Investments

583Portfolio Exits

120Partners & Customers

10Service Providers

1About IQT

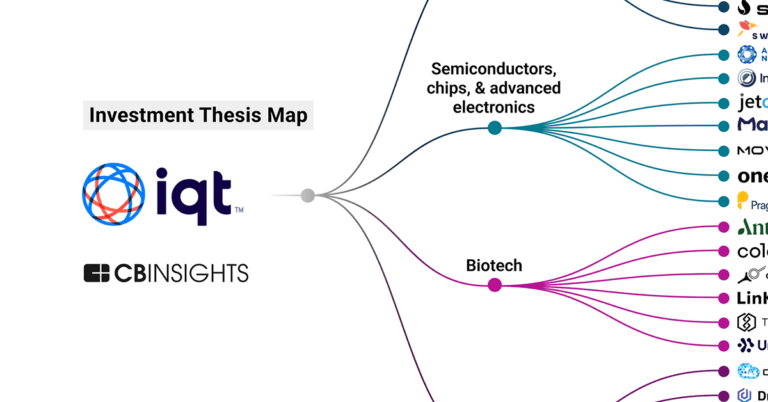

IQT operates as the not-for-profit strategic investor of the US national security community. IQT identifies, evaluates, and leverages emerging commercial technologies to deliver best-in-class capabilities, insights, and other services to government partners through a global investment platform. IQT was formerly known as Peleus. It was founded in 1999 and is based in Tysons, Virginia.

Expert Collections containing IQT

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find IQT in 2 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Game Changers 2018

20 items

Research containing IQT

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned IQT in 5 CB Insights research briefs, most recently on Sep 29, 2025.

Latest IQT News

Oct 4, 2025

K-치안산업, 제2의 방산으로 키워야 한다 [김홍일 칼럼] 제도적 기반·자본 공급구조 갖춰야 전문가 칼럼 입력 :2025/10/04 22:09 수정: 2025/10/04 22:10 김홍일 케이유니콘인베스트먼트 대표 안전은 더 이상 추상적인 공공재가 아니다. 범죄, 재난, 사이버 위협이 기술화·지능화하는 오늘날, 안전은 곧 국가의 미래 자산이자 새로운 성장 동력이다. 한국은 세계적으로 가장 높은 치안 안정성을 유지하고 있고, ICT 인프라와 경찰 역량 또한 세계적 수준이다. 그러나 이 강점을 산업적 가치로 전환하는 시도는 체계적이지 않다. 치안의 수요는 본질적으로 공공 영역에 집중돼 있지만, 관련 연구개발(R&D)과 자본 조달 구조는 산발적이고 규모도 작다. 이는 곧 치안산업을 국가 전략산업으로 육성할 필요성을 보여준다. 위험의 스펙트럼을 보면, 가장 폭력적이고 고강도의 물리적 리스크는 방위산업이 맡아왔다. 반대로 일상에서의 저강도 리스크는 보험을 통한 리스크 관리로 분산할 수 있었다. 그러나 그 중간 영역—보이스피싱, 사이버 범죄, 사회적 혼란, 재난 등—은 경찰과 치안 역량이 담당해야 한다. 김홍일 대표 문제는 이 영역에서조차 기술적 투자가 구조적으로 부족하다는 점이다. 보이스피싱만 해도 2023년 기준 피해액이 1조 3531억 원(금융감독원 자료)으로 집계됐고, 최근 5년간 누적 피해는 6조 원을 넘어섰다. 같은 기간 경찰의 관련 R&D 예산은 전체 치안 예산의 1%에도 미치지 못했다. 사회적 비용 대비 투자 수준이 지나치게 낮은 것이다. 해외 사례는 다르다. 미국은 CIA와 국방부가 공동 출자해 설립한 인큐텔(In-Q-Tel)을 통해 매년 50여 개 이상의 스타트업에 투자하고, 사이버보안·AI·드론 분야의 상용화를 촉진한다. 싱가포르는 내무부 산하 HTX를 통해 국가 치안 기술 R&D에 연간 1억 싱가포르 달러(약 1,000억 원) 이상을 투입하고 있다. 이스라엘은 모사드 직속의 리버타드 벤처스를 통해 보안·사이버 스타트업에 과감히 투자하며, 확보한 기술을 빠르게 글로벌 시장에 확산시킨다. 세 나라 모두 정부 예산·전략펀드·법적 지원이라는 삼각축을 통해 치안·안전 산업 생태계를 조성했다. 한국은 방위산업의 성공 경험을 이미 갖고 있다. 방위산업법 제정과 방위사업청 설립, 공공 조달 체계 마련은 민간 기업의 성장을 촉진했고, 그 결과 K-9 자주포와 FA-50 전투기 같은 무기체계가 세계 시장에서 경쟁력을 확보했다. 2023년 한국의 방산 수출액은 170억 달러에 달했으며, 2030년까지 200억 달러를 목표로 하고 있다. 치안산업도 동일한 구조를 적용할 수 있다. 공공 수요와 제도적 기반을 마련해 민간 기술을 육성한다면, 제2의 K-방산으로 성장할 수 있다. 특히 사이버 보안, 스마트 감시·순찰, 데이터 기반 치안 서비스는 이미 글로벌 시장 수요가 폭발적으로 증가하는 분야다. 치안산업을 전략적으로 육성한다면 그 파급효과는 산업·고용·사회 안전망을 동시에 강화하는 방향으로 이어질 것이다. 치안 기술을 보유한 스타트업과 중소기업은 세계 시장으로 진출할 수 있고, 청년 인재뿐 아니라 퇴직 경찰·군인·기술자들에게 재취업의 기회를 제공한다. 범죄 예방과 재난 대응 역량이 강화되면 국민이 체감하는 안전 수준은 높아지고, 한국은 K-방산에 이어 K-치안이라는 새로운 글로벌 브랜드를 구축할 수 있다. 정부의 초기 투자와 민간 자본의 후속 투자가 선순환을 이루게 되면 산업 성장, 고용 창출, 사회 안정이라는 세 가지 효과를 동시에 달성할 수 있다. 관련기사

IQT Investments

583 Investments

IQT has made 583 investments. Their latest investment was in Sakana AI as part of their Series B on November 17, 2025.

IQT Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/17/2025 | Series B | Sakana AI | $135M | Yes | Factorial Funds, Fundomo, Geodesic Capital, Khosla Ventures, Lux Capital, Macquarie Capital, Mitsubishi UFJ Financial Group, Mouro Capital, MPower Partners, NEA, Ora Global, Shikoku Electric Power Company, and Undisclosed Investors | 6 |

11/12/2025 | Seed VC | Voya Energy | $13M | Yes | 8090 Industries, Brian Janous, Energy Impact Partners, Founders Fund, Liquid 2 Ventures, Overmatch Ventures, Peter Reinhardt, Seven Stars, Sheldon Kimber, SV Angel, and Trust Ventures | 3 |

11/6/2025 | Series D | Synchron | $200M | Yes | ARCH Venture Partners, Bezos Expeditions, Double Point Ventures, K5 Global Technology, Khosla Ventures, METIS Innovative, National Reconstruction Fund Corporation, Neuro Technology Investors, Protocol Labs Venture, Qatar Investment Authority, and T.Rx Capital | 2 |

10/30/2025 | Seed VC | |||||

10/14/2025 | Series A - II |

Date | 11/17/2025 | 11/12/2025 | 11/6/2025 | 10/30/2025 | 10/14/2025 |

|---|---|---|---|---|---|

Round | Series B | Seed VC | Series D | Seed VC | Series A - II |

Company | Sakana AI | Voya Energy | Synchron | ||

Amount | $135M | $13M | $200M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Factorial Funds, Fundomo, Geodesic Capital, Khosla Ventures, Lux Capital, Macquarie Capital, Mitsubishi UFJ Financial Group, Mouro Capital, MPower Partners, NEA, Ora Global, Shikoku Electric Power Company, and Undisclosed Investors | 8090 Industries, Brian Janous, Energy Impact Partners, Founders Fund, Liquid 2 Ventures, Overmatch Ventures, Peter Reinhardt, Seven Stars, Sheldon Kimber, SV Angel, and Trust Ventures | ARCH Venture Partners, Bezos Expeditions, Double Point Ventures, K5 Global Technology, Khosla Ventures, METIS Innovative, National Reconstruction Fund Corporation, Neuro Technology Investors, Protocol Labs Venture, Qatar Investment Authority, and T.Rx Capital | ||

Sources | 6 | 3 | 2 |

IQT Portfolio Exits

120 Portfolio Exits

IQT has 120 portfolio exits. Their latest portfolio exit was Xanadu on November 03, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/3/2025 | Acq - Pending | Crane Harbor Acquisition | 3 | ||

9/10/2025 | Management Buyout | 2 | |||

9/9/2025 | Acquired | 4 | |||

Date | 11/3/2025 | 9/10/2025 | 9/9/2025 | ||

|---|---|---|---|---|---|

Exit | Acq - Pending | Management Buyout | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | Crane Harbor Acquisition | ||||

Sources | 3 | 2 | 4 |

IQT Partners & Customers

10 Partners and customers

IQT has 10 strategic partners and customers. IQT recently partnered with KA Imaging on November 11, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

11/2/2022 | Partner | Canada | KA Imaging Announces New Strategic Funding Fueling Innovation `` We are pleased to be part of the In-Q-Tel , Inc. portfolio and look forward to expanding our relationship with IQT and its government partners , '' said Amol Karnick , President and CEO of KA Imaging . | 3 | |

11/2/2022 | Partner | United States | OpenFin Pushes Into Government Sector With In-Q-Tel Partnership OpenFin has entered into a strategic partnership with In-Q-Tel , the intelligence community 's venture capital arm , in a push to establish its presence in the government sector . | 1 | |

10/26/2022 | Partner | United States | Trust Lab to Help Federal Market Safeguard the Web from Misinformation and Harmful Actors. Trust Lab enters strategic partnership with In-Q-Tel . | 1 | |

5/17/2022 | Partner | ||||

9/1/2021 | Vendor |

Date | 11/2/2022 | 11/2/2022 | 10/26/2022 | 5/17/2022 | 9/1/2021 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Vendor |

Business Partner | |||||

Country | Canada | United States | United States | ||

News Snippet | KA Imaging Announces New Strategic Funding Fueling Innovation `` We are pleased to be part of the In-Q-Tel , Inc. portfolio and look forward to expanding our relationship with IQT and its government partners , '' said Amol Karnick , President and CEO of KA Imaging . | OpenFin Pushes Into Government Sector With In-Q-Tel Partnership OpenFin has entered into a strategic partnership with In-Q-Tel , the intelligence community 's venture capital arm , in a push to establish its presence in the government sector . | Trust Lab to Help Federal Market Safeguard the Web from Misinformation and Harmful Actors. Trust Lab enters strategic partnership with In-Q-Tel . | ||

Sources | 3 | 1 | 1 |

IQT Service Providers

1 Service Provider

IQT has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

IQT Team

60 Team Members

IQT has 60 team members, including current Chief Executive Officer, President, Stephen C. Bowsher.

Name | Work History | Title | Status |

|---|---|---|---|

Stephen C. Bowsher | InterWest Partners, E*TRADE, Individual, and FreeLoader | Chief Executive Officer, President | Current |

Name | Stephen C. Bowsher | ||||

|---|---|---|---|---|---|

Work History | InterWest Partners, E*TRADE, Individual, and FreeLoader | ||||

Title | Chief Executive Officer, President | ||||

Status | Current |

Compare IQT to Competitors

500 Global operates as a venture capital firm focused on investing in technology companies with a global outlook. The company provides venture capital investment and mentorship to entrepreneurs and investors, with the goal of supporting startups and fostering innovation across various markets. It was founded in 2010 and is based in Palo Alto, California.

SignalFire serves as a venture capital firm with a technology company model, focusing on data-driven investment and support for early-stage to growth-stage startups. The firm offers financial support and services, including insights through its Beacon platform, sector-specific advisory, and portfolio support to assist in scaling and team building. SignalFire primarily serves sectors such as AI/ML, developer tools, B2B SaaS, healthcare, cybersecurity, and consumer markets. It was founded in 2012 and is based in San Francisco, California.

Andreessen Horowitz invests in technology companies across various stages and sectors, including consumer, enterprise, bio/healthcare, crypto, fintech, and games industries. It was founded in 2009 and is based in Menlo Park, California.

Breyer Capital operates as a venture capital and private equity investor focusing on catalyzing impact entrepreneurs across various sectors. The company makes long-term, strategic investments in businesses leveraging artificial intelligence, machine learning, and other transformative technologies. Breyer Capital primarily invests in sectors such as artificial intelligence (AI), health, consumer software, media and gaming, financial technology, enterprise and data, security, and climate solutions. It was founded in 2006 and is based in Austin, Texas.

Cohen Circle operates as an investment firm providing capital to late stage fintech companies within the financial services sector. The firm focuses on capital provision across the capital structure, including private-to-public investing, venture investing, and impact investments. Cohen Circle operates within the fintech, technology, and impact investment sectors. Cohen Circle was formerly known as FinTech Masala. It was founded in 2015 and is based in New York, New York.

Felicis operates as a venture capital firm focused on providing investment and support to early-stage and growth-stage companies in various sectors. It specializes in areas including artificial intelligence (AI), health and bio, infrastructure, security, and vertical SaaS. Felicis also offers programs for executive coaching and development for founders. It was founded in 2006 and is based in Menlo Park, California.

Loading...