Apollo

Founded Year

2015Stage

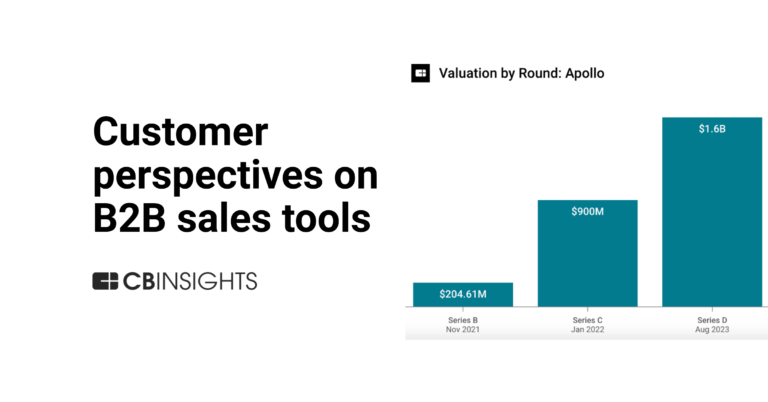

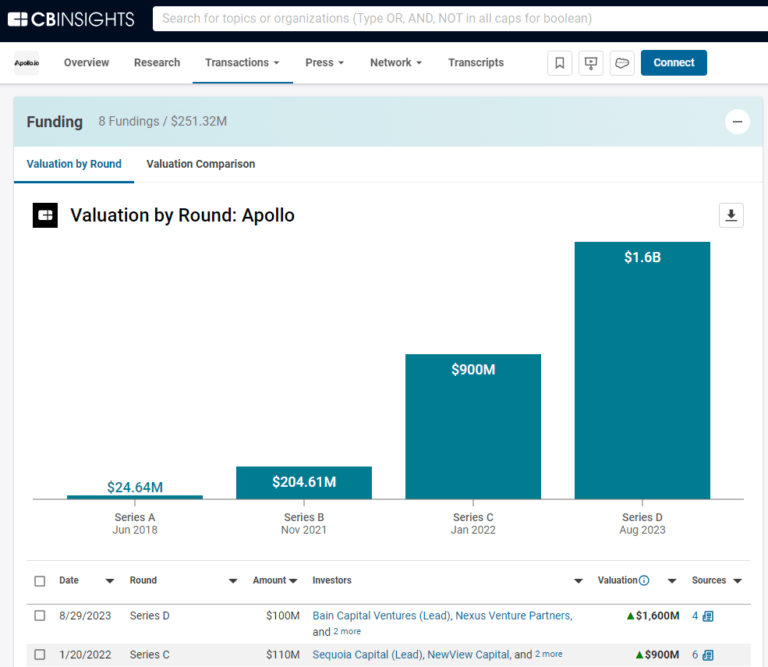

Series D | AliveTotal Raised

$251.32MValuation

$0000Last Raised

$100M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-23 points in the past 30 days

About Apollo

Apollo operates as an artificial intelligence (AI) sales platform that focuses on prospecting, lead generation, and sales automation within the business-to-business (B2B) sales sector. The company provides a platform that includes a database of contacts, sales engagement tools, and automation features to assist sales and marketing teams in building pipelines and closing deals. Apollo serves sales professionals and organizations aiming to improve their market strategies with data insights and automation. Apollo was formerly known as ZenProspect. It was founded in 2015 and is based in Covina, California.

Loading...

ESPs containing Apollo

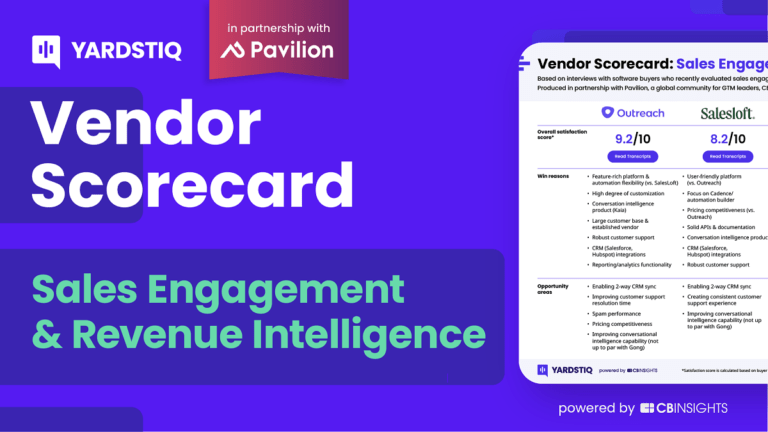

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The sales engagement platforms market uses advanced technologies to streamline and enhance interactions between sales teams and prospects. Through integrated communication tools, analytics, and automation, they optimize outreach efforts, ensuring timely and personalized interactions. By centralizing data, these solutions enable sales professionals to tailor their approaches, resulting in higher co…

Apollo named as Leader among 12 other companies, including Salesforce, ZoomInfo, and Outreach.

Apollo's Products & Differentiators

Pipeline Builder

Enables teams to identify, research, and prioritize leads, orchestrate multichannel outreach, and book meetings efficiently. Driven by a robust B2B database, Pipeline Builder combines 65+ filters, intent signals, AI-powered prospecting, waterfall data enrichment, Parallel Dialer for high-volume calling, and automated email workflows, including Warm-Up and Domain/Mailbox Purchase, to streamline engagement and scheduling. Users can quickly move from lead identification to opportunity creation with zero manual data imports or tool switching required.

Loading...

Research containing Apollo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Apollo in 6 CB Insights research briefs, most recently on Jan 3, 2024.

Jan 3, 2024

2024 prediction: Gong acquires Apollo

Apr 6, 2023 report

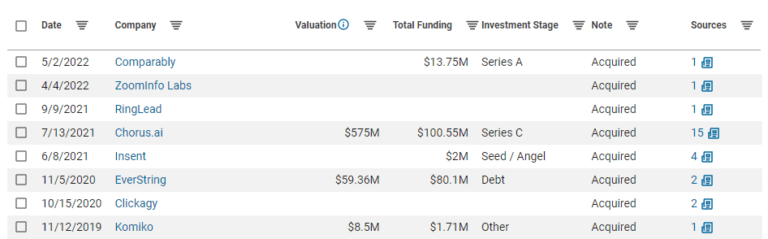

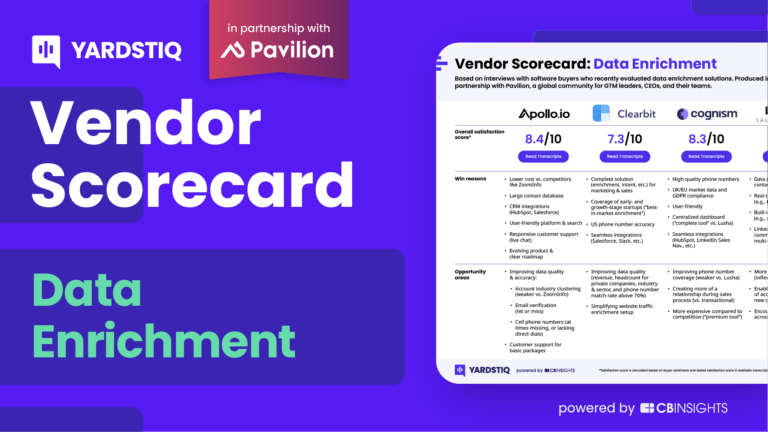

Top data enrichment companies — and why customers chose themExpert Collections containing Apollo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Apollo is included in 3 Expert Collections, including Ad Tech.

Ad Tech

4,236 items

Companies offering tech-enabled marketing and advertising services.

Unicorns- Billion Dollar Startups

1,309 items

AI agents & copilots

1,771 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

Apollo Patents

Apollo has filed 3 patents.

The 3 most popular patent topics include:

- digestive system procedures

- digestive system surgery

- electromagnetic radiation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/20/2019 | 1/16/2024 | Neurophysiology, Electronic health records, Autonomic nervous system, Neuroscience, Sympathetic nervous system | Grant |

Application Date | 12/20/2019 |

|---|---|

Grant Date | 1/16/2024 |

Title | |

Related Topics | Neurophysiology, Electronic health records, Autonomic nervous system, Neuroscience, Sympathetic nervous system |

Status | Grant |

Latest Apollo News

Nov 11, 2025

The manual prospecting game is brutal. You're scrolling LinkedIn like it's social media, Googling company directories, and playing email address roulette with firstname.lastname@company.com combinations. Meanwhile, your competitors are probably booking meetings while you're still trying to figure out if Sarah from accounting is actually the decision maker. Here's something that actually works: lead finder platforms that dig up verified contacts with real emails and enough background info to sound like you've done your homework. We tested seven tools that actually help you find prospects worth talking to, so you can skip the manual search and get straight to selling. 1. Instantly Supersearch Most lead finder platforms give you a name and email, then wish you luck. Supersearch actually cares whether you close the deal. It's part of Instantly's cold email engine, so in addition to collecting contacts, you're also feeding a machine designed to turn them into customers. With over 450 million verified contacts and seven data sources working overtime, Supersearch finds emails that make other platforms look like they're using Yellow Pages. Supersearch also takes care of personalization with integrated AI. Instead of copying and pasting generic templates, you get direct access to OpenAI, Anthropic, and other AI providers to customize every message based on your prospect's specific situation and company details. Key Features: 2. Apollo Apollo solves the annoying problem of running three different subscriptions just to send a cold email. Lead generation, email automation, and pipeline management all live under one roof. With more than 275 million contacts and sequences that actually know when to stop emailing (because someone replied), it handles the heavy lifting. The Chrome extension works great too: see a prospect on LinkedIn, click once, and you're done. However, some users say the data isn't always 100% accurate, so expect some dead emails and incomplete profiles mixed in with the good stuff. Key Features: 3. Clay Clay figured out that sales reps spend way too much time doing manual research. Instead of opening ten browser tabs to research one prospect across LinkedIn, company websites, and news sites, Clay does the legwork for you. It connects to more than 75 data sources and uses AI to automatically dig up the good stuff: recent funding rounds, job changes, or that LinkedIn post where your prospect complained about their current vendor. Once Clay builds your list, it fills in missing emails and company details, then sends everything straight to your CRM. Clay isn't a complete solution, though. It works best as part of a bigger automation setup, so you'll likely need additional tools to complete your sales process. Key Features: 4. ZoomInfo While most tools give you basic contact information, ZoomInfo provides everything: company revenue, tech stack, recent funding rounds, hiring sprees, and that news article from last week about their expansion plans. The intent data feature tells you when companies are researching solutions like yours, so you're not making blind outreach attempts. The data gets refreshed regularly, which means you're working with current information instead of months-old contact details. One thing to keep in mind: ZoomInfo costs more than most small companies spend on their entire sales stack, making it a tough sell for smaller teams. Key Features: 5. Skrapp While other tools treat LinkedIn as just another data source, Skrapp built its entire engine around extracting verified emails from professional networks. It works seamlessly with LinkedIn Sales Navigator and regular LinkedIn profiles, turning your browsing into a contact database. The platform also focuses on email verification with multiple deliverability checks, which means fewer bounces when you hit send. However, Skrapp has some limitations. Email accuracy can be inconsistent, especially with newer or smaller companies. Key Features: 6. Lead Finder Most lead finder platforms make you pick a lane: LinkedIn scraping, domain searches, or database hunting. Lead Finder says “why choose?” and lets you work however makes sense for your process. Feed it LinkedIn profiles, company names, or basic prospect details, and it builds your contact list accordingly. The standout feature is tracking newly launched websites daily. These are fresh businesses with zero inbox competition and untapped potential. That said, Lead Finder is something of a mystery. There aren't enough user reviews to verify data accuracy, and the tool shares a name with another company, which makes research confusing. Key Features: 7. Leadspicker Leadspicker isn't really a lead finder in the classic sense; more like an AI sales assistant that also happens to find leads. The AI learns how each prospect behaves and adjusts everything: message tone, send times, and even which channel to use next. If someone ignores your LinkedIn message but opens emails, Leadspicker figures that out and switches tactics automatically. The downside is that Leadspicker works best for typical B2B companies. So, if you're in a highly regulated industry or selling something really niche, you'll probably find limited relevant prospects. Key Features Final Thoughts Here's what we learned after testing these platforms: there are no perfect lead finder platforms, but there's definitely a right one for your situation. If you're running a lean sales team, focus on tools that combine lead finding with email automation to avoid juggling multiple subscriptions. Enterprise teams can justify the premium platforms with deeper data intelligence, while startups should prioritize accuracy over volume. What matters most isn't just finding contacts but finding them at the right moment. Look for platforms that track buying signals or company changes, because timing beats perfect data every time. A mediocre lead who just got funding will respond better than a perfect prospect who's locked into a three-year contract. Featured image; Freepik

Apollo Frequently Asked Questions (FAQ)

When was Apollo founded?

Apollo was founded in 2015.

Where is Apollo's headquarters?

Apollo's headquarters is located at 440 North Barranca Avenue, Covina.

What is Apollo's latest funding round?

Apollo's latest funding round is Series D.

How much did Apollo raise?

Apollo raised a total of $251.32M.

Who are the investors of Apollo?

Investors of Apollo include Nexus Venture Partners, Tribe Capital, Sequoia Capital, Bain Capital Ventures, NewView Capital and 17 more.

Who are Apollo's competitors?

Competitors of Apollo include Hyperbound, DeepSales, Clay, Grata, Jeeva and 7 more.

What products does Apollo offer?

Apollo's products include Pipeline Builder and 3 more.

Loading...

Compare Apollo to Competitors

Deal Collective curates private market investment opportunities for its members in the financial investment sector. The company offers a platform for experienced investors to access various investment deals, discuss them, and make investment decisions. Deal Collective primarily serves accredited investors aiming to expand their deal pipeline and professional network. It is based in Houston, Texas.

Seamless.AI focuses on artificial intelligence (AI)-driven sales intelligence and lead generation within the B2B sector. The company provides tools to find, verify, and enrich business contact information, allowing sales professionals to connect with potential customers. Seamless.AI serves sales development reps, account executives, sales operations, and marketing teams across various industries. Seamless.AI was formerly known as Seamless Contacts. It was founded in 2014 and is based in Dublin, Ohio.

Lusha operates as a sales intelligence platform that provides access to business to business (B2B) databases and lead generation services. The company offers functionalities such as contact and company search, lead generation, customer relationship management (CRM) data enrichment, and compliance with data privacy regulations. Lusha serves sales teams, revenue operations, marketers, and recruiters with tools to enhance their processes. It was founded in 2016 and is based in Boston, Massachusetts.

Sales Marker is a business-to-business (B2B) sales intelligence platform that uses a corporate entity database and intent data to support business activities. The company provides services that analyze web search behavior to identify companies with specific needs, allowing for targeted engagement through automated actions. Sales Marker serves sectors that require targeted strategies for lead generation and customer acquisition. It was formerly known as CrossBorder. It was founded in 2021 and is based in Tokyo, Japan.

UserGems focuses on sales and marketing technology, enhancing pipeline generation through artificial intelligence (AI) and buying signal automation. The company offers products that capture buying signals and automate outreach processes, allowing teams to prioritize and engage with potential customers. UserGems serves sectors that require sales and marketing solutions, such as technology and professional services. It was founded in 2019 and is based in San Francisco, California.

LeadIQ is a B2B prospecting platform that provides outbound sales automation and lead generation capabilities. The company includes features for CRM data enrichment, insights for prospecting, and functionalities for outreach and tracking sales triggers. LeadIQ serves sales and marketing teams aiming to enhance their prospecting efforts and ensure data accuracy within their CRM systems. It was founded in 2015 and is based in San Francisco, California.

Loading...