Early-stage activity points to what’s next in tech, from maturing stablecoin infrastructure to the specialized data providers emerging as key AI infrastructure.

In October, private companies globally raised 1,350+ early-stage rounds globally (noting this total will rise as more deals are published retroactively).

Download the full report to access comprehensive CB Insights data on early-stage activity, including top investors & deals, valuation data, and our predictive signals. Below, we highlight notable trends to watch.

Emerging tech trends to watch

Click the links to see underlying deal activity. Companies mentioned based on CB Insights Mosaic startup potential scores and relevance.

Stablecoin infrastructure is blockchain’s breakout category

Blockchain startups raised over 80 deals in October (out of 1,394 total early-stage deals), in line with September’s activity. The deals accounted for $1.1B in funding, representing 13% of total early-stage dollars invested in the month and a major jump from prior months, thanks to Tempo’s $500M round.

Overall, institutional investor activity (20 blockchain deals had CVC backers) and a median deal size of $6M (vs. $2.5M across the venture landscape) indicates investor conviction in a maturing blockchain landscape. See the companies already deploying their solutions in the market with CB Insights Commercial Maturity scores here.

Stablecoin infrastructure emerged as a leading theme, with 15+ companies raising capital in October.

The build-out is happening across multiple layers. At the protocol level, Tempo (744 Mosaic), a Layer-1 blockchain developed by Stripe and Paradigm for stablecoin transactions and payments, raised the largest round of the month — a $500M Series A at a $5B valuation.

Activity extends to the middleware layer, with Tesser (618 Mosaic, $4.5M seed) and Cybrid (705 Mosaic, $10M Series A) building API infrastructure that lets traditional banks integrate stablecoin capabilities.

Geographic diversification is notable as well. Lumx (596 Mosaic, $3.4M seed) focuses on stablecoin payments infrastructure in Latin America, while Standard Economics (671 Mosaic, $9M) is targeting developing markets with cross-border payment solutions.

The activity signals the potential of stablecoin rails to become core financial infrastructure.

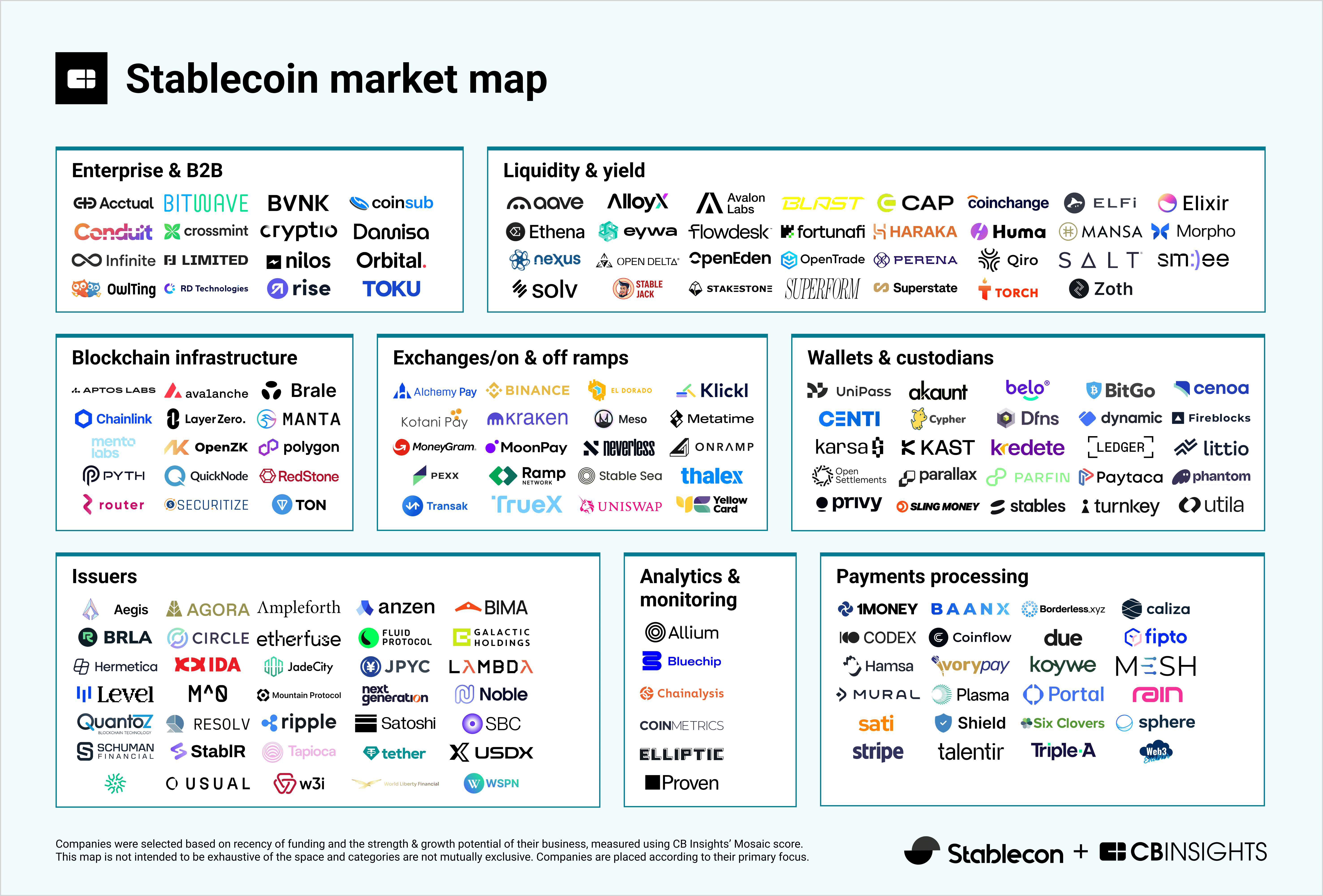

Review the stablecoin market map (May 2025) here.

AI agents make inroads across semiconductor design, healthcare, payments

Companies targeting AI agent applications & infrastructure raised over 70 deals in October. Smart Money investors — the top 25 VCs identified by CB Insights — backed 16 AI agent startups (22%) in the month.

Key emerging trends to note based on deal activity include:

- Browser automation & web agent infrastructure (5 deals): Most business-critical workflows still live in web UIs that require manual navigation rather than APIs. Companies like Kernel (646 Mosaic, $22M Series A) provide browsers-as-a-service infrastructure that enables agents to interact with websites.

- Semiconductor & hardware design (5 deals): Hardware engineering, from semiconductor chips to mechanical CAD, involves complex, time-intensive design and verification tasks. ChipAgents (710 Mosaic, $21M Series A) automates chip design workflows, while Adam (576 Mosaic, $4.1M) provides AI-powered CAD tools for mechanical engineering and 3D design.

- Voice agents for healthcare (4 deals): Healthcare providers face labor shortages and 24/7 patient communication demands. Attuned Intelligence (669 Mosaic, $13M seed), Remedy (474 Mosaic, $0.5M YC note), and OutcomesAI ($10M seed) deploy voice agents that handle appointment scheduling, prescription refills, and patient triage autonomously.

- Payments & transaction infrastructure (4 deals): To enable agents to initiate transactions, companies like Kite AI (702 Mosaic, Series A) are building specialized payment infrastructure. Others in this category such as Pagentic (562 Mosaic, $2M pre-seed) are focused on building payments and billing infrastructure for monetizing AI agents’ activities.

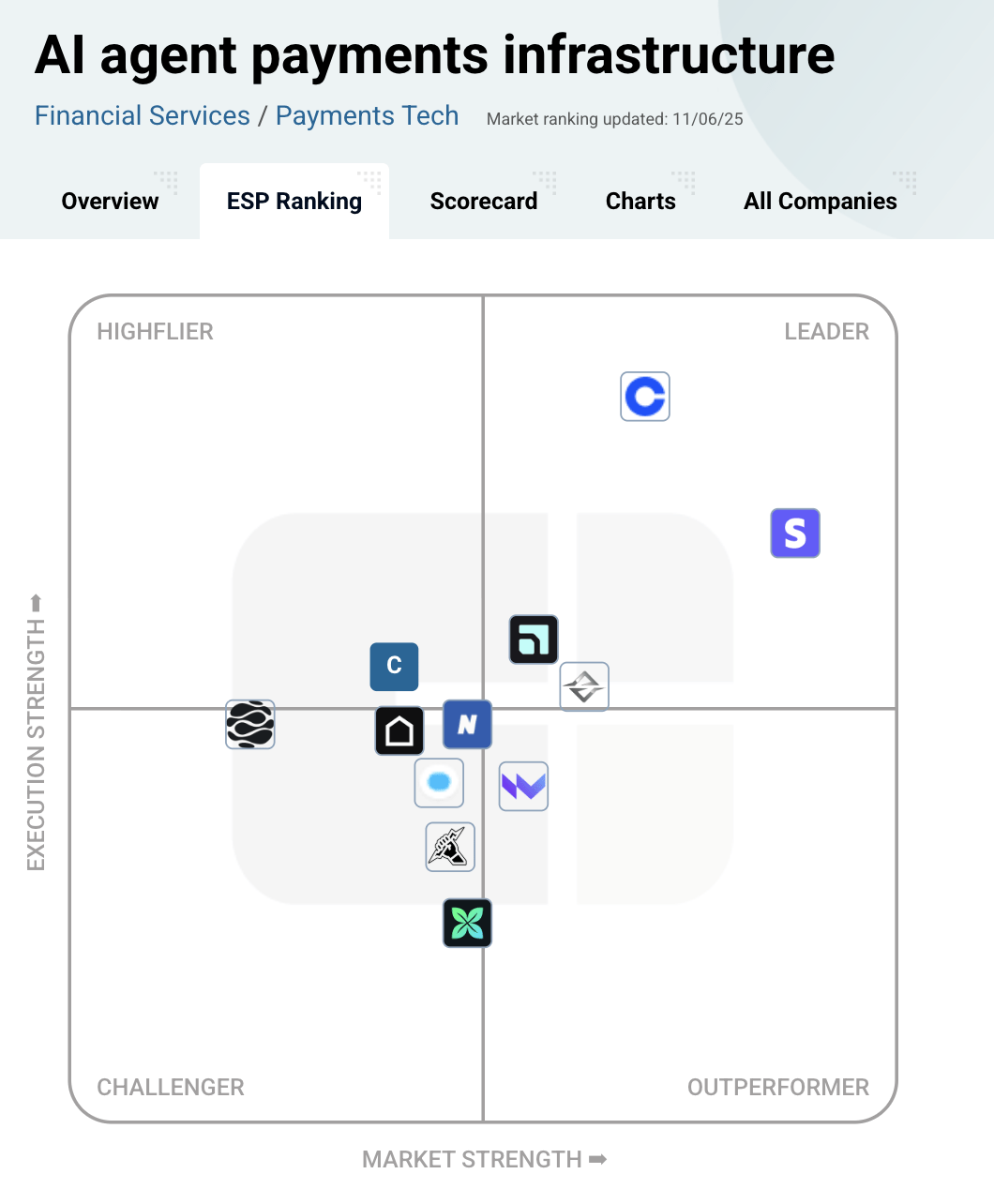

Compare 17 players in the AI agent payments infrastructure landscape on CB Insights.

Real-world training data providers scale specialized AI capabilities

Foundation models are bottlenecked by training data quality and diversity. October early-stage activity (6 deals) highlights specialized data providers emerging as important infrastructure for AI development, particularly for reasoning, coding, and physical-world applications.

For example:

- DataCurve (822 Mosaic, $15M Series A) offers a “bounty” platform where software engineers complete coding tasks to generate high-quality training data for models

- General Intuition (664 Mosaic, $134M seed) is training spatial-temporal reasoning models on interactive video data from gaming environments

- Lucent (507 Mosaic, $1.3M pre-seed) creates behavioral datasets from real-world product web interactions to train browser agents

- Hillclimb (479 Mosaic, $0.5M YC note) connects mathematicians with AI labs to create advanced math training data to improve models’ reasoning abilities

Wildfire detection & prevention technology attracts investment

Wildfire seasons are intensifying globally, driving demand for new detection and response technologies (5 deals). Companies like SenseNet (Mosaic 777, $10M Series A) and Frontline Wildfire Defense (Mosaic, $48M Series A) are deploying detection networks (sensors, cameras, and satellite data), automated suppression systems (sprinklers, foam, drones), and predictive risk platforms for utilities, governments, and property owners in fire-prone regions.

Review the wildfire tech market map (February 2025) here.

Methodology

This report includes equity early-stage financings (convertible note, angel, pre-seed, seed, Series A) to private companies in October 2025. We excluded companies that are later-stage that raised an angel round or convertible note in the month. Categorization based primarily on company descriptions.

FURTHER READING

- State of Venture Q3’25

- State of AI Q3’25

- Early-Stage Trends Report: Smart Money is all in on AI agents, the rise of autonomous labs, and more in September

- The AI agent market map