Investments

826Portfolio Exits

112Funds

12Research containing SMBC Venture Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SMBC Venture Capital in 4 CB Insights research briefs, most recently on Apr 29, 2025.

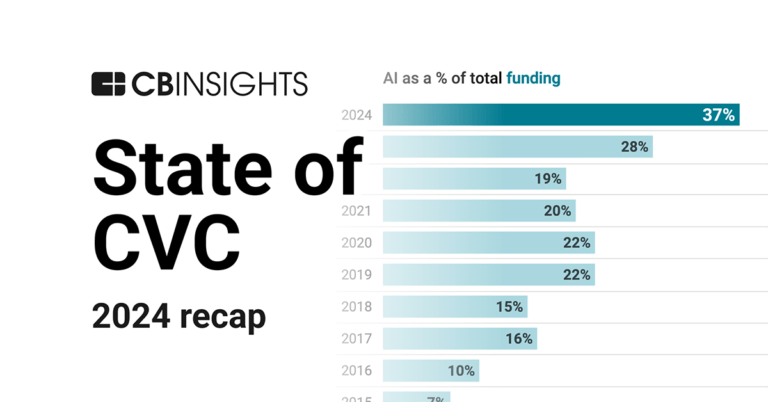

Apr 29, 2025 report

State of CVC Q1’25 Report

Feb 4, 2025 report

State of CVC 2024 Report

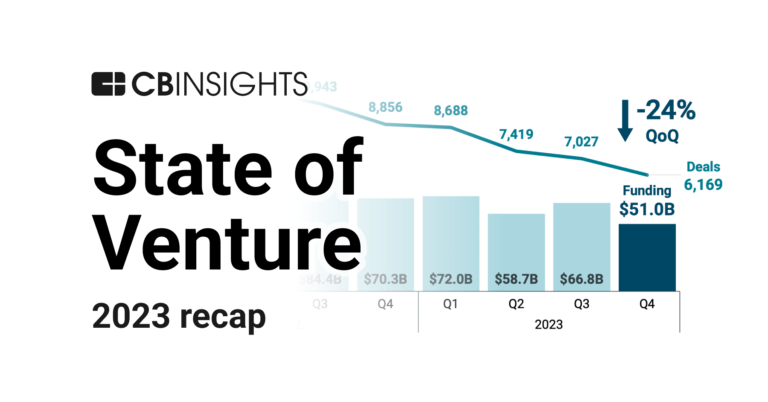

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest SMBC Venture Capital News

Nov 12, 2025

今後の展望 さらに中長期的には、無人化・省人化を目指す施設運営事業者とのアライアンスを積極的に推進し、幅広い市場への応用展開を視野に入れております。これにより、当社が目指す「AIカメラで人に依存しないビジネスモデルを再構築し、持続可能な社会インフラを築く」ことを実現し、持続的な成長と企業価値の向上に取り組んでまいります。 新規投資家の皆様からのコメント 代表取締役 マネージング・パートナー 岩澤 脩氏・阿部 大和氏 このたび、リード投資家としてOpt Fitの挑戦に伴走できることを嬉しく思います。人口減少と人手不足は日本社会が直面する最大の課題のひとつです。その中でOpt Fitが築いてきたのは単なるプロダクトではなく、現場に寄り添いながら社会課題を解決する仕組みそのものです。地道な努力をいとわず、泥臭く改善を重ねることで築き上げた解約率0.1%未満という圧倒的な信頼と、短期間で複数領域での実用化までこぎつけた実行力は、Opt Fitが持つ類まれな強みだと感じます。この挑戦が日本における次世代の社会インフラにまで発展していくことを信じ、ファーストライト・キャピタルは投資家として引き続き全力で支援してまいります。 SMBCベンチャーキャピタル株式会社 投資営業第四部 次長 馬籠 勇人氏 労働人口が減少していく中で、業界を問わず事業オペレーションの効率化が求められています。Opt Fit社は、これまでフィットネス領域のお客様へ寄り添いながら課題を深く理解し、現場のニーズに沿ったソリューションを提供してきました。結果として、人手不足の解消に直結する価値提供ができており、マストハブなソリューションとなっています。今後は、これまで培ってきた実績・ノウハウ等の事業アセットを活かし、介護を含めた他領域のお客様とっても、なくてはならないインフラとして広がっていくことを期待しております。SMBCグループを活用し、この挑戦をできる限り支援して参りたいと思います。 株式会社フィデアキャピタル 代表取締役 北野 善久氏 株式会社Opt Fit 代表取締役・渡邊昂希からのメッセージ

SMBC Venture Capital Investments

826 Investments

SMBC Venture Capital has made 826 investments. Their latest investment was in Immunosens as part of their Series C on November 14, 2025.

SMBC Venture Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/14/2025 | Series C | Immunosens | No | 2 | ||

11/12/2025 | Series B | Opt Fit | $3.24M | Yes | Accord Ventures, Fidea Venture, First Light Capital, Money Forward Venture Partners, NOBUNAGA Capital Village, and STATION Ai | 4 |

11/11/2025 | Series A | ZIRITZ | $4.53M | Yes | All About, Apollo Capital, Daiwa Corporate Investment, Mint, Nissay Capital, and Saison Ventures | 4 |

11/6/2025 | Series B | |||||

11/6/2025 | Series E |

Date | 11/14/2025 | 11/12/2025 | 11/11/2025 | 11/6/2025 | 11/6/2025 |

|---|---|---|---|---|---|

Round | Series C | Series B | Series A | Series B | Series E |

Company | Immunosens | Opt Fit | ZIRITZ | ||

Amount | $3.24M | $4.53M | |||

New? | No | Yes | Yes | ||

Co-Investors | Accord Ventures, Fidea Venture, First Light Capital, Money Forward Venture Partners, NOBUNAGA Capital Village, and STATION Ai | All About, Apollo Capital, Daiwa Corporate Investment, Mint, Nissay Capital, and Saison Ventures | |||

Sources | 2 | 4 | 4 |

SMBC Venture Capital Portfolio Exits

112 Portfolio Exits

SMBC Venture Capital has 112 portfolio exits. Their latest portfolio exit was Pretia on November 04, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/4/2025 | Acquired | 2 | |||

9/18/2025 | Acquired | 2 | |||

8/13/2025 | IPO | Public | 2 | ||

Date | 11/4/2025 | 9/18/2025 | 8/13/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 2 | 2 | 2 |

SMBC Venture Capital Acquisitions

1 Acquisition

SMBC Venture Capital acquired 1 company. Their latest acquisition was Collabos on June 30, 2011.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

6/30/2011 | Other | Management Buyout | 1 |

Date | 6/30/2011 |

|---|---|

Investment Stage | Other |

Companies | |

Valuation | |

Total Funding | |

Note | Management Buyout |

Sources | 1 |

SMBC Venture Capital Fund History

12 Fund Histories

SMBC Venture Capital has 12 funds, including Next Generation Corporate Growth Support I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

3/29/2017 | Next Generation Corporate Growth Support I | Early-Stage Venture Capital | Open | $8.72M | 1 |

12/31/2016 | SMBC VC 3 | Early-Stage Venture Capital | Closed | 1 | |

12/31/2014 | SMBC VC 2 | Early-Stage Venture Capital | Closed | 1 | |

6/6/2012 | SMBC Business Development II | ||||

7/22/2011 | SMBC VC 1 |

Closing Date | 3/29/2017 | 12/31/2016 | 12/31/2014 | 6/6/2012 | 7/22/2011 |

|---|---|---|---|---|---|

Fund | Next Generation Corporate Growth Support I | SMBC VC 3 | SMBC VC 2 | SMBC Business Development II | SMBC VC 1 |

Fund Type | Early-Stage Venture Capital | Early-Stage Venture Capital | Early-Stage Venture Capital | ||

Status | Open | Closed | Closed | ||

Amount | $8.72M | ||||

Sources | 1 | 1 | 1 |

SMBC Venture Capital Team

3 Team Members

SMBC Venture Capital has 3 team members, including current Chief Executive Officer, President, Akira Ochiai.

Name | Work History | Title | Status |

|---|---|---|---|

Akira Ochiai | Chief Executive Officer, President | Current | |

Name | Akira Ochiai | ||

|---|---|---|---|

Work History | |||

Title | Chief Executive Officer, President | ||

Status | Current |

Compare SMBC Venture Capital to Competitors

Coral Capital operates as a venture capital firm focusing on seed to Series B stage investments across various industries. The firm supports startups from software as a service (SaaS) to nuclear fusion, providing funding and strategic insights. It primarily sells to the startup ecosystem, offering resources such as talent, capital, and knowledge to entrepreneurs aiming to build legendary companies. Coral Capital was formerly known as 500 Startups Japan. It was founded in 2018 and is based in Tokyo, Japan.

ANOBAKA is a venture capital firm that invests in early-stage internet-business-focused startups. It focuses on fintech, medical tech, mobile technology, and other technology company. It was formerly known as KVP. It was founded in 2015 and is based in Tokyo, Japan.

Skyland Ventures is a Japanese investment company focused on seed-stage startups. It provides cashback and MEV (Miner Extractable Value) solutions with BNB, Polygon chain, etc. The company was founded in 2012 and is based in Tokyo, japan.

Genesia Ventures is a seed and early-stage investment firm that supports entrepreneurs. The company was founded in 2016 and is based in Tokyo, Japan.

Carta Ventures is a wholly-owned venture capital subsidiary of Carta Holdings, a Japanese media, and advertising technology company. Carta Ventures focuses its efforts on the rapidly growing Asian markets.

Mitsui Sumitomo Insurance Venture Capital operates as a venture capital firm investing in growth-stage companies. The company provides financial backing and post-investment support to its portfolio companies. Mitsui Sumitomo Insurance Venture Capital serves sectors requiring venture capital investment and support for entrepreneurship. It was founded in 1990 and is based in Tokyo, Japan.

Loading...