Covariant

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$207MValuation

$0000Last Raised

$80M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-97 points in the past 30 days

About Covariant

Covariant develops automation solutions using artificial intelligence (AI) in the robotics sector. Its main offering, the Covariant Brain, is an AI platform intended to allow robots to pick various items autonomously from day one, supporting warehouse operations. Its technology is used by fulfillment companies to improve operational processes and tackle labor challenges. It was formerly known as Embodied Intelligence. It was founded in 2017 and is based in Emeryville, California.

Loading...

Covariant's Product Videos

ESPs containing Covariant

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The robot foundation model developers market refers to the segment of the artificial intelligence and robotics industry focused on developing foundational AI models for a wide variety of robotic form factors. These models, built on advanced machine learning architectures, provide the underlying capabilities for a wide array of robotic tasks, such as perception, decision-making, and interaction. Th…

Covariant named as Challenger among 15 other companies, including Microsoft, Meta, and Amazon.

Covariant's Products & Differentiators

Robotic Putwall

ln batch picking operations for apparel, health & beauty, general ecommerce, etc., Covariant robotic solutions can autonomously sort items into an order bin or putwall — freeing up workers for more value-added tasks while increasing throughput.

Loading...

Research containing Covariant

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Covariant in 4 CB Insights research briefs, most recently on Jul 31, 2025.

Expert Collections containing Covariant

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Covariant is included in 7 Expert Collections, including Robotics.

Robotics

2,753 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

AI 100 (All Winners 2018-2025)

300 items

The winners of the 4th annual CB Insights AI 100.

Future Unicorns 2019

50 items

Supply Chain & Logistics Tech

754 items

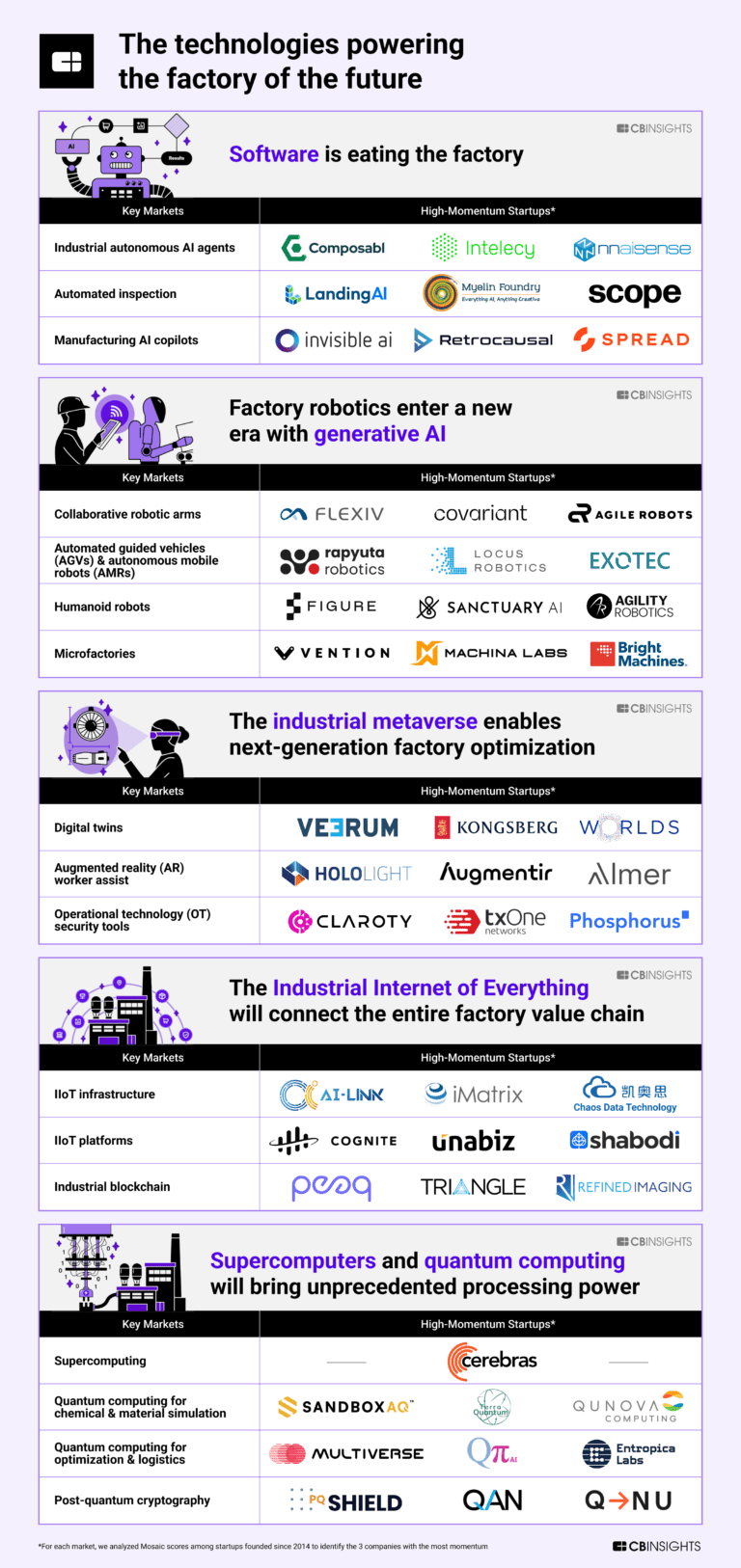

Advanced Manufacturing

7,017 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Future of the Factory (2024)

436 items

This collection contains companies in the key markets highlighted in the Future of the Factory 2024 report. Companies are not exclusive to the categories listed.

Latest Covariant News

Nov 12, 2025

这些人几乎覆盖了OpenAI的所有关键岗位:模型研发、训练系统、对齐与安全、产品工程与工具链。他们不仅是GPT系列的构建者,也亲历了从研究原型到亿级用户产品的全过程。 这是一轮极具组织穿透力的人才外溢。 在商业世界里,他们没有选择“复制OpenAI”,而是试图重构某个曾经只存在于OpenAI内部的系统逻辑:有人强调安全为先,有人重做工具链,有人直接落地智能体应用;有的公司成立三个月,估值已达50亿美元,有的还未有产品,就完成了上亿美元融资。 某种程度上,这些人的离开,并没有切断OpenAI的影响力,反而让它的技术路径与组织经验,借由新的公司被扩散到了更广泛的产业层面。 OpenAI系创业者,撑起700亿 当一家顶级实验室的创新红利接近上限,人才与理念的外溢几乎成为自然规律。 就像硅谷当年的“PayPal帮”一样,2022年至2025年间的OpenAI,也正在成为AI世界的“黄埔军校”。 据乌鸦君不完全统计,这三年间,已有9名核心成员离开OpenAI,创办了8家AI公司,即使不算两家未披露估值的公司,累计估值已经在700亿美元左右。 他们并非普通工程师,大多在离职前担任研究负责人、首席科学家或团队核心人员,主导的方向涵盖模型结构、训练体系、安全机制与产品部署,几乎覆盖OpenAI的技术中枢。 从他们创业方向看,主要集中在AI安全、智能体以及AI应用。 首先,是围绕“AI 安全”的创业潮。 2024 年5 月,OpenAI 联合创始人、长期担任首席科学家的 Ilya Sutskever 选择离开,成立 Safe Superintelligence (SSI)。这是一家纯研究导向的公司,主张将“监管即服务”作为超级智能的前提,为全球 AI 开发者提供能力评估、风险建模与可解释性框架。 SSI 的创始团队包括前 Alignment 负责人 Paul Christiano 与策略研究员 Daniel Kokotajlo,成立数月即获红杉资本与 Founders Fund 联合投资,首轮融资超 5 亿美元,成为全球估值最高的 AI 安全公司之一。 与此同时,前 CTO Mira Murati 与 OpenAI 联合创始人 John Schulman 共同创立了 Thinking Machines Lab,试图重建“科研即平台”的基础设施,面向高校和企业。 这家公司复用了 OpenAI 工具链的理念,强调数据治理、模型复现与 AI 责任追踪。今年 7 月完成 20 亿美元 seed 轮融资,10 月估值已达 200 亿美元。 第二类,是围绕“智能体”与人机交互的创业。 Adept AI由前工程副总裁David Luan创立,主攻“能操作电脑的AI助手”。他曾主导GPT-2与GPT-3的训练体系,离职后迅速组建团队并获得超4亿美元融资。 Inflection AI则由DeepMind联合创始人Suleyman和前OpenAI战略顾问Simonyan创办,35人核心团队中包含多位GPT项目的工程师。该公司强调“对话即智能体”,其产品Pi被认为是“最具人格温度”的AI助手,目前估值近40亿美元。 Perplexity AI的创始人Aravind Srinivas曾在OpenAI负责推理系统与多模态搜索。他带领的团队大多来自OpenAI工具链小组,目前已完成15亿美元融资,估值超过200亿。其“对话式搜索+引用溯源”的模式,被视为AI搜索的关键转折点。 第三条,是将通用模型能力迁移至垂直场景。 Eureka Labs由Karpathy创办,专注AI教育与自适应学习系统,打造自动生成课程、反馈与评测的教学平台。团队多为OpenAI工具链出身,首轮融资达4亿美元,估值超过50亿。 Covariant由Pieter Abbeel创办,主打通用机器人操作系统;Periodic Labs聚焦材料科学与实验室AI自动化,2025年完成A轮融资,估值达8亿美元。 相比其他创业公司,从OpenAI走出的创业者更容易在短时间内获得高估值。 Ilya Sutskever的SSI,没有产品、没有用户,仅用三个月时间,就完成了10亿美元融资,估值达50亿美元; 前CTO Mira Murati成立的Thinking Machines Lab,在创业5个月后就拿到了20亿美元的种子轮融资; 前OpenAI研究副总裁Liam Fedus创办的Periodic Labs,仅成立3个月,就获得了a16z领投的2亿美元融资。 这些公司的共同点是:尚无明确产品路径,但创始人来自OpenAI的核心管理团队。他们还未开始构建收入模型,估值已经被推到了数十亿美元。 这是一种罕见的市场信号。在资本看来,只要出发点够接近OpenAI,就足够值得押注一轮。 从Meta到xAI,OpenAI何以成为全球AI人才库? 除了创业之外,OpenAI正在悄然成为整个AI产业最重要的人才“蓄水池”。据乌鸦君不完全统计,自2022年以来,已有至少16位核心成员离开OpenAI,加入其他AI公司。 不少企业已将OpenAI视为顶尖技术能力的“供应源”,而过去半年,动作最激进的,是Meta。 6月至7月,一支成建制的队伍从OpenAI苏黎世与旧金山研究团队集体迁往Meta——这并非个人行为,而是一次成建制、成团队的集体迁移。 据统计,OpenAI有多达11人加入Meta新组建的“Superintelligence Labs”,其中包括Shengjia Zhao、Jason Wei、Lu Liu、Shuchao Bi、Allan Jabri、Alexander Kolesnikov、Xiaohua Zhai、Jiahui Yu、Lucas Beyer、Hongyu Ren等人。 他们几乎覆盖了OpenAI在多模态、模型对齐、训练优化与底层系统等关键能力: Shengjia Zhao成为Meta的首席科学家,重建团队的核心研究路线——从模型对齐、推理框架到视觉Transformer的再训练; Jason Wei接手模型科学工作,专注多任务泛化与推理一致性; Allan Jabri与Jiahui Yu延续DALL·E图像生成与视觉-语言融合的研究,把OpenAI的多模态积累嫁接到Llama体系上。 苏黎世出身的Xiaohua Zhai与Lucas Beyer,在PyTorch的FSDP/DTensor等分布式能力上深调优,使Meta在分布式训练和数据分片上追上OpenAI内部架构。 这是一支“纯血OpenAI班底”,Meta正在用它复刻并升级自己的AGI研究体系。 而Meta并不是唯一的“受益方”。 Kyle Kosic作为xAI的首批创始成员,2023年从OpenAI跳槽至xAI并担任基础设施负责人,主导相关模型开发工作。他帮助马斯克的团队在短时间内搭建出与OpenAI相似的推理框架,不过在2024年5月,他选择重返OpenAI。 在DeepMind,前OpenAI开发者生态负责人Logan Kilpatrick接任Gemini的开发者与社区负责人。他曾主导GPT API的生态建设,如今延续类似路径,强化Gemini产品的开发者接口与商业化反馈机制。 OpenAI系出身者为何成为市场上最抢手的一批人? 答案并不复杂。他们是少数亲历过GPT-4、GPT-4.5、GPT-5、Sora等模型从训练、评估、安全对齐到全球上线全过程的人。他们知道如何将前沿算法转化为面向亿级用户的商业系统,这种能力稀缺且不可快速复制。 更关键的是,OpenAI极其扁平的组织结构,给了他们一个高度复合的实践场。 在OpenAI内部,分为两条主干:研究团队和工程团队。其中,研究团队负责模型原型、安全策略与对齐机制,工程团队构建稳定的上线系统。 两者中间没有明显割裂,研究员可以直接影响产品决策,开发者也参与模型验证。团队以“小组制”运作,每组几乎具备端到端从研究到部署的全流程权限,类似微型创业单位。 这种高自由度、高耦合度的研发体系,催生出一批“杂而深”的人才:他们既熟悉底层算法,也具备工程实现与产品化思维。 为了找到这样的人,OpenAI的用人标准与主流研究机构明显不同。它有两条明确的“不看”: 一是不看学历。博士学位并不是进入门槛,很多核心研究员甚至只有本科背景。比如DALL·E作者Aditya Ramesh,仅有纽约大学的学士学位。 二是不看资历。OpenAI习惯让新人挑大梁。Sora项目负责人Bill Peebles是2023年刚刚毕业的博士,加入不到一年就开始带队。 这种机制锻造出一批具备跨学科知识结构、强落地导向、愿意对最终产品负责的人。他们熟悉前沿技术,也懂如何把技术推向规模化产品。 对Meta、xAI以及更多新兴公司来说,他们争抢的,从来不只是技术履历本身,而是OpenAI那套组织机制与产品哲学下沉淀出的关键人才。 这些人能将使命驱动的研究精神,与可交付的产品标准融合在一起。而这,正是构建下一代AI公司最需要的能力。

Covariant Frequently Asked Questions (FAQ)

When was Covariant founded?

Covariant was founded in 2017.

Where is Covariant's headquarters?

Covariant's headquarters is located at 5905 Christie Avenue, Emeryville.

What is Covariant's latest funding round?

Covariant's latest funding round is Series C - II.

How much did Covariant raise?

Covariant raised a total of $207M.

Who are the investors of Covariant?

Investors of Covariant include Amplify Partners, Index Ventures, Radical Ventures, CPP Investments, Northgate Capital and 18 more.

Who are Covariant's competitors?

Competitors of Covariant include Modular AI, Nimble, Sileane, AICA, Dexterity and 7 more.

What products does Covariant offer?

Covariant's products include Robotic Putwall and 3 more.

Who are Covariant's customers?

Customers of Covariant include Capacity, GXO, Obeta and McKesson.

Loading...

Compare Covariant to Competitors

Berkshire Grey develops artificial intelligence (AI) enabled enterprise robotics aimed at the fulfillment and logistics sectors. The company provides solutions that assist in tasks such as identifying, picking, sorting, packing, and moving goods within a warehouse. Berkshire Grey's technology targets warehouse operations, focusing on the needs of retailers, e-commerce, and logistics enterprises. It was founded in 2013 and is based in Bedford, Massachusetts.

Plus One Robotics provides robotic and automated material handling solutions within the logistics and warehousing industry. The company offers services such as depalletizing, parcel induction, and palletizing, powered by PickOne artificial intelligence (AI) software and supported by human oversight to enhance productivity. Plus One Robotics serves sectors including general merchandise, parcel & post, and third-party logistics (3PL). It was founded in 2016 and is based in San Antonio, Texas.

Scallog provides robotic solutions for order preparation within the logistics sector. The company offers products including mobile robots, shelving systems, and workstations that are intended to automate and optimize warehouse operations. Scallog's solutions are utilized in e-commerce, industrial, retail, fashion, consumer goods, and cosmetic-pharmaceutical sectors. It was founded in 2013 and is based in Nanterre, France.

RightHand Robotics provides robotic piece-picking solutions for order fulfillment in industries like e-commerce and pharmaceuticals. Its offerings include a robotic system for item picking, machine learning, and artificial intelligence, along with fleet management and customer support services. Its technology integrates into existing workflows for order fulfillment. It was founded in 2015 and is based in Charlestown, Massachusetts.

Bleum Robotics provides software and IT development services across industries including high-tech, financial services, and telecommunications. The company focuses on development centers and provides services such as application development, infrastructure support, maintenance, testing, and modernization of legacy systems. Bleum Robotics serves clients in North America and Europe with a focus on delivering solutions through a delivery model. It was founded in 2001 and is based in Englewood, Colorado.

inVia Robotics provides warehouse automation solutions within the logistics and supply chain industry. The company offers products including autonomous mobile robots, an artificial intelligence (AI) powered warehouse intelligence platform, and a modular goods-to-person system aimed at improving warehouse productivity and operational efficiency. inVia Robotics serves e-commerce distribution centers and supply chain operations, providing a robotics-as-a-service model that integrates with existing infrastructure. It was founded in 2015 and is based in Westlake Village, California.

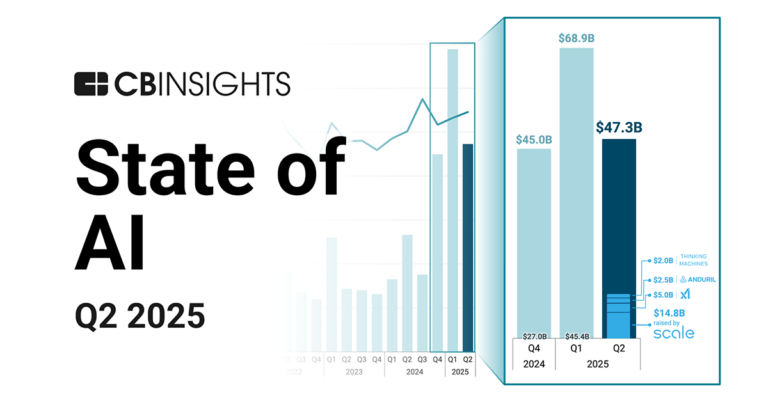

Loading...