Zilch

Founded Year

2018Stage

Line of Credit - II | AliveTotal Raised

$799.49MLast Raised

$177.65M | 7 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-4 points in the past 30 days

About Zilch

Zilch provides buy now, pay later services across various online retail sectors. The company offers a payment solution that allows customers to make purchases and pay for them over six weeks. It primarily serves the e-commerce industry with its virtual Mastercard. The company was founded in 2018 and is based in London, United Kingdom.

Loading...

Zilch's Product Videos

ESPs containing Zilch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Zilch named as Challenger among 15 other companies, including Klarna, Affirm, and Synchrony.

Zilch's Products & Differentiators

Pay in 1

Pay online or Tap & Pay anywhere in one and receive immediate cash back

Loading...

Research containing Zilch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

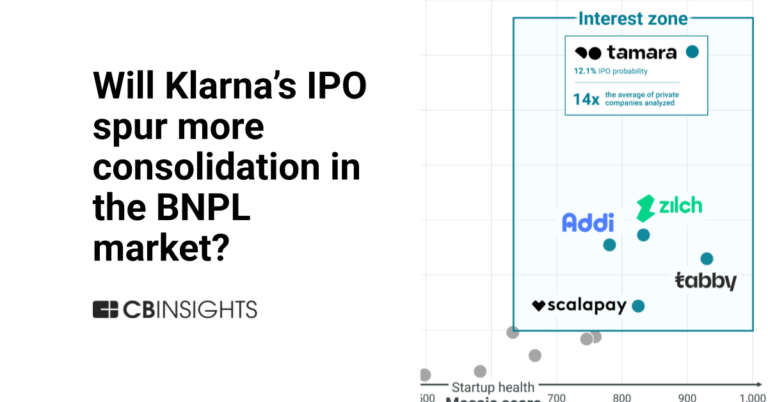

CB Insights Intelligence Analysts have mentioned Zilch in 1 CB Insights research brief, most recently on Sep 12, 2025.

Expert Collections containing Zilch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zilch is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,641 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,309 items

Digital Lending

2,735 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Zilch Patents

Zilch has filed 6 patents.

The 3 most popular patent topics include:

- credit cards

- merchant services

- online payments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/28/2020 | 12/31/2024 | Payment systems, Payment service providers, Merchant services, Online payments, Credit cards | Grant |

Application Date | 10/28/2020 |

|---|---|

Grant Date | 12/31/2024 |

Title | |

Related Topics | Payment systems, Payment service providers, Merchant services, Online payments, Credit cards |

Status | Grant |

Latest Zilch News

Nov 14, 2025

📩 Pour nous contacter: redaction@fw.media 1 minute de lecture Zilch prépare le lancement de Zilch Pay, une fonctionnalité de paiement en un clic attendue pour le premier semestre 2026. Avec ce produit, la fintech britannique veut trouver une place significative dans un marché dominé par Amazon et Apple Pay, alors que le checkout express s’impose comme un standard dans l’e-commerce européen. Le groupe s’appuie sur une base de plus de 5,3 millions de clients, dont une partie utilise Zilch plusieurs dizaines de fois par an. Cette fréquence d’usage permet à l’entreprise de tester des parcours simplifiés auprès d’utilisateurs déjà familiers de son interface. L’objectif est d’intégrer le paiement en un clic à un modèle combinant flexibilité de règlement, récompenses et connexion directe aux enseignes. Zilch déploie cette stratégie dans un contexte de consolidation du paiement en ligne. Amazon renforce One-Click dans plusieurs régions et Apple étend Apple Pay Capture ainsi que Pay Later sur les principales plateformes marchandes. Dans ce contexte concurrentiel, Zilch mise sur Intelligent Commerce, un moteur d’analyse dopé à l’IA qui transforme les données d’engagement en signaux exploitables en temps réel par les marchands. Ce socle technologique doit permettre d’alimenter Zilch Pay avec des données comportementales déjà intégrées aux parcours utilisateurs. Le groupe revendique plusieurs milliers de marchands connectés, dont Amazon, Tesco, eBay et Sports Direct. La société aligne ainsi paiement, récompenses et data marketing dans une même infrastructure, avec la volonté de proposer un outil transactionnel intégrable par les enseignes sans modification profonde de leur architecture existante. Fondée en 2020 par Philip Belamant et Sean O’Connor, Zilch qui a levé plus de 806 millions d’euros depuis sa création, vient de boucler un nouveau financement de 150 millions d’euros (176,7 millions de dollars) en dette et equity. Le tour est mené par KKCG, avec la participation de BNF Capital et d’investisseurs stratégiques additionnels. L’opération inclut l’expansion de sa titrisation menée par Deutsche Bank. Les fonds sont destinés à renforcer la visibilité de la marque via des investissements ATL, poursuivre le développement produit et examiner des opportunités de M&A. La société affirme avoir traité plus de 5 milliards de livres sterling de volume marchand depuis son lancement.

Zilch Frequently Asked Questions (FAQ)

When was Zilch founded?

Zilch was founded in 2018.

Where is Zilch's headquarters?

Zilch's headquarters is located at 111 Buckingham Palace Road, London.

What is Zilch's latest funding round?

Zilch's latest funding round is Line of Credit - II.

How much did Zilch raise?

Zilch raised a total of $799.49M.

Who are the investors of Zilch?

Investors of Zilch include Deutsche Bank, BNF Capital, KKCG, U.S. Bank, Leading European Tech Scaleups and 11 more.

Who are Zilch's competitors?

Competitors of Zilch include Klarna, Treyd, Hokodo, The Very Group, Tabby and 7 more.

What products does Zilch offer?

Zilch's products include Pay in 1 and 2 more.

Loading...

Compare Zilch to Competitors

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

Payl8r is a company that provides retail finance solutions in the financial services sector. It enables businesses to offer payment options that allow customers to finance purchases over time. Payl8r serves the ecommerce and retail sectors. It was founded in 2014 and is based in Manchester, England.

Cashew specializes in flexible payment solutions within the financial services sector. The company offers a range of products, including buy now, pay later options, interest-free installment plans, and comprehensive financial management services. Cashew primarily caters to individual consumers seeking manageable payment options for their purchases. It was founded in 2020 and is based in Dubai, United Arab Emirates.

Billie specializes in BNPL payment methods for the B2B sector and offers digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

SplitIt provides buy now, pay later (BNPL) solutions within the financial technology sector. The company offers a merchant-branded Installments-as-a-Service platform that facilitates buy now, pay later (BNPL) at the point of sale, allowing consumers to pay in installments while earning credit card rewards. Its services address the limitations of traditional buy now, pay later (BNPL) providers by offering a network of application programming interfaces (API) for card networks, issuers, and acquirers. SplitIt was formerly known as PayItSimple. It was founded in 2012 and is based in Atlanta, Georgia.

GenoaPay was a financial services company specializing in payment solutions within the consumer finance sector. The company offered a payment plan service that allowed customers to make purchases and spread the cost over 10 weekly installments without incurring fees or interest. GenoaPay primarily served the retail sector, providing merchants with tools to increase sales and customer acquisition by offering flexible payment options. It is based in Auckland, New Zealand.

Loading...