The AI agent moment is reshaping enterprise software.

Since our last mapping in March 2025, the landscape has exploded from roughly 300 players to thousands as tech companies race to launch AI agent offerings across horizontal use cases and industry applications.

Agentic solutions have become a leading acquisition target for enterprise software incumbents, while 1 in 5 new unicorns ($1B+ valuation) are now developing agents.

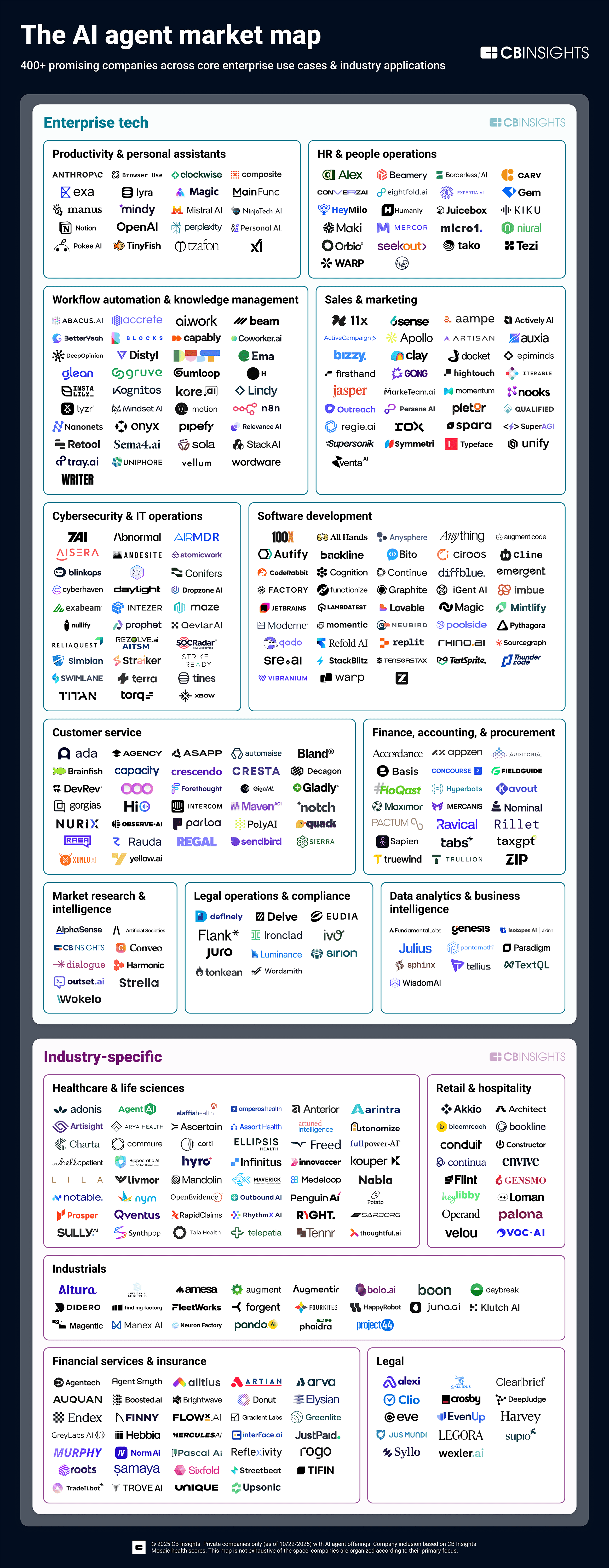

To help navigate this expansion, we mapped 400+ promising private companies building AI agent applications.

We selected companies for inclusion based on Mosaic startup health and potential scores (600+). We included private companies only with agent offerings and organized them according to their primary focus. This market map is not exhaustive of the space. For companies building infrastructure for agents, see our AI agent tech stack.

Please click to enlarge.

Want to be considered for future AI agent research? Brief our analysts to ensure we have the most up-to-date data on your company.

Here’s what today’s AI agent landscape signals about the future of tech:

- The private AI agent market is moving towards greater specialization. Horizontal AI agent startups outnumber verticalized solutions nearly 2-1 in the landscape. However, since we last published the map, industry-specific solutions have surged. This iteration features 47 companies in the healthcare & life sciences category, up from 7 in March. Partly behind the surge are commercially mature private companies launching agent offerings (or rebranding) to meet the moment. At the same time, emerging startups (see our analysis of Y Combinator’s recent batches here and here) are betting that highly regulated industries will favor specialized solutions over horizontal tools.

- Leading AI agent companies are growing revenue at lightning speed, with the top 20 revenue leaders (with agents as a primary product) averaging just 3.8 years old. Software development leads revenue activity with 6 coding agents making the top rankings including Anysphere (Cursor) and Replit. This market is the most crowded on the map, reflecting the value agents bring to well-defined workflows and testable environments. But it’s also facing challenges as reasoning models drive higher inference costs, previewing the pricing pressures other agent categories will face. CB Insights customers can dig into revenue data for the full AI agent & copilot landscape with this search.

- AI agent startups focused on cybersecurity operations are most primed to exit, based on average CB Insights M&A probability scores. Nullify (autonomous agents for application security) and Strike Ready (AI-powered SOC platform) top the list with 70%+ probability of getting acquired within the next two years. AI-related cybersecurity M&A (both for AI security solutions and AI-powered solutions) has already reached record levels in 2025 so far. Cyber leaders are snapping up competitors to keep up with an evolving attack surface.

Methodology & category notes

Companies profiled on the map are working on various levels of autonomy, from agentic, LLM-powered workflows to fully autonomous agents.

These agents combine reasoning (foundation models for decision-making), memory (information storage and retrieval), tool use (external system integration), and planning (task decomposition and adaptation) capabilities.

We excluded companies building agent-specific infrastructure, focusing on startups targeting core enterprise use cases and industry-specific workflows.

Companies were selected from a pool of over 1,700 based on their CB Insights Mosaic score.

Evaluates the overall health and growth potential of private companies based on performance, financial stability, market conditions, and management strength. It combines these factors into a single score (out of 1,000).

Enterprise tech

Click into each market to view the full description and market players on the CB Insights platform.

This segment primarily features startups targeting enterprises, with industry-agnostic applications across job functions such as:

- Data analytics

- Coding

- Finance and accounting

- Sales

- Marketing

- Customer service

- Recruiting

- Security operations centers

- Legal (in-house)

- IT operations & support

Companies in the productivity & personal assistants category are targeting consumers and employees directly across applications like research, time management, and other browser-based tasks.

General workflow automation & knowledge management tools are one of the largest categories on the map, encompassing the AI agent builder platforms market, which offers no-code and low-code solutions for business users to automate workflows.

Industry-specific

This layer features companies catering to industry applications, including:

- Financial services & insurance (e.g., investment research, loan servicing & collections, compliance workflows)

- Healthcare & life sciences (e.g., revenue cycle management, clinical documentation, patient access)

- Industrials (e.g., manufacturing optimization, supply chain, construction)

- Retail & hospitality (e.g., shopping agents, website personalization, restaurant & hotel)

FURTHER READING

- The AI agent bible

- The AI agent tech stack

- The AI agent market map: March 2025 edition

- State of AI Q3’25