Unstructured

Founded Year

2022Stage

Incubator/Accelerator | AliveTotal Raised

$65MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+1 points in the past 30 days

About Unstructured

Unstructured specializes in data extraction and transformation and focuses on the technology sector. The company provides services that capture unstructured data from various documents and convert it into AI-friendly formats, such as JSON, facilitating the integration with large language models (LLMs). It was founded in 2022 and is based in Rocklin, California.

Loading...

Unstructured's Product Videos

ESPs containing Unstructured

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The machine learning training data curation market offers solutions to support data quality control in the AI algorithm training process. These solutions help organizations complete key tasks, such as selecting the best subsets of data for training models, triaging datasets for bias, and identifying labeling errors. Ultimately, these solutions help minimize the downstream effects of poor-quality…

Unstructured named as Highflier among 13 other companies, including Scale, Snorkel AI, and Voxel51.

Loading...

Research containing Unstructured

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Unstructured in 9 CB Insights research briefs, most recently on Oct 20, 2025.

Oct 20, 2025 report

Book of Scouting Reports: 2025’s Digital Health 50

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025

Mar 6, 2025

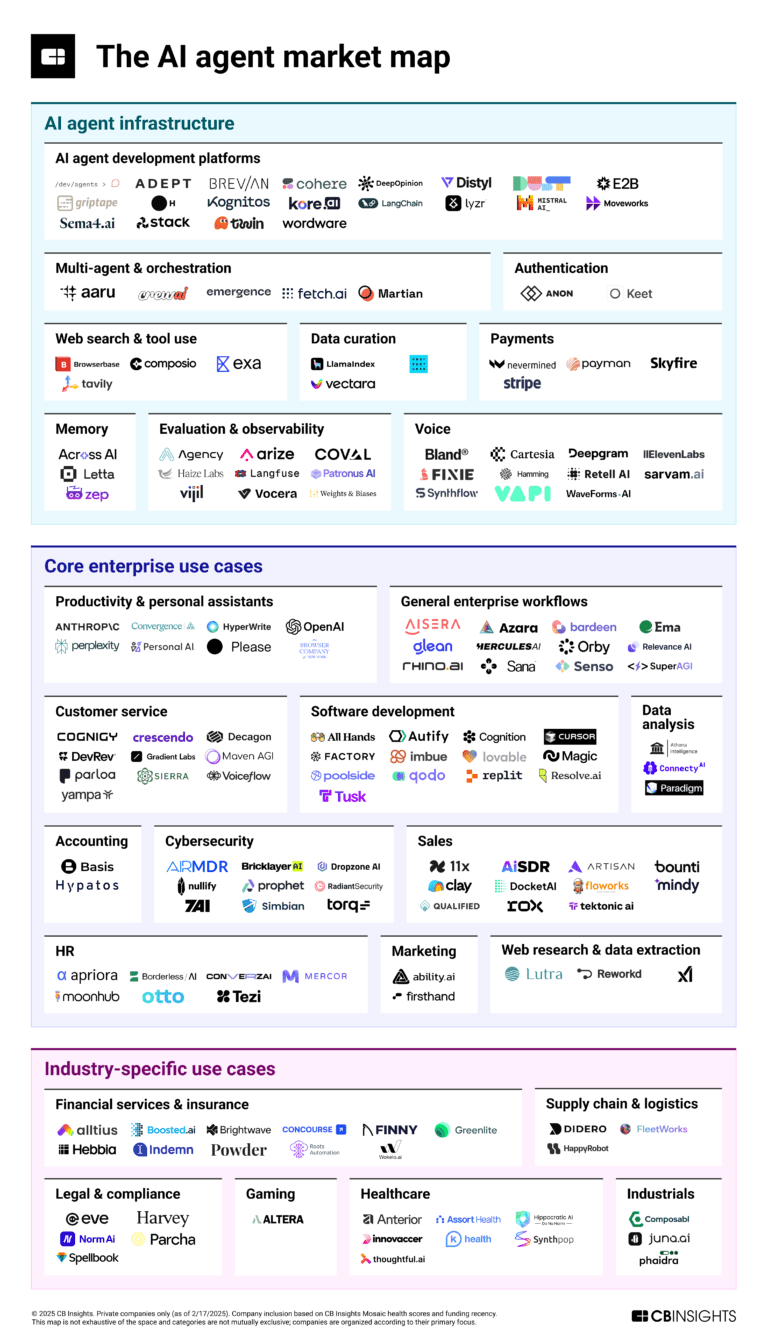

The AI agent market map: March 2025 edition

Feb 28, 2025

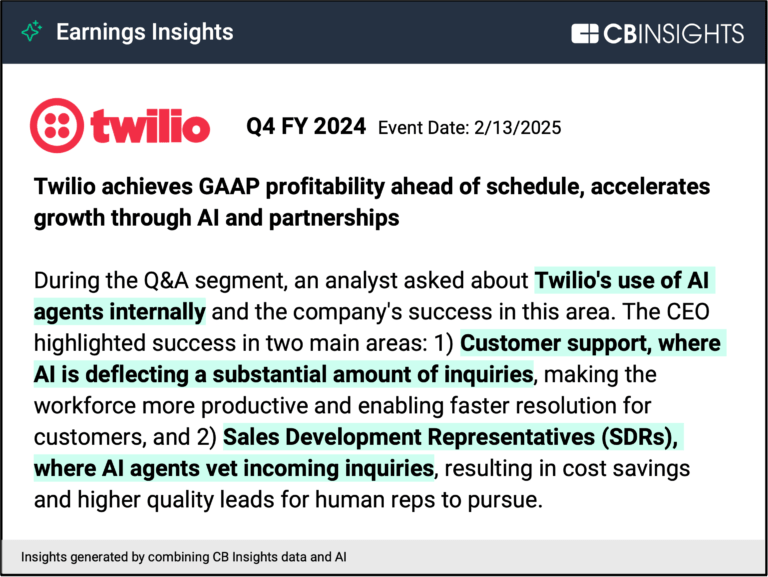

What’s next for AI agents? 4 trends to watch in 2025Expert Collections containing Unstructured

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Unstructured is included in 7 Expert Collections, including Generative AI.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

AI 100 (2024)

100 items

Artificial Intelligence (AI)

20,894 items

AI agents (March 2025)

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

AI 100 (2025)

100 items

AI agents & copilots

1,771 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

Latest Unstructured News

Sep 11, 2025

"AI is reshaping the global economy and is expected to drive every business or personal process in our lives within a few years. However, this all depends on the availability of robust data management solutions, a market segment holding unprecedented opportunities for Israeli startups," writes Barrel Kfir, Partner at Dell Technologies Capital. Barrel Kfir Reports about Google and Nvidia’s intentions to invest in ‘Vast Data’ at a massive valuation of $30 billion have shone a spotlight on a technological field hidden in the depths of the world of AI. The fame of the artificial intelligence world has so far been reaped by the model and infrastructure builders, namely companies like the pioneering OpenAI, and the leading chip manufacturer, Nvidia. Running the models and applications, however, requires robust data management and access solutions. How was this need born? The evolution of AI to Generative, and now to Agentic, AI has created new and unique data challenges that differ from the algorithmic and hardware challenges that have so far taken center stage. In fact, AI models became a commodity, and the differentiating factor between the various AI solution providers is in their ability to wisely and efficiently manage the data required by a new generation of applications. (Photo: Rami Zeranger) For decades, many software products were built on the ‘Data Repository’ model which enables productively storing, managing, and accessing data. This approach, known as ‘System of Record’, was replaced by a ‘System of Insight’ approach in this era of AI, an approach seeking to extract insights from information in real time while handling the large data volumes involved. The data volumes required for developing Generative and Agentic AI applications have grown by orders of magnitude of tens, from gigabyte to petabyte levels. This exponential growth requires new data infrastructures and tools that are capable of handling them efficiently. This brought on the rapid development of the AI data management market, already reaching $25.1 billion in 2023 and expected to reach $70.2 billion by 2028. The scope of venture capital investments in the data management market reached $1.3 billion in 2024, reflecting significant, 195% growth compared to only $440 million in 2023. All the tech and cloud giants, including IBM, Oracle, AWS, Informatica, Salesforce, SAP and others, operate in this market. Each offering their own AI data management solutions. An ecosystem of startups developing new solutions for new niches has been evolving in parallel. Related articles: Where is the next untapped potential? In this dynamic market, new categories which constitute opportunities for Israeli entrepreneurs in the AI field are constantly developing. Among these new categories are: Data management infrastructure - Several startups, among them Israeli ones such as Vast Data and MIN.IO, have already developed comprehensive data management infrastructure for the development of AI applications. Ready-to-use infrastructure of this type processes large amounts of diversely sourced data at fast rates in a cost effective manner, producing outputs that generate real-time insights for these applications. Large Language Model workflows and management infrastructure - Another field gaining momentum in recent years as part of the increasing adoption of LLMs is that of dedicated databases which enable more efficient work, development and management of these models. Companies such as Pincorn and Redis are considered leading players in this field. Data versioning - Yet another new market born out of the data needs of the AI era is Data Versioning. Previously, developers managed software versions, while today, when the data for training models and the models themselves are datasets, the ability to manage data versions collaboratively between teams within an organization is becoming imperative. Making changes without fear for system stability, going backwards or forwards to better performing versions, and more, is now a necessity. Companies like LakeFS, AirFlow and others offer solutions for this market. Commercialization of unstructured data - The development of Generative and Agentic AI applications has created a need to convert unstructured data into structured data. Many startups, among them Israeli ones such as Flexor, Unstructured.io, specialize in converting free-flowing text and voice conversations into structured data which serves as the basis for training service center chatbots and agents tasked with autonomous problem solving. Artificial intelligence is reshaping the global economy and is expected to drive every business or personal process in our lives within a few years. However, this all depends on the availability of robust data management solutions, a market segment holding unprecedented opportunities for Israeli startups. Barrel Kfir is a Partner at Dell Technologies Capital. TAGS

Unstructured Frequently Asked Questions (FAQ)

When was Unstructured founded?

Unstructured was founded in 2022.

Where is Unstructured's headquarters?

Unstructured's headquarters is located at 5406 Crossings Drive, Rocklin.

What is Unstructured's latest funding round?

Unstructured's latest funding round is Incubator/Accelerator.

How much did Unstructured raise?

Unstructured raised a total of $65M.

Who are the investors of Unstructured?

Investors of Unstructured include Palantir FedStart, Bain Capital Ventures, Mango Capital, Madrona Venture Group, NVentures and 21 more.

Who are Unstructured's competitors?

Competitors of Unstructured include LlamaIndex, Reducto, Navikenz, Deasy Labs, Boosted.ai and 7 more.

Loading...

Compare Unstructured to Competitors

Artie offers real-time data replication and operates within the data management and analytics industry. It offers a platform that enables synchronization of databases with data warehouses, utilizing change data capture (CDC) to facilitate data flow while maintaining database performance. Its services support sectors that require data pipeline management and real-time analytics, such as technology and finance. It was founded in 2018 and is based in San Francisco, California.

Sony Interactive Entertainment is involved in video game development and entertainment innovation, associated with its PlayStation brand. The company offers products including hardware, network services, and a portfolio of games. Sony Interactive Entertainment primarily serves sectors related to gaming and entertainment. Sony Interactive Entertainment was formerly known as Sony Network Entertainment. It was founded in 1993 and is based in San Mateo, California.

LlamaIndex focuses on document automation and artificial intelligence (AI) agent development within the technology sector. The company provides products for parsing, extracting, indexing, and retrieving unstructured data, as well as a framework for building and orchestrating AI workflows. LlamaIndex serves sectors such as finance, insurance, manufacturing, and healthcare, offering solutions for document processing and workflow automation. LlamaIndex was formerly known as GPT Index. It was founded in 2023 and is based in San Francisco, California.

Contextual AI focuses on retrieval-augmented generation (RAG) in the artificial intelligence (AI) sector. The company provides a platform that allows enterprises to create RAG agents aimed at improving productivity in expert knowledge work. Contextual AI serves companies, offering solutions for subject-matter experts. It was founded in 2023 and is based in Mountain View, California.

Rejustify is a company focused on AI-enhanced data integration and preparation within the data science industry. It offers an ETL tool that streamlines the process of extracting, transforming, and loading data from multiple sources, simplifying data set preparation for users. The company's services are primarily utilized by sectors that require data-driven decision-making and involve extensive data analysis tasks. It was founded in 2019 and is based in Luxembourg, Luxembourg.

CerebralZip develops artificial intelligence tools that help organizations connect data from sources, identify new business leads, and extract important information for decision-making. Its solutions are designed to support professionals in fields such as cybersecurity, digital forensics, and business intelligence by turning data into actionable insights. It was founded in 2024 and is based in Pune, India.

Loading...