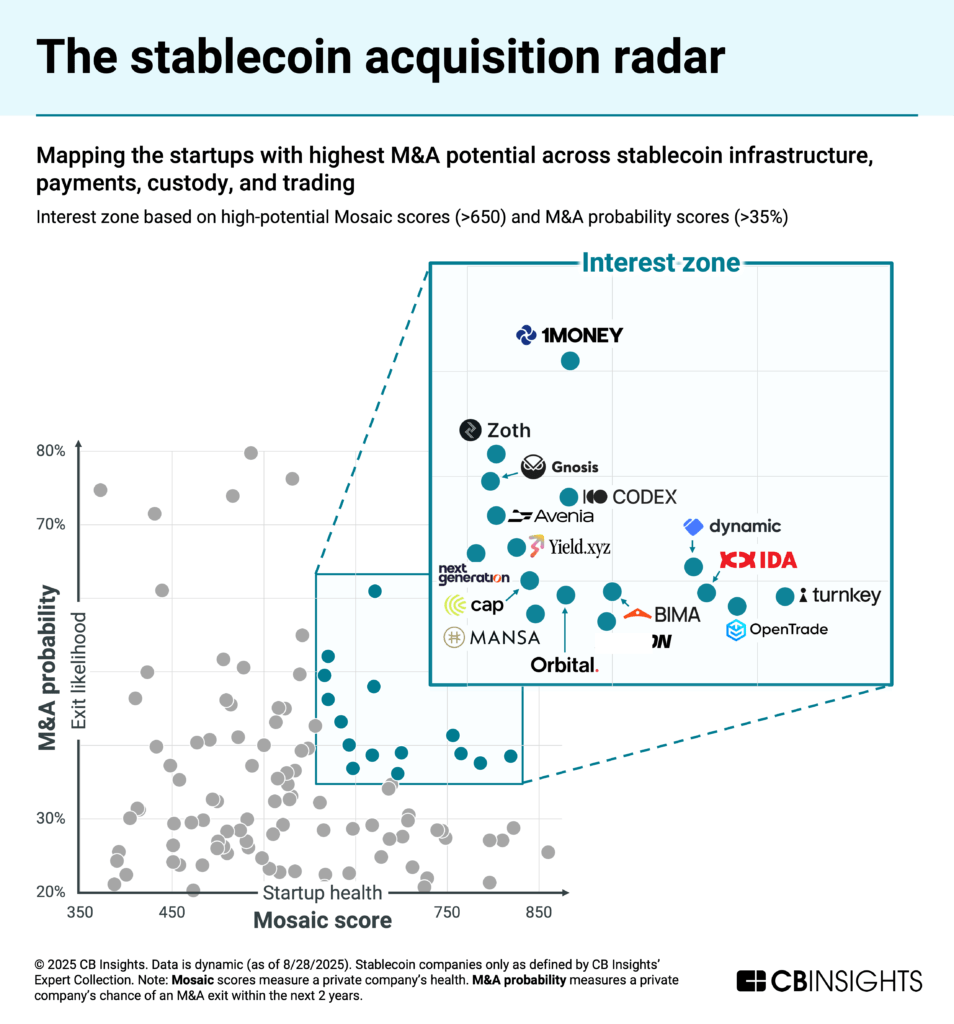

Using CB Insights’ predictive signals and data science, we identified the top stablecoin acquisition targets for fintechs:

Our methodology focuses on companies with strong acquisition potential by filtering for:

- M&A Probability: CB Insights’ proprietary signal measuring a private company’s chance of an M&A exit within the next 2 years, used to screen companies based on exit likelihood.

- Mosaic Score: CB Insights’ proprietary metric measuring private companies’ overall health and growth potential using non-traditional signals, widely used to identify high-potential emerging tech companies.

All companies in our stablecoin acquisition radar have above-average M&A probability (greater than 20%) and Mosaic scores (greater than 370).

Within this dataset, we identified the most promising acquisition candidates across the stablecoin ecosystem, with Mosaic scores greater than 650 and M&A probabilities over 35%.

Stablecoin funding and fintech M&A surge in tandem

Stablecoin funding is set to surge nearly tenfold in 2025, reaching a projected $10.2B. This funding boost coincides with a sustained spike in fintech M&A activity overall. Meanwhile, domestic fintechs are increasingly active in stablecoins, indicating near-future acquisitions by payment processors and crypto giants.

For example, Ripple, which has recently launched a stablecoin, acquired prime brokerage Hidden Road, and applied for a banking license, acquired stablecoin B2B remittance company Rail.io for $200M, positioning itself as an enterprise financial services provider powered by blockchain technology.

Mike Giampapa, General Partner of Galaxy Ventures (which provided Series A funding to Rail last year) explains:

”Despite $190T+ in annual flows, cross-border payments remain outdated. Galaxy Ventures invests in stablecoins and next-gen rails to deliver more efficient, transparent, and programmable payments. Rail stood out as an API-first platform merging fiat and digital into one compliant network – removing friction, lowering costs, and setting a new global standard for payments.”

Key takeaways:

Many companies in the M&A interest zone are developing stablecoin infrastructure designed for existing financial services providers, positioning themselves to support traditional financial institutions wading deeper into digital assets

This also makes them prime targets for crypto giants looking for entry points to mainstream financial processes.

With an M&A probability of 35% and a Mosaic score of 790, the next logical target could be OpenTrade, which offers white-label stablecoin infrastructure and yield products to neobanks, custodians, and treasury managers. Bastion (36% M&A probability, 696 Mosaic score) provides a stablecoin issuance platform for financial institutions and enterprises, making it attractive for controlling traditional finance’s entry into stablecoins.

Major crypto companies are already blending stablecoin capabilities with conventional financial services. Ripple’s acquisitions of Rail.io and Hidden Road, alongside its banking license application and RLUSD launch, signal a strategy to provide enterprise financial services using blockchain infrastructure. And stablecoin issuer Circle applied for a banking license in June following its $7B IPO earlier that month. As crypto giants increasingly resemble financial institutions, the startups using stablecoins to build bridges to TradFi emerge as key acquisition targets to drive and support this process.

Startups using stablecoins to facilitate cross-border payments via on- and off-ramps are prime candidates for acquisition

As the highest-potential acquisition target, 1Money Network stands out with a 62% M&A probability and 670 Mosaic score. Like Ripple’s recent acquisition, Rail, 1Money Network’s API offering for high-volume, cross-border stablecoin transactions makes it an attractive target for established processors looking to rapidly deploy stablecoin capabilities globally or crypto giants encroaching on traditional finance. And like Rail, it’s already backed by Galaxy Ventures.

Major payment processors accelerating stablecoin integrations to counter crypto competition will be the next to snap up these key targets. Already, payment processors are rapidly integrating stablecoin infrastructure to defend cross-border payments market share. Mastercard and Visa enabled new stablecoins on their networks this summer. And earnings transcripts mentions of “stablecoins” from both have increased sharply since the beginning of 2025. Meanwhile, Stripe has acquired stablecoin infrastructure companies Privy and Bridge ($1.1B). And it just unveiled a Layer-1 blockchain in partnership with Paradigm designed to facilitate cross-border payments using stablecoins.

Yield solutions are the next key target for players of all sizes

Yield-bearing stablecoins are a nascent space attracting diverse investor attention. Despite having the lowest average commercial maturity scores, yield and liquidity solutions are attracting the most deals and funding among all stablecoin categories.

Big names in fintech and crypto have already begun to acquire companies in the space. Stripe’s acquisition of Bridge last year included its USDB coin, which generates interest through BlackRock money market fund backing. In January, Circle acquired tokenized money market fund provider Hashnote for $5M.

High-potential acquisition targets include Yield.xyz (42% M&A probability, 635 Mosaic score), which aggregates returns across multiple yield opportunities through cross-chain APIs. Zoth (50% M&A probability, 616 Mosaic score) offers restaking layers, tokenized funds, stablecoin issuance, and the ZeUSD token for generating yield from financial instruments.

What is Mosaic?

Mosaic is CB Insights’ proprietary metric that measures private companies’ overall health and growth potential using non-traditional signals. Mosaic is widely used as a target company and market screener to identify high-potential emerging tech companies.

What is M&A Probability?

M&A Probability is CB Insights’ proprietary signal that measures a private company’s chance of an M&A exit within the next 2 years. It is used to quickly screen and triangulate companies based on exit likelihood.

Combining Mosaic Score and M&A Probability makes it easy to shortlist acquisition targets.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.