Zetwerk

Founded Year

2018Stage

Debt - VII | AliveTotal Raised

$1.021BValuation

$0000Last Raised

$8.71M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+141 points in the past 30 days

About Zetwerk

Zetwerk offers a manufacturing network that provides manufacturing services across sectors. It offers custom-made components, mass production, quality certification, inventory, and supply chain management, focusing on precision parts, capital goods, and consumer goods. It operates in industries such as transportation, industrial machinery, consumer products, construction, energy, and aerospace. It was founded in 2018 and is based in Bengaluru, India.

Loading...

Zetwerk's Product Videos

ESPs containing Zetwerk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand manufacturing platforms market facilitates the on-demand production of goods by connecting businesses seeking manufacturing services with a network of manufacturing partners capable of producing custom or small-batch orders. These platforms have emerged as a solution for businesses seeking flexibility, reduced lead times, and cost-effective manufacturing options, particularly for pro…

Zetwerk named as Outperformer among 15 other companies, including Dassault Systemes, Stratasys, and Xometry.

Zetwerk's Products & Differentiators

General Fabrication

Non-precision manufacturing such as steel structurals, bridges, etc.

Loading...

Research containing Zetwerk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zetwerk in 2 CB Insights research briefs, most recently on Mar 1, 2024.

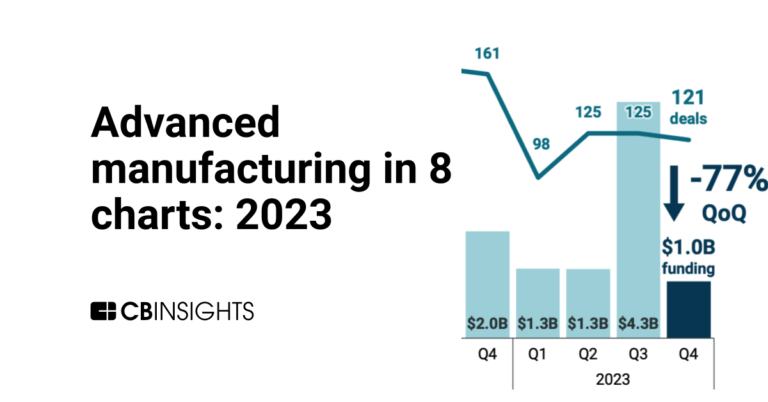

Mar 1, 2024

Advanced manufacturing in 8 charts: 2023Expert Collections containing Zetwerk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zetwerk is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,424 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Supply Chain & Logistics Tech

4,664 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,309 items

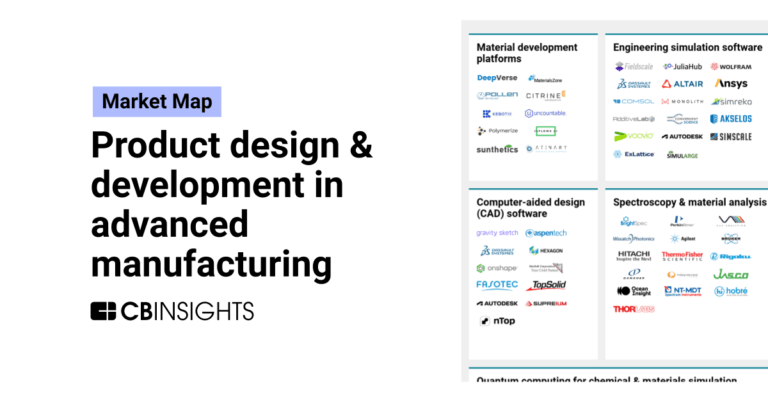

Advanced Manufacturing

7,577 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Advanced Manufacturing 50

50 items

Latest Zetwerk News

Nov 12, 2025

This report describes and explains the defense market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region. The global defense market reached a value of nearly $473.47 billion in 2024, having grown at a compound annual growth rate (CAGR) of 5.54% since 2019. The market is expected to grow from $473.47 billion in 2024 to $682.1 billion in 2029 at a rate of 7.57%. The market is then expected to grow at a CAGR of 8.19% from 2029 and reach $1.01 trillion in 2034. Growth in the historic period resulted from the rising geopolitical tensions, favorable government initiatives, growing adoption of unmanned combat vehicles and growing military modernization programs. Factors that negatively affected growth in the historic period were cybersecurity threats and defense budget reductions in developed nations. Going forward, the rising homeland disaster and crisis response, rise in counter-terrorism operations, increasing focus on space-based defense capabilities and increasing defense and military budgets will drive the growth. Factor that could hinder the growth of the defense market in the future include technological complexity and integration challenges, complex regulatory and compliance requirements and trade war and tariffs. The defense market is segmented by type into air-based defense equipment, sea-based defense equipment, land-based defense equipment, defense equipment maintenance, repair and overhauling services and defense support and auxiliary equipment. The air-based defense equipment market was the largest segment of the defense market segmented by type, accounting for 34.40% or $162.89 billion of the total in 2024. Going forward, the defense equipment maintenance, repair and overhauling services segment is expected to be the fastest growing segment in the defense market segmented by type, at a CAGR of 8.31% during 2024-2029. The defense market is segmented by operation into autonomous defense equipment and manual. The manual market was the largest segment of the defense market segmented by operation, accounting for 64.55% or $305.64 billion of the total in 2024. Going forward, the autonomous defense equipment segment is expected to be the fastest growing segment in the defense market segmented by operation, at a CAGR of 8.73% during 2024-2029. The defense market is segmented by platform into airborne, land and naval. The airborne market was the largest segment of the defense market segmented by platform, accounting for 67.87% or $321.35 billion of the total in 2024. Going forward, the naval segment is expected to be the fastest growing segment in the defense market segmented by platform, at a CAGR of 8.31% during 2024-2029. The defense market is segmented by application into mission systems, weapon systems, firearms and structural components. The mission systems market was the largest segment of the defense market segmented by application, accounting for 37.71% or $178.55 billion of the total in 2024. Going forward, the mission systems segment is expected to be the fastest growing segment in the defense market segmented by application, at a CAGR of 8.55% during 2024-2029. Asia Pacific was the largest region in the defense market, accounting for 32.48% or $153.77 billion of the total in 2024. It was followed by North America, Western Europe and then the other regions. Going forward, the fastest-growing regions in the defense market will be Middle East and Africa where growth will be at CAGRs of 12.95% and 12.89% respectively. These will be followed by Eastern Europe and Western Europe where the markets are expected to grow at CAGRs of 9.03% and 8.07% respectively. The global defense market is concentrated, with large players operating the market. The top ten competitors in the market made up to 46.51% of the total market in 2024. Lockheed Martin Corp. was the largest competitor with a 13.50% share of the market, followed by BAE Systems with 7.26%, Raytheon Technologies (RTX) Corp. with 5.61%, The Boeing Company with 4.55%, L3Harris Technologies Inc. with 3.60%, Airbus SE with 2.76%, Thales Group with 2.51%, Safran with 2.43%, Rheinmetall AG with 2.23% and AVIC (Aviation Industry Corp of China) with 2.07%. The top opportunities in the defense market segmented by type will arise in the air-based defense equipment segment, which will gain $70.14 billion of global annual sales by 2029. The top opportunities in the defense market segmented by operation will arise in the manual segment, which will gain $121.39 billion of global annual sales by 2029. The top opportunities in the defense market segmented by platform will arise in the airborne segment, which will gain $139.22 billion of global annual sales by 2029. The top opportunities in the defense market segmented by application will arise in the mission systems segment, which will gain $90.53 billion of global annual sales by 2029. The defense market size will gain the most in the USA at $34.6 billion. Market-trend-based strategies for the defense market include launch of innovative technologies, such as multi-layered, indigenous counter-drone systems, launch of innovative technologies, such as AI-based defense systems, launch of innovative technologies, such as advanced hexacopter drones, to enhance surveillance capabilities, focus on expanding by investing in their facilities, focus on collaborations and sales partnerships to strengthen their market position, launch of innovative product, such as autonomous military prototype vehicle, to enhance operational efficiency, launch of innovative technologies, such as AI (artificial intelligence)-enabled systems and focus on investments in next-gen technology to strengthen their position in the market. Player-adopted strategies in the defense market include focus on strengthening its business operations through strategic partnerships and through securing new contracts. To take advantage of the opportunities, the analyst recommends the defense market companies to focus on indigenous counter-drone innovation, focus on AI-enabled defense systems, focus on advanced hexacopter drone deployment, focus on defense equipment maintenance, repair and overhauling services, expand in emerging markets, continue to focus on developed markets, focus on expanding multi-channel distribution, focus on building strategic distribution partnerships, focus on value-based pricing aligned with market conditions, focus on aligning promotion with strategic objectives, focus on building measurable and targeted engagement, focus on developing skilled and trusted personnel. Major Market Trends Strategic Collaborations Driving Innovation in the Defense Market U.S. Department of Defense Unveils AI Strategy to Maintain Battlefield Superiority Strategic Investment in Next-Generation Defense Technology EDJx and Cubic Partner to Introduce Cutting-Edge Internet of Military Things Platform for Battlefield Edge Computing Competitive Landscape and Company Profiles Lockheed Martin Corporation Nokia Corporation Acquired Fenix Group BAE Systems Plc Acquired Ball Aerospace L3Harris Technologies Inc. Acquired Aerojet Rocketdyne Zetwerk Acquired Pinaka Aerospace Solutions Thales Group Acquired RUAG S&T Fairbanks Morse Defense (FMD) Acquired Federal Equipment Company (FEC) Rheinmetall Acquired EMT Infineum Acquired ISCA UK

Zetwerk Frequently Asked Questions (FAQ)

When was Zetwerk founded?

Zetwerk was founded in 2018.

Where is Zetwerk's headquarters?

Zetwerk's headquarters is located at 17th Cross, HSR Layout, Bengaluru.

What is Zetwerk's latest funding round?

Zetwerk's latest funding round is Debt - VII.

How much did Zetwerk raise?

Zetwerk raised a total of $1.021B.

Who are the investors of Zetwerk?

Investors of Zetwerk include JM Financial Investment Managers, Mehta Group, Oriental Biotech, ARC Investment Partners, Rakesh Gangwal and 31 more.

Who are Zetwerk's competitors?

Competitors of Zetwerk include Infra.Market, 3YOURMIND, OfBusiness, CADDi, Credlix and 7 more.

What products does Zetwerk offer?

Zetwerk's products include General Fabrication and 4 more.

Loading...

Compare Zetwerk to Competitors

KREATIZE focuses on the automated procurement of mechanical components for companies in the plant and machine engineering sectors. The company provides services such as manufacturing capacity matching, predictable pricing, quality management, and process documentation, integrated with the client's ERP system. KREATIZE serves sectors that require efficient procurement of low-demand mechanical parts. It was founded in 2015 and is based in Berlin, Germany.

Moglix is a B2B e-commerce platform focused on the procurement of industrial supplies across various sectors. The company offers a wide range of products, including safety gear, power tools, office supplies, electrical equipment, and healthcare and lab supplies. Moglix caters primarily to the needs of the manufacturing, industrial, and business sectors by providing essential tools, equipment, and supplies necessary for their operations. It was founded in 2015 and is based in Singapore.

OfBusiness is a business-to-business commerce platform that operates in the sectors of metals, chemicals, agri-products, and apparel. The company focuses on improving procurement processes and supply chains for businesses. OfBusiness also includes financial services through its arm, Oxyzo, which provides working capital solutions for small and medium enterprises (SMEs). It was founded in 2015 and is based in Ahmedabad, India.

Industrybuying is a B2B e-commerce platform specializing in industrial and office supplies. The company offers a catalogue of products including material handling and packaging, testing and measuring instruments, office supplies, and cleaning products. Industrybuying serves businesses and SMEs across various sectors, offering wholesale pricing, GST invoice options, bulk order discounts, and financial options like IB Credit and no-cost EMI. It was founded in 2013 and is based in New Delhi, India. IndustryBuying operates as a subsidiary of MonotaRO.

Eezee specializes in modern procurement and operates as a business supplies marketplace in the MRO (Maintenance, Repair, and Operations) sector. The company offers an online platform that connects businesses with a network of accredited suppliers for efficient sourcing and procurement of industrial and business supplies. Eezee's services cater to enterprises looking to streamline their supply chain management, offering features such as visual track and trace, ERP integration, and pre-negotiated pricing. It was founded in 2016 and is based in Singapore.

Udaan focuses on the trade ecosystem and supporting small businesses across various sectors. The company offers products including fruits & vegetables, and pharma, along with services such as supply chain and logistics operations, and financial products and services through UdaanCapital. Udaan serves small business owners, including kiranas, chemists, hotels, and offices, by providing a platform for wholesale purchasing and inventory management. It was founded in 2016 and is based in Bengaluru, India.

Loading...