Investments

1020Portfolio Exits

134Funds

17Partners & Customers

4About Mitsubishi UFJ Capital

Mitsubishi UFJ Capital operates as a venture capital firm within the Mitsubishi UFJ Financial Group. It is a commercial financial institution specializing in healthcare, electronics, and high-technology investments. It supports companies in their pre-seed and pre-series A stages with growth capital investments, and aims to partner with the companies until initial public offering (IPO), mergers and acquisitions (M&A), and other exit strategies. It was founded in 1974 and is based in Tokyo, Japan.

Research containing Mitsubishi UFJ Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mitsubishi UFJ Capital in 4 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

State of CVC Q1’25 Report

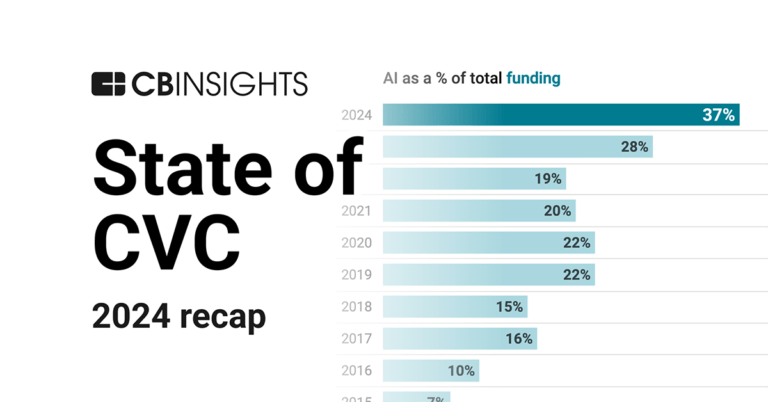

Feb 4, 2025 report

State of CVC 2024 Report

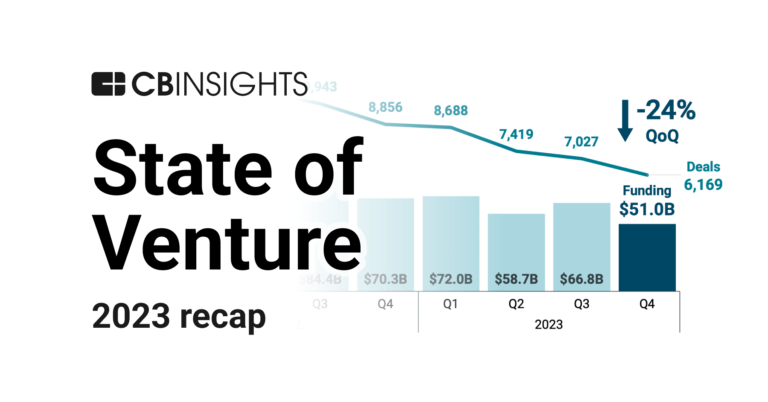

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest Mitsubishi UFJ Capital News

Oct 22, 2025

ファッションフリマアプリのdigdig、シリーズAラウンドで約4億円の資金調達を実施 2025年10月22日 10時00分 「オシャレを持続可能にするインフラを創る。」をミッションにファッションフリマアプリを運営する株式会社digdig(ディグディグ|本社:東京都渋谷区、代表取締役:楊 承峻、以下:当社)は、三井住友海上キャピタル株式会社、三菱UFJキャピタル株式会社、Value Chain Innovation Fund(※)、全国保証イノベーションファンド(※)を引受先とした第三者割当増資、ならびに株式会社みずほ銀行からの融資によりシリーズAラウンドにおいて総額約4億円の資金調達を実施しました。 今後は、衣類の処分方法を再定義する国内No.1の古着売買プラットフォームの構築を目指すとともに、AIと物流を掛け合わせたスマートリユースインフラの実装や、古着市場に特化した新規事業の展開も予定しています。 全国保証イノベーションファンド(Spiral Innovation Partners株式会社が運営) 今回リード投資家として、株式会社digdigに投資させていただきました。 『digdig』は、まだ使える衣類をリユースし、環境負荷を大幅に削減しつつ、売る人と買う人を繋ぐことで「オシャレを持続可能にするインフラを創る。」ことを目指しています。 衣類は「捨てる」から「digdigへ送る」へ、日本の常識を変えるチャレンジに伴走出来ることを非常に楽しみにしております。 三菱UFJキャピタル株式会社 投資第二部次長 佐藤 可奈 氏 カジュアル古着のオンラインサイトのパイオニア的存在になることを期待しています。MUFGリソースを活用して、サポートをして参ります。 ファッションの二次流通に新たな選択肢を与える存在として、「オシャレを持続可能にするインフラを創る。」の実現を目指す『digdig』の飛躍に期待しています。 株式会社digdig 代表取締役 楊 承峻コメント 流行を追うだけではなく、自分らしいスタイルを大切にする人たちの背中をそっと支えるような存在でありたい。そう願いながら、私たちは単なるプロダクト提供にとどまらず、ライフスタイルの新しい提案を続けていきます。 まだ小さな取り組みかもしれませんが、積み重ねた先にある未来を信じて、挑戦を続けていきます。 『digdig』について 『digdig』は、服を売るときに感じる「面倒くさい」「安すぎる」といったユーザーの悩みを解決するために誕生した、ファッションフリマアプリです。ユーザーは、アプリから届く専用の出品キットに洋服を詰めて返送し、希望販売価格を入力するだけ。撮影・採寸・梱包・発送といった手間のかかる作業は、すべて『digdig』が代行します。 『digdig』の普及により、服のリユースやリサイクルが促進され、環境面でも大きなインパクトが期待されます。たとえば、廃棄されていた衣類が再資源化されることで、年間最大約2,500万トンのCO₂排出量が削減できる可能性があり、これは東京都の年間排出量の約4割に相当します。このように『digdig』は、人と社会の双方にとって「持続可能なオシャレ」を実現する、新たなスタンダードを目指しています。 ■ 関連リンク

Mitsubishi UFJ Capital Investments

1,020 Investments

Mitsubishi UFJ Capital has made 1,020 investments. Their latest investment was in Turing as part of their Series A on November 17, 2025.

Mitsubishi UFJ Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/17/2025 | Series A | Turing | $63.17M | No | ANRI, Canon MJ MIRAI Fund, Chibagin Capital, Dai Nippon Printing, DENSO, ENEOS Holdings, Global Brain, GMO Internet Group, JGC Corporation, JIC Venture Growth Investments, Mercuria, Mirai Sozo Capital, Mitsubishi HC Capital, Mitsui Fudosan, Mizuho Capital, Sony Financial Ventures, Spiral Ventures, Tokyu Fudosan Holdings, Wing Capital Partners, Yanmar Ventures, Z Venture Capital, and ZENRIN Future Partners | 3 |

11/13/2025 | Series B | Ascend | $5.81M | Yes | Globis Capital Partners, LTS, Mercuria, Samurai Incubate, Spiral Innovation Partners, and Undisclosed Investors | 3 |

11/11/2025 | Series A | Voyt | No | 3 | ||

10/27/2025 | Seed VC - II | |||||

10/22/2025 | Series A |

Date | 11/17/2025 | 11/13/2025 | 11/11/2025 | 10/27/2025 | 10/22/2025 |

|---|---|---|---|---|---|

Round | Series A | Series B | Series A | Seed VC - II | Series A |

Company | Turing | Ascend | Voyt | ||

Amount | $63.17M | $5.81M | |||

New? | No | Yes | No | ||

Co-Investors | ANRI, Canon MJ MIRAI Fund, Chibagin Capital, Dai Nippon Printing, DENSO, ENEOS Holdings, Global Brain, GMO Internet Group, JGC Corporation, JIC Venture Growth Investments, Mercuria, Mirai Sozo Capital, Mitsubishi HC Capital, Mitsui Fudosan, Mizuho Capital, Sony Financial Ventures, Spiral Ventures, Tokyu Fudosan Holdings, Wing Capital Partners, Yanmar Ventures, Z Venture Capital, and ZENRIN Future Partners | Globis Capital Partners, LTS, Mercuria, Samurai Incubate, Spiral Innovation Partners, and Undisclosed Investors | |||

Sources | 3 | 3 | 3 |

Mitsubishi UFJ Capital Portfolio Exits

134 Portfolio Exits

Mitsubishi UFJ Capital has 134 portfolio exits. Their latest portfolio exit was Infcurion on October 24, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/24/2025 | IPO | Public | 2 | ||

10/15/2025 | Acquired | 4 | |||

10/7/2025 | IPO | Public | 2 | ||

Date | 10/24/2025 | 10/15/2025 | 10/7/2025 | ||

|---|---|---|---|---|---|

Exit | IPO | Acquired | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | Public | |||

Sources | 2 | 4 | 2 |

Mitsubishi UFJ Capital Fund History

17 Fund Histories

Mitsubishi UFJ Capital has 17 funds, including Mitsubishi UFJ Capital VII.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

2/20/2019 | Mitsubishi UFJ Capital VII | Multi-Stage Venture Capital | Closed | $136.98M | 1 |

2/20/2019 | Mitsubishi UFJ Life Science II | Multi-Stage Venture Capital | Closed | $91.32M | 1 |

2/20/2017 | Mitsubishi UFJ Life Science I | Multi-Stage Venture Capital | Closed | $88.37M | 1 |

2/20/2017 | Mitsubishi UFJ Capital VI | ||||

11/30/2015 | Mitsubishi UFJ Venture Fund II |

Closing Date | 2/20/2019 | 2/20/2019 | 2/20/2017 | 2/20/2017 | 11/30/2015 |

|---|---|---|---|---|---|

Fund | Mitsubishi UFJ Capital VII | Mitsubishi UFJ Life Science II | Mitsubishi UFJ Life Science I | Mitsubishi UFJ Capital VI | Mitsubishi UFJ Venture Fund II |

Fund Type | Multi-Stage Venture Capital | Multi-Stage Venture Capital | Multi-Stage Venture Capital | ||

Status | Closed | Closed | Closed | ||

Amount | $136.98M | $91.32M | $88.37M | ||

Sources | 1 | 1 | 1 |

Mitsubishi UFJ Capital Partners & Customers

4 Partners and customers

Mitsubishi UFJ Capital has 4 strategic partners and customers. Mitsubishi UFJ Capital recently partnered with AGC Group on March 3, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/4/2025 | Partner | Japan | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | 1 | |

8/19/2021 | Partner | ||||

1/10/2019 | Partner | ||||

1/23/2015 | Vendor |

Date | 3/4/2025 | 8/19/2021 | 1/10/2019 | 1/23/2015 |

|---|---|---|---|---|

Type | Partner | Partner | Partner | Vendor |

Business Partner | ||||

Country | Japan | |||

News Snippet | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | |||

Sources | 1 |

Mitsubishi UFJ Capital Team

10 Team Members

Mitsubishi UFJ Capital has 10 team members, including current President, Kei Andoh.

Name | Work History | Title | Status |

|---|---|---|---|

Kei Andoh | President | Current | |

Name | Kei Andoh | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | President | ||||

Status | Current |

Compare Mitsubishi UFJ Capital to Competitors

Nissay Capital is the venture capital arm of Nippon Life Insurance Company. Nissay Capital invests in early and growth-stage businesses, resulting in a well-balanced portfolio across multiple sectors and markets. Nissay Capital was founded in 1991 and is based in Tokyo, Japan.

Globis Capital Partners is a venture capital firm that offers comprehensive support in human resources), funds, and management expertise. Its people programs include an MBA program, management school, executive education, corporate training programs, e-learning programs, and more. The company was founded in 2006 and is based in Tokyo, Japan.

ANOBAKA is a venture capital firm that invests in early-stage internet-business-focused startups. It focuses on fintech, medical tech, mobile technology, and other technology company. It was formerly known as KVP. It was founded in 2015 and is based in Tokyo, Japan.

Coral Capital operates as a venture capital firm focusing on seed to Series B stage investments across various industries. The firm supports startups from software as a service (SaaS) to nuclear fusion, providing funding and strategic insights. It primarily sells to the startup ecosystem, offering resources such as talent, capital, and knowledge to entrepreneurs aiming to build legendary companies. Coral Capital was formerly known as 500 Startups Japan. It was founded in 2018 and is based in Tokyo, Japan.

Genesia Ventures is a seed and early-stage investment firm that supports entrepreneurs. The company was founded in 2016 and is based in Tokyo, Japan.

Mitsui Sumitomo Insurance Venture Capital operates as a venture capital firm investing in growth-stage companies. The company provides financial backing and post-investment support to its portfolio companies. Mitsui Sumitomo Insurance Venture Capital serves sectors requiring venture capital investment and support for entrepreneurship. It was founded in 1990 and is based in Tokyo, Japan.

Loading...