Perplexity

Founded Year

2022Stage

Series D - IV | AliveTotal Raised

$976.15MValuation

$0000Last Raised

$200M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+15 points in the past 30 days

About Perplexity

Perplexity develops artificial intelligence-powered information discovery tools designed for answering questions and exploring topics. The company's tools provide real-time answers, personalized search experiences, and integration with various data sources, and collaborate on joint events, co-sell engagements, and co-marketing, enabling users to efficiently access information for enhancing their research and decision-making processes. It primarily serves the technology sector. It was founded in 2022 and is based in San Francisco, California.

Loading...

Loading...

Research containing Perplexity

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Perplexity in 22 CB Insights research briefs, most recently on Nov 13, 2025.

Nov 13, 2025 report

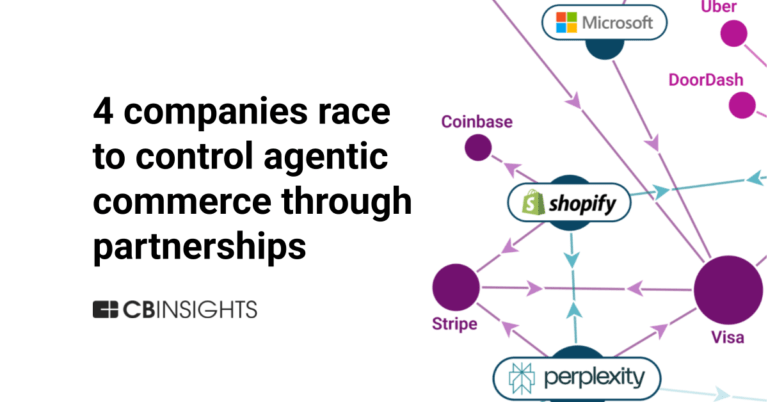

The agentic commerce market map

Oct 30, 2025 report

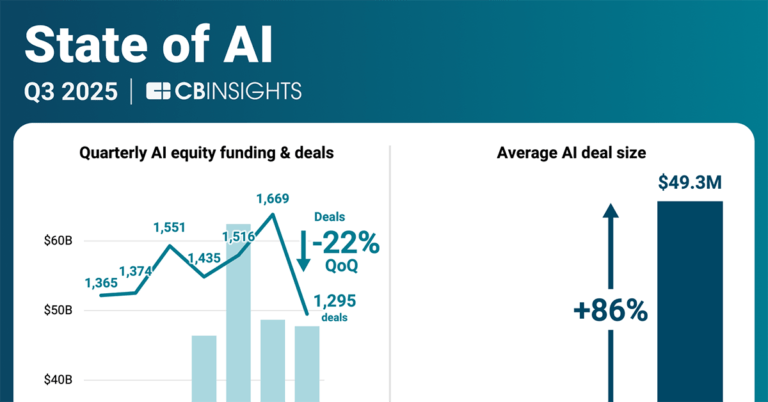

State of AI Q3’25 Report

Oct 15, 2025 report

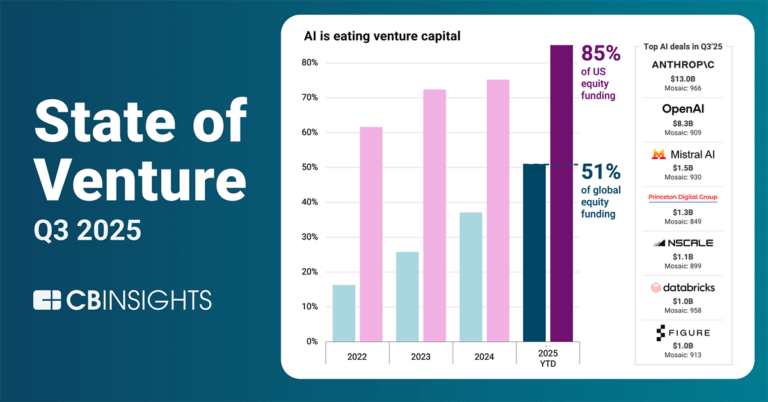

State of Venture Q3’25 Report

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

Aug 22, 2025

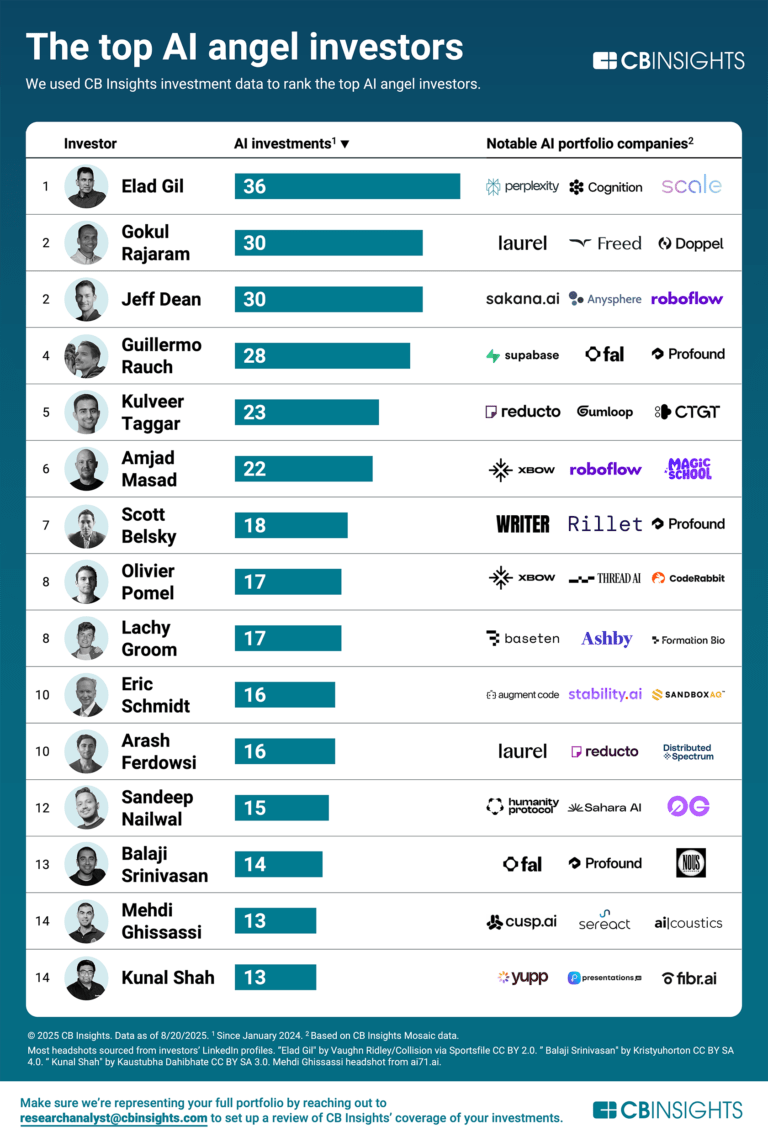

The top angel investors in AI

Aug 14, 2025 report

Book of Scouting Reports: Enterprise AI Agents

Aug 11, 2025 report

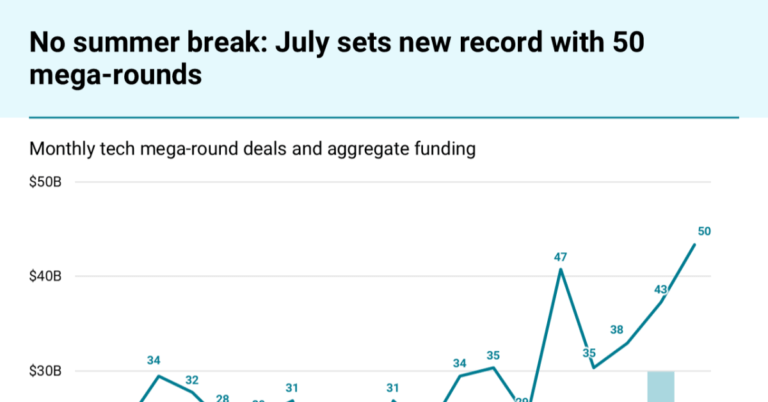

No summer break for AI: July 2025 hits 50 mega-rounds and 7 new unicornsExpert Collections containing Perplexity

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Perplexity is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

AI 100 (All Winners 2018-2025)

200 items

Generative AI 50

50 items

CB Insights' list of the 50 most promising private generative AI companies across the globe.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

AI 100 (2024)

100 items

Artificial Intelligence (AI)

20,894 items

Latest Perplexity News

Nov 14, 2025

Comments Drawer Column Follow Sources Follow Buy Anthropic. Short Perplexity. Notes from this year’s Cerebral Valley conference. Buy Anthropic. Short Perplexity. Notes from this year’s Cerebral Valley conference. by Sources author, Verge contributor Follow Link Alex Heath Alex Heath Follow is a contributing writer and author of the Sources newsletter. This is an excerpt of Sources by Alex Heath , a newsletter about AI and the tech industry, syndicated just for The Verge subscribers once a week. I spent yesterday at Eric Newcomer’s Cerebral Valley conference in San Francisco, which is now in its third year. I’ve attended this event for three years in a row because Eric does a great job curating the speakers and the audience, and the conversations are more substantive than a typical industry event. This year was no exception; however, I found the most interesting part of the day to be when the results of an anonymous audience survey were shared onstage. The more than 300 attendees who participated in the survey primarily consisted of AI company founders, followed by investors, other industry professionals (including product leaders and engineers), and members of the media. Here are the results of the survey in order of how they were shared onstage: 1. What will be OpenAI’s annualized revenue be at the end of 2026? Median answer: $30 billion. Median answer: $6 trillion. 3. What year will an independent committee of experts, as dictated by the Microsoft-OpenAI agreement, declare that we have reached AGI? Top answer: 2030 4. Which venture capital firm’s AI portfolio are you the most jealous of? The top three most voted for, from first to last: Andreessen Horowitz, Khosla Ventures, and Sequoia. 5. If you could put money in any private technology companies today, what would they be? Top five companies in order from first to last: Anthropic, OpenAI, Cursor, Anduril, SpaceX, and OpenEvidence. 6. What global company’s model will top the LMArena web development leaderboard at the end of 2026? In order from first to last: OpenAI, Anthropic, Gemini, Grok, Qwen. 7. If you could short a $1 billion-plus valuation startup, which would it be? First place was Perplexity. Second place went to OpenAI. Other names shown onstage: Cursor, Figure, Harvey, Mercor, Mistral, and Thinking Machines. What stood out to me from these results (Newcomer has published the slides for his paying subscribers): A softening on OpenAI: Given that Sam Altman has said OpenAI plans to end this year with $20 billion of annualized revenue, this group of AI insiders doesn’t expect next year to be as exponential for the business as the leap from 2024 to 2025. The prediction that AGI won’t be declared until 2030 suggests a lack of faith in model progress meaningfully improving in the near term, although that answer could also be clouded by the complexity of how OpenAI and Microsoft must settle on how it’s decided. (I’m still waiting for either company to share information on who its “independent committee of experts” will be and how they’ll decide.) It was also notable that more attendees wanted to buy Anthropic stock than OpenAI’s, despite the consensus being that OpenAI would lead LMArena next year. Meta wasn’t in the conversation. It wasn’t named on the list of models likely to lead LMArena next year. The presence of a Chinese model (Alibaba’s Qwen) in the top five signals a shift that’s already underway, as many companies fine-tune open-source Chinese models rather than Llama. Meta has a lot to prove if it wants to re-enter the model race. Perplexity is controversial. But everyone working in AI already knows that. Other takeaways from Cerebral Valley: What’s driving reverse acquihires ? I attended a breakout session about AI acquihires, such as Meta’s deal with ScaleAI to hire Alexandr Wang and Google’s deals with Character and Windsurf. I’ve closely covered many of these deals over the past couple of years, but it was interesting to hear the group’s perspective on what drives them. Antitrust scrutiny of Big Tech certainly plays a factor, but some who have been involved in these kinds of transactions also made the point that bigger companies are racing each other to shore up talent and move faster than their competition. They have seemingly “infinite money,” as one member of the group put it, and see it as a game of placing bets on a very finite pool of talent. One AI founder in the group, who fielded multiple offers of this kind, recalled a member of a Big Tech company’s corporate development team asking him how much he wanted his startup to be valued for a deal. No one cares about AGI anymore. At the first Cerebral Valley conference , the topic of AGI was a major throughline. A startup founder onstage said that “we’re going to be dead” by the time OpenAI releases GPT-10. This year, multiple onstage conversations noted how AGI barely registered as a discussion topic. Instead, most of the interviews focused on the business applications of AI. Multiple companies represented onstage at the first Cerebral Valley event didn’t exist and are now worth billions of dollars. There was a strain of AI bubble fear throughout the day, but mostly, everyone seemed dialed in on how they could win market share and provide products that people want to pay for. Standout quotes from onstage interviews: Replit CEO Amjad Masad: “If you are competing on price, then maybe you don’t have a business.” Elad Gill: “Most companies should sell at some point. There’s often a market-maximizing moment where you’re going to get the best deal you can. A very small number of companies should never ever sell.” San Francisco Mayor Daniel Lurie: “People are starting to complain about traffic. Thank goodness. I want those complaints. We still have a lot of empty office space.” Anthropic CPO Mike Krieger: “Time spent is, I can tell you, not on any of the dashboards that I look at. It’s just not a main consideration.” xAI co-founder Jimmy Ba: “Knowledge is just crystalized computation from the past.” Follow topics and authors from this story to see more like this in your personalized homepage feed and to receive email updates. Alex Heath Sources author, Verge contributor Follow Column Follow Sources Follow

Perplexity Frequently Asked Questions (FAQ)

When was Perplexity founded?

Perplexity was founded in 2022.

Where is Perplexity's headquarters?

Perplexity's headquarters is located at 115 Sansome Street, San Francisco.

What is Perplexity's latest funding round?

Perplexity's latest funding round is Series D - IV.

How much did Perplexity raise?

Perplexity raised a total of $976.15M.

Who are the investors of Perplexity?

Investors of Perplexity include NuVentures, NEA, Institutional Venture Partners, NVentures, Bossa Invest and 70 more.

Who are Perplexity's competitors?

Competitors of Perplexity include CHAI, OpenAI, Sana Labs, You.com, Liner and 7 more.

Loading...

Compare Perplexity to Competitors

Vectara develops a generative artificial intelligence platform and specializes in retrieval-augmented generation for various business domains. The company offers a suite of services that enable businesses to integrate conversational AI, semantic search, and question-answering capabilities into their applications. It primarily serves the technology industry. Vectara was formerly known as ZIR AI. It was founded in 2022 and is based in Palo Alto, California.

You.com provides enterprise AI solutions within the technology sector. The company offers products including a Web Search API for integrating real-time web data into AI applications, and Enterprise AI Solutions that enable businesses to build AI agents and workflows. It was founded in 2020 and is based in Palo Alto, California.

Algolia operates as an end-to-end artificial intelligence (AI) search and discovery platform in the technology sector. It offers a suite of search solutions that leverage natural language processing and vector search technology to deliver relevant search experiences across web, mobile, and voice-enabled devices. Algolia primarily serves sectors such as retail, e-commerce, business-to-business (B2B) electronic commerce, marketplaces, media, and Software as a Service(SaaS). It was founded in 2012 and is based in Palo Alto, California.

Twelve Labs is a company that focuses on video intelligence within the tech industry. The company's offerings include a platform that analyzes, searches, generates, and embeds video content, and provides workflow automation for various applications. The company serves sectors that require video understanding, such as media and entertainment, security, and automotive industries. It was founded in 2021 and is based in San Francisco, California.

Andi specializes in search technology within the artificial intelligence sector. The company offers a generative AI-powered search platform that provides direct answers to queries, functioning similarly to conversing with an informed friend. Andi's platform integrates language models with live data to deliver concise explanations and summaries from various sources without the interference of SEO spam, ads, or surveillance. It was founded in 2021 and is based in Miami, Florida.

Glean serves as an enterprise artificial intelligence (AI) platform that provides tools for workplace productivity across various sectors. Its main offerings include AI-assisted search, custom generative AI applications, and management of AI agents. The platform is used by departments such as engineering, customer service, sales, and human resources, in industries including retail and financial services. It was founded in 2019 and is based in Palo Alto, California.

Loading...