your financials with FreshBooks’ easy expense tracking feature. Users can snap receipts, categorize expenses, and integrate seamlessly with their bank accounts for real-time expense monitoring, which enhances budget management processes. Time Tracking FreshBooks integrates time tracking across its platform, enabling users to log billable hours with accuracy. This is especially useful for co-working spaces offering additional services, ensuring timely billing and optimal resource allocation. Client Portal The client portal offers a central hub for managing client relationships. Clients can view and pay invoices, reducing billing disputes and enhancing professionalism and client satisfaction. Project Management Beyond accounting, FreshBooks also facilitates project management with features allowing users to track project milestones, deadlines, and deliverables from the same platform, ensuring smooth operations. Pros & Cons Comprehensive features for expense and time tracking. Cons: Some limitations in advanced reporting functionalities. Pricing FreshBooks pricing begins at $15 per month for the Lite plan, with more advanced plans available at higher price points. Visit their pricing page for more details. User Review QuickBooks Online: Feature-Packed Accounting QuickBooks Online is a feature-packed, cloud-based accounting software that serves a wide range of industries, including co-working spaces. Known for its comprehensive set of accounting tools, QuickBooks Online simplifies financial management with its robust functionality and intuitive user experience. Comprehensive Reporting QuickBooks Online offers advanced reporting capabilities, providing detailed insights into financial metrics, cash flow, and profit and loss. These reports guide informed decision-making and financial planning. Integrated Payroll For co-working spaces with employees, QuickBooks’ integrated payroll simplifies salary processing, tax filing, and other payroll-related tasks, reducing administrative burdens. Automatic Bank Reconciliation Save time by automatically reconciling bank statements with QuickBooks Online. Streamlining this process helps identify discrepancies early on and ensures accurate financial records. Expense Management QuickBooks offers robust expense management tools, allowing businesses to track, categorize, and reconcile expenses effortlessly, ensuring oversight on spending habits. Inventory Management Although not a core focus for co-working spaces, QuickBooks Online supports inventory tracking for businesses offering retail or service-related products, maintaining optimal stock levels. Pros & Cons Supports a wide range of industry needs, including inventory management. Cons: Can be more expensive compared to other options for small businesses. Pricing QuickBooks Online pricing starts at $20 per month, with plans scaling based on features and the number of users. Explore their pricing page for more information. User Review Xero: Simplicity for Efficient Accounting As an intuitive, efficient accounting solution, Xero provides small businesses with the tools they need to manage finances effortlessly. With its straightforward design and feature-rich platform, Xero caters well to co-working space owners seeking to streamline financial operations. Real-Time Financial View Xero’s dashboard provides a real-time view of cash flow, including bank balances and pending invoices, ensuring financial transparency and aiding quick decision-making. Bank Connections Xero offers easy bank reconciliation with direct bank feeds, enabling seamless integration with financial institutions for real-time transaction updates. This integration reduces manual data entry and errors. Invoicing Customization Create tailored invoices with Xero’s customizable templates. Automate invoicing processes with recurring invoice setups, and offer clients flexible payment options for enhanced cash flow. Expense Claims Manage expense claims efficiently with Xero, allowing team members to submit expense receipts and claims electronically for streamlined approval and repayment. Pros & Cons Efficient bank reconciliation and real-time financial tracking. Cons: Lacks some advanced features found in more comprehensive solutions. Pricing Xero offers plans starting at $11 per month, with scalable options for complex business needs. Visit their pricing page for more information. User Review Wave: Cost-Effective for Small Teams Wave stands out as an outlier for its cost-effectiveness, especially beneficial for small co-working spaces with tight budgets. While it may not have the expansive array of features as other software, it provides essential accounting tools at no cost to users. Free Invoicing Wave offers robust invoicing capabilities that allow users to create professional invoices that won’t break the bank. Customize and automate invoices for free, providing a simple yet effective way to handle client billing. Accounting & Bookkeeping Wave’s free accounting and bookkeeping are tailored for small businesses, offering essential tools for managing accounts payable and receivable, categorizing transactions, and reconciling accounts without any charge. Receipt Management The Wave receipt app allows businesses to photograph and organize receipts effortlessly. This integration simplifies the documentation of expenses and enhances financial record-keeping. Pros & Cons Offers genuinely free invoicing and basic accounting tools. Cons: May lack advanced tools required by larger, more complex operations. Pricing Wave’s core accounting, invoicing, and reporting tools are free of charge. Premium services like payroll or payment processing are available separately. Check their pricing page for more details. User Review Sage Business Cloud Accounting: Scalable and Professional Sage Business Cloud Accounting offers straightforward and scalable solutions for co-working space owners looking to manage and scale their operations efficiently. Known for its reliability and flexibility, Sage provides professional tools that simplify complex accounting tasks for businesses of varying sizes. Automated Transactions Sage automates banking transactions and reconciliations, ensuring that all financial data is updated in real-time, minimizing manual entry errors, and enhancing the accuracy of financial reporting. Customizable Reports Businesses benefit from Sage’s customizable financial reports, which provide insights into cash flow, financial performance, and forecasts, assisting in strategic planning and financial decision-making. Inventory Tracking Although not often needed by co-working spaces, Sage includes inventory tracking functionalities, useful for businesses offering merchandise or other tangible products. Online Payments The online payments feature ensures that clients can pay invoices through multiple channels, enabling faster collections and improving cash flow. Pros & Cons Scalable, with options for growing businesses. Cons: Some areas of the user interface can be complex for new users. Pricing Sage Business Cloud Accounting starts at $10 per month, with feature-rich plans scaling upwards. Check their pricing page for more options. User Review Comparison Table How to Choose the Right Accounting Software? Finding the right accounting software can be daunting with so many options available. Here are some actionable steps to help you make your choice: Define Your Needs Start by clearly defining your business requirements. Consider factors such as the size of your co-working space, the complexity of transactions, and specific features you might need, like invoicing, billing, or expense tracking. Budget Considerations Evaluate your budget and compare it against the pricing plans of different software solutions. Free options like Wave can be attractive for small spaces, while scalable applications like Enerpize and Sage might be worthwhile for rapidly growing businesses. Trial and Test Make use of free trial periods offered by most accounting software. Testing will allow you to get a feel for the software’s ease of use, integrate it with existing systems, and determine if it meets your needs. Check Integration Capabilities Ensure the software integrates with other business tools you use, such as CRM systems or email marketing platforms. Seamless integration is crucial for maintaining workflow efficiency and data accuracy across platforms. Consider User Support Good customer support can save time and mitigate issues, making it an essential factor in your decision. Review the resources, forums, and support channels each software offers to see how they resolve user queries. Read User Reviews User reviews provide invaluable insights into the real-world application of the software. Platforms like G2, Capterra, and TrustRadius are great resources to understand the strengths and weaknesses of each solution. Future-Proofing Your Choice Choose software that can scale with your business. As your co-working space grows, your financial management needs will expand. A versatile solution like Enerpize can accommodate your evolving business requirements. Conclusion Choosing the right accounting software can significantly impact the financial efficiency of your co-working space. While there are many options to consider, Enerpize emerges as the leading solution due to its tailored features, flexibility, and affordability. By understanding the unique features and benefits offered by each platform, you can make an informed decision that aligns with your business goals and budget. Invest in the best accounting software now, and set a strong foundation for your co-working space’s financial health. Previous article

Xero Frequently Asked Questions (FAQ)

When was Xero founded?

Xero was founded in 2006.

Where is Xero's headquarters?

Xero's headquarters is located at 19-23 Taranaki Street, Te Aro, Wellington.

What is Xero's latest funding round?

Xero's latest funding round is PIPE - V.

Who are the investors of Xero?

Investors of Xero include Matrix Capital Management, Valar Ventures, Craig Winkler, Sam Morgan, Peter Thiel and 6 more.

Who are Xero's competitors?

Competitors of Xero include Fiskl, Ember, Fortnox, PayToMe, Autobooks and 7 more.

Loading...

Compare Xero to Competitors

Intuit QuickBooks provides cloud-based accounting solutions for businesses across various sectors. The company offers financial management tools including invoicing, billing, payroll processing, and financial reporting. Intuit QuickBooks serves small to medium-sized businesses that require accounting and bookkeeping services. It was founded in 1983 and is based in Mountain View, California.

FreshBooks serves as a cloud-based accounting and invoicing software that provides functionalities for invoicing, expense tracking, time tracking, financial reporting, and online payment processing. It is used by freelancers, self-employed professionals, and small to medium-sized businesses across various industries. It was founded in 2003 and is based in Toronto, Canada.

MYOB provides business management software for various sectors. Its offerings include financial management, workforce management, and inventory and distribution management solutions. MYOB's platform serves sole operators, small to medium businesses, and accountants and bookkeepers by providing tools for invoicing, payroll, and tax management. It was founded in 1991 and is based in Cremorne, Australia.

Glean AI focuses on accounts payable automation and spend intelligence in the financial technology sector. The company provides software that automates data extraction, general ledger coding, bill approvals, and payments, and offers insights into spending trends and vendor management. Glean AI's solutions aim to support collaboration among accounting and financial planning teams, assisting in budget planning and decision-making. It was founded in 2019 and is based in New York, New York. In April 2025, Glean AI was acquired by Pipe.

Banana.ch is a software solution company that specializes in the development of accounting software for small businesses, non-profit organizations, and individuals. The company's main product, Banana Accounting Plus, is a user-friendly software that provides professional accounting services including expense and revenue management, VAT management, invoicing, budget planning, inventory management, and time management. The company primarily serves the financial technology industry. It was founded in 1990 and is based in Lugano, Switzerland.

TaxAct specializes in tax preparation software for individuals and businesses. They offer a range of services, including online tax filing, live tax advice, and tax filing for professionals. TaxAct caters to a broad audience, from everyday individuals to business owners and tax professionals, providing tools and resources to meet various tax needs. TaxAct was formerly known as 2nd Story Software. It was founded in 1998 and is based in Dallas, Texas.

Loading...