Together AI

Founded Year

2022Stage

Series B | AliveTotal Raised

$533.5MValuation

$0000Last Raised

$305M | 9 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+62 points in the past 30 days

About Together AI

Together AI focuses on the development, training, fine-tuning, and deployment of generative artificial intelligence (AI) models. The company provides services including AI model training, inference, and utilizes a cloud-based infrastructure. Together AI serves various sectors by offering solutions that cover the generative AI process from research to production. It was founded in 2022 and is based in San Francisco, California.

Loading...

ESPs containing Together AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The small language model (SLM) tools & development market includes companies and open-source projects that create, customize, and deploy compact AI language models optimized for efficiency and domain-specific use. These models deliver faster inference, lower costs, and on-device capabilities compared with large language models. The market includes model developers, fine-tuning and optimization pla…

Together AI named as Outperformer among 15 other companies, including Microsoft, Google, and Amazon.

Together AI's Products & Differentiators

GPU Clusters

Large-scale NVIDIA Blackwell GPU clusters, turbocharged by Together AI research.

Loading...

Research containing Together AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Together AI in 14 CB Insights research briefs, most recently on Oct 24, 2025.

Oct 20, 2025 report

Book of Scouting Reports: 2025’s Digital Health 50

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

Apr 29, 2025 report

State of CVC Q1’25 Report

Apr 24, 2025 report

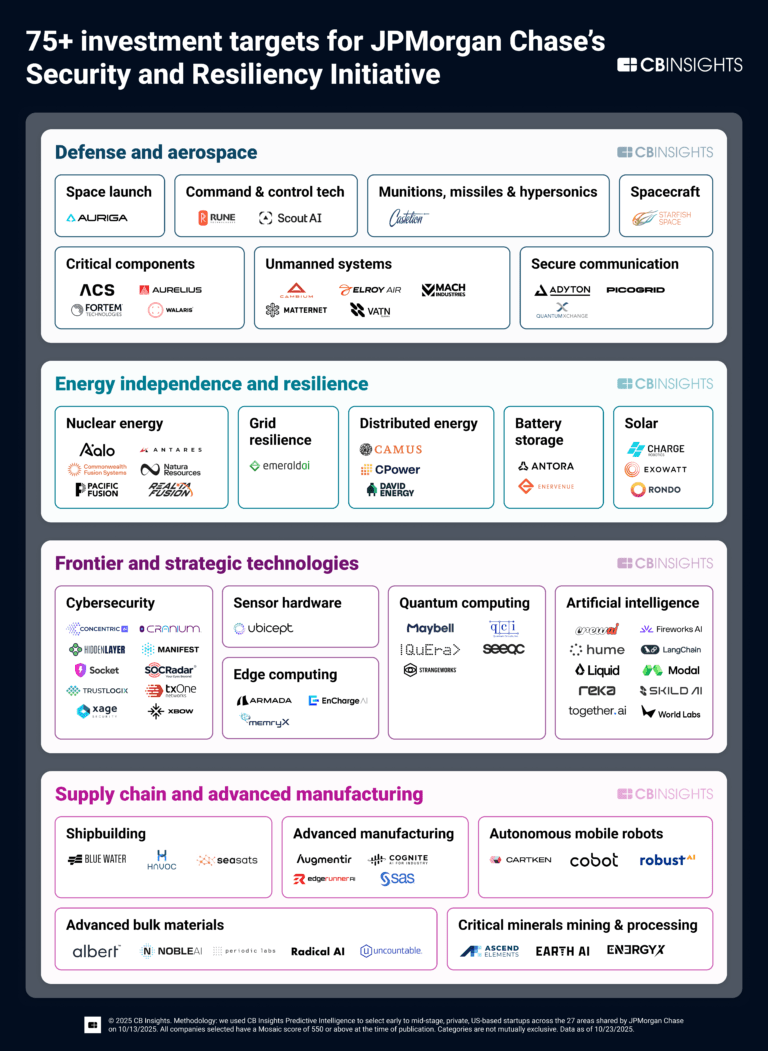

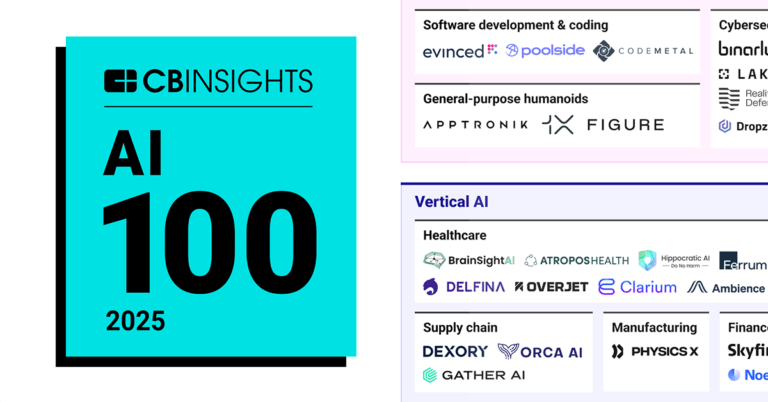

AI 100: The most promising artificial intelligence startups of 2025

May 24, 2024

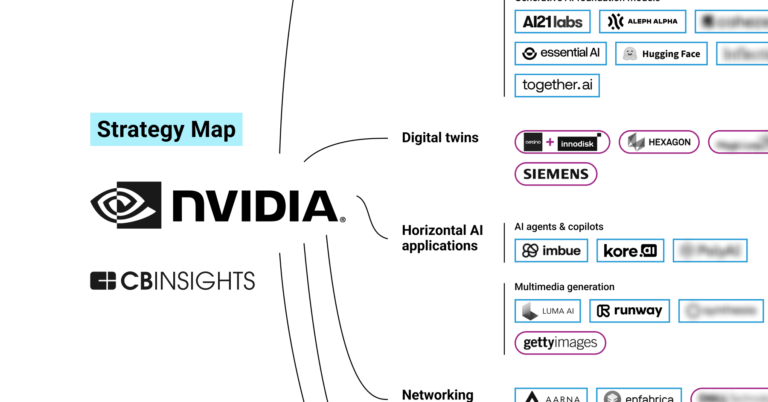

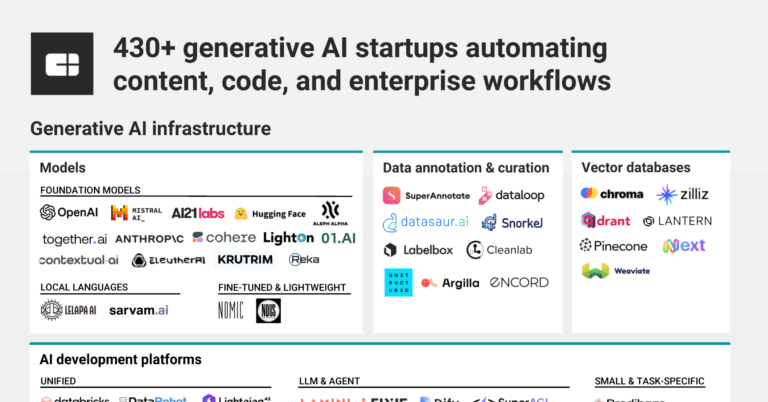

The generative AI market mapExpert Collections containing Together AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Together AI is included in 6 Expert Collections, including Generative AI.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence (AI)

37,256 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

AI 100 (2024)

100 items

Unicorns- Billion Dollar Startups

1,297 items

AI 100 (2025)

100 items

AI 100 (All Winners 2018-2025)

200 items

Latest Together AI News

Nov 7, 2025

The rollout took an unexpected turn when users discovered that both tools were actually running on Chinese-made AI systems. Developers in several countries began noticing Chinese-language text appearing in code snippets generated by Cursor. Around the same time, Windsurf confirmed that its core model was provided by Z.ai (formerly Zhipu AI) after the company's official account on X reposted Windsurf's launch announcement with a congratulatory note. The revelation drew mixed reactions online, with some users joking that it might be time to start learning Mandarin. But beneath the humor lies a deeper story about how quickly China's AI ecosystem is reshaping the global landscape. In the US, relationships between AI model developers and application startups have long been fraught. When OpenAI was reportedly in talks to acquire Windsurf earlier this year, Anthropic immediately cut off Windsurf's model access. Now, with open-source models climbing global leaderboards, developers are increasingly turning to non-US providers for flexibility and lower costs. Windsurf isn't alone. Vercel recently added Z.ai's GLM-4.6 to its API offerings. Cerebras, a major US chipmaker, said it would begin promoting GLM-4.6 as a primary model starting November 5. Together AI has deployed Alibaba's Qwen-3-Coder, while inference platform Featherless now supports Moonshot AI's Kimi K2 RELATED ARTICLE News Is Kimi K2 strong enough to spark China's next “DeepSeek moment?” Written by 36Kr English Just a year ago, Chinese companies were integrating models from OpenAI and Anthropic into their systems. Now, the flow has reversed. The reason, analysts say, is straightforward: China's open-source models have caught up in both performance and cost. The rise of DeepSeek , Alibaba's Qwen, and the growing prominence of Z.ai have strengthened their credibility. The fact that two of the most popular US coding assistants rely on Chinese models underscores the competitiveness of China's AI developers, especially in coding, where benchmarks and performance are easy to quantify. Affordability is another major factor. Social Capital founder Chamath Palihapitiya recently said Groq migrated workloads to Moonshot's Kimi K2 model because it was “way more performant and frankly just a ton cheaper” than offerings from OpenAI and Anthropic. Cost efficiency, he added, has become the AI sector's new frontier. Coding tools are one of the few AI categories that have achieved clear product-market fit. Anthropic currently leads, with OpenAI's GPT-5 and Codex expected to intensify competition. Meanwhile, Chinese firms are moving quickly to secure market share. Data from OpenRouter, which aggregates over 100 AI models, shows that four of the five most used products as of September were coding-related tools. Within that group, Chinese models are rapidly gaining traction. According to PPIO, Z.ai's GLM and Moonshot's Kimi ranked among the most used globally in the third quarter, with GLM's usage peaking above 10% and Kimi holding between 2–5% market share. Chinese developers are also turning this momentum into direct revenue. In September, Z.ai introduced a subscription service for developers similar to Anthropic's Claude Code, priced between RMB 20–200 (USD 2.8–28), roughly one-tenth the cost of its US counterpart. The plan supports more than ten major coding tools and is available worldwide. According to 36Kr , the service has already generated annual recurring revenue of over RMB 100 million (USD 14 million). Following that launch, Moonshot rolled out its own developer package for Kimi on October 24, and MiniMax introduced a free limited version of its M2 model with plans for a paid tier. KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Xiao Xi for 36Kr.

Together AI Frequently Asked Questions (FAQ)

When was Together AI founded?

Together AI was founded in 2022.

Where is Together AI's headquarters?

Together AI's headquarters is located at 251 Rhode Island Street, San Francisco.

What is Together AI's latest funding round?

Together AI's latest funding round is Series B.

How much did Together AI raise?

Together AI raised a total of $533.5M.

Who are the investors of Together AI?

Investors of Together AI include Long Journey Ventures, Lux Capital, Scott Banister, Emergence Capital, Prosperity7 Ventures and 53 more.

Who are Together AI's competitors?

Competitors of Together AI include Fireworks AI and 8 more.

What products does Together AI offer?

Together AI's products include GPU Clusters and 3 more.

Loading...

Compare Together AI to Competitors

Arc Compute specializes in the optimization of GPU resources within the technology sector. The company offers solutions for GPU infrastructure, including servers and cloud instances, that aim to maximize GPU utilization and performance, thereby increasing throughput and improving overall performance. Arc Compute primarily serves organizations in the AI industry. It was founded in 2020 and is based in Toronto, Canada.

Aethir is a decentralized cloud computing infrastructure provider that offers access to GPUs for AI model training, fine-tuning, inference, and cloud gaming. The company primarily serves the artificial intelligence and gaming industries with its distributed cloud solutions. It was founded in 2021 and is based in Singapore, Singapore.

RunPod provides cloud-based graphics processing unit (GPU) computing services in the artificial intelligence (AI) sector. The company offers GPU instances, serverless deployment for AI workloads, and infrastructure for training and deploying AI models. RunPod's services include inference, AI model training, and processing compute-heavy tasks. It was founded in 2022 and is based in Moorestown, New Jersey.

Fractile develops chips for AI model inference, focusing on large language models. The company aims to reduce the time and cost of processing by addressing bottlenecks in existing hardware through the integration of computation and memory. Fractile was formerly known as Neu Edge. It was founded in 2022 and is based in Newbury, United Kingdom.

d-Matrix specializes in AI inference technology within the computing sector. The company offers a platform named Corsair, which is designed to provide low-latency processing for generative AI applications. Corsair is a solution for data centers, aiming to make AI inference viable by addressing the balance between speed and efficiency. It was founded in 2019 and is based in Santa Clara, California.

io.net focuses on providing artificial intelligence (AI) solutions. The company offers a platform to harness global graphics processing unit (GPU) resources to provide computing power for AI startups, allowing users to create and deploy clusters for machine learning applications. It primarily serves the AI development and cloud computing industries. io.net was formerly known as Antbit. It was founded in 2022 and is based in New York, New York.

Loading...