Competition is ramping up within digital health.

Deal volume has dropped consistently since 2021, raising the stakes for all players. Emerging startups need clear differentiation and proven traction to secure funding. Investors face greater opportunity costs with every check they write. And incumbents must identify which early-stage vendors will scale — decisions that shape their tech strategies and market position.

In this environment, identifying future leaders matters more than ever. Our annual Digital Health 50 highlights private companies with strong growth potential, focusing on early-stage players with strong market traction, high-quality investors, and growing teams.

From a pool of over 12K companies, we selected 50 based on CB Insights data and predictive signals, including deal activity, partnerships, leadership strength, hiring momentum, investor quality, and our proprietary Mosaic score. Our analysis also incorporated exclusive interviews with software buyers and Analyst Briefings submitted by startups.

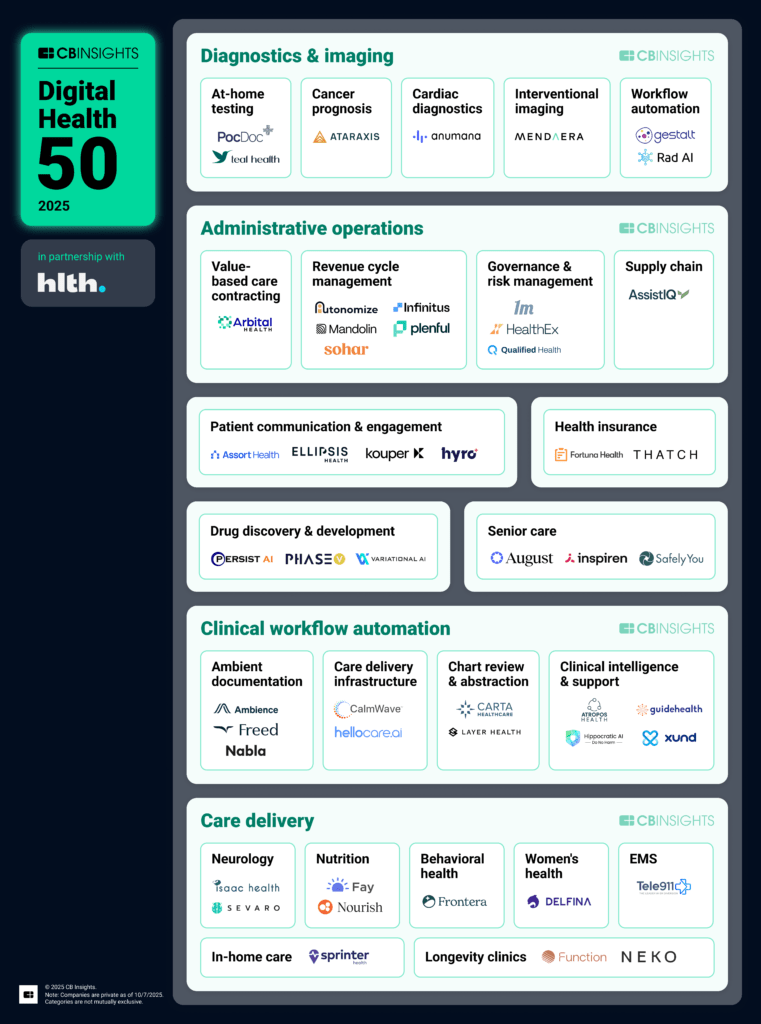

Below, we map out the winners based on their core offering and highlight key trends from this year’s cohort. Customers can track all 50 companies in this Expert Collection.

Please click to enlarge.

Key Takeaways on the Digital Health 50

1. Healthcare is shifting from reactive to preventive care, with earlier detection and remote access redefining when and where intervention occurs.

Multiple companies on this year’s list are enabling earlier disease detection through AI-powered diagnostics, comprehensive health screenings, and continuous monitoring. These include cardiovascular disease prediction from ECG data (Anumana), full-body preventive scans (Function Health, Neko Health), and at-home diagnostic testing (PocDoc, Teal Health).

Virtual and telehealth platforms are making preventive and specialty care more accessible by bringing clinical expertise outside hospitals and clinics. These companies provide 24/7 access to specialized services like neurology (Sevaro, Isaac Health), maternal health (Delfina), and nutrition counseling (Nourish, Fay Nutrition), while others are removing geographic barriers through mobile and home-based care (Sprinter Health).

This shift toward prevention resonates with investors as well. Leila Zegna, Founding General Partner at Kindred Capital, a lead investor in Sohar Health, sees it as a strategic imperative:

“We’ve seen an enormous wave of behavior change with patients taking accountability for their own health care outcomes, and we now have the tools to enable people to do that. It is the dream of moving from sick care to true health care…I think those are really promising technologies that we as a society and as a group of venture capitalists should really try and support because they do well and they do good at the same time.”

2. Workflow automation tools are tackling provider burnout and workforce shortages.

Physician burnout costs the US healthcare system an estimated $4.6B annually. It contributes to severe workforce shortages, with 31 out of 35 physician specialties facing ongoing gaps. Rural areas are hit hardest, and by 2037, non-metro areas are projected to face a 60% shortage of physicians.

Many of this year’s Digital Health 50 focus on reducing provider burnout and streamlining workflows. Ambient documentation tools, which automate clinical notes, continue to attract significant capital. Companies Ambience, Freed, and Nabla earned spots on this year’s list, with Ambience and Nabla securing 11 combined business relationships this year and Freed differentiating through its focus on small clinics, now serving nearly 25,000 clinicians.

Beyond documentation, tools addressing hospital operations are also making an impact. AssistIQ reduces the time OR staff spend locating and recording surgical supplies, while CalmWave addresses alarm fatigue. These tools simplify clinical workflows and free up time for meaningful patient interactions.

Investors see this moment as a convergence point. Katheleen Eva of StandUp Ventures, who led AssistIQ’s seed round, notes:

“I think [healthcare] is largely under digitized and that means that there is a huge opportunity because as technology becomes easier to implement and get going, coupled with some of the new AI advancements with respect to computer vision and other sort of multimodal aspects, I think that it’s a combination of the technology is now so powerful and the customer is now ready.”

3. AI is becoming embedded in healthcare, but its regulatory environment demands purpose-built infrastructure.

This year’s 50 companies include 47 developing AI solutions, up from 36 in 2024. They are building the compliance, safety, and governance systems critical to AI adoption in healthcare.

Yet, adoption remains hindered by trust gaps. Sooah Cho, Partner at SignalFire, a lead investor in Qualified Health, points to research showing:

“… a lot of providers, like 84%, had lacked confidence in ability to trust AI, and more than 70% of healthcare employees were just using generative AI tools on their own via undercover use.”

This creates major risks of regulatory liability and potential leakage of protected health information (PHI).

Addressing these concerns requires AI systems purpose-built for healthcare’s unique requirements. Hippocratic AI is developing large language models designed specifically for healthcare with clinical safety validation, recognizing that general-purpose AI can’t meet the stringent requirements of regulated environments where errors have serious consequences.

Equally critical is the infrastructure that enables safe AI deployment. Companies are building platforms for AI governance and oversight (Qualified Health), clinical data abstraction (Carta Healthcare), and patient consent management (HealthEx). These foundational layers ensure compliance, data quality, and the trust necessary for AI adoption in heavily regulated healthcare environments.

4. Voice AI agents are healthcare’s new front door, automating phone-based workflows from patient scheduling to insurance verification calls.

Voice AI is one of the fastest-growing areas in AI development — platforms have raised nearly $400M in funding in 2025 and account for the fastest-growing headcounts among early-stage genAI companies. Healthcare’s heavy reliance on phone communication makes it a natural fit for this technology.

Companies are deploying voice AI agents for appointment scheduling and care navigation (Assort Health), billing inquiries (Hyro), ongoing patient engagement (Kouper Health, Ellipsis Health), and post-discharge follow-ups (Hippocratic AI). These systems handle high-volume routine interactions 24/7, addressing the expense and bottlenecks of traditional call centers so staff can focus on cases that require human expertise.

The technology is also automating time-intensive administrative tasks for providers, including calling insurance companies for benefit verification and prior authorizations (Infinitus Systems, Mandolin) — work that previously consumed significant staff hours. As these systems mature, they’re moving beyond scripted interactions toward adaptive, context-aware agents that handle complex conversations and integrate with existing healthcare IT systems.

Mosaic scores from the 2025 Digital Health 50 winners

| Group | Category | Company | Mosaic |

|---|---|---|---|

| Administrative operations | Governance & risk management | 1m | 625 |

| Administrative operations | Governance & risk management | HealthEx | 776 |

| Administrative operations | Governance & risk management | Qualified Health | 850 |

| Administrative operations | Revenue cycle management | Autonomize | 861 |

| Administrative operations | Revenue cycle management | Infinitus Systems | 872 |

| Administrative operations | Revenue cycle management | Mandolin | 802 |

| Administrative operations | Revenue cycle management | Plenful | 777 |

| Administrative operations | Revenue cycle management | Sohar Health | 796 |

| Administrative operations | Supply chain | AssistIQ | 806 |

| Administrative operations | Value-based care contracting | Arbital Health | 857 |

| Care delivery | Behavioral health | Frontera | 709 |

| Care delivery | EMS | Tele911 | 682 |

| Care delivery | In-home care | Sprinter Health | 737 |

| Care delivery | Longevity clinics | Function Health | 911 |

| Care delivery | Longevity clinics | Neko Health | 834 |

| Care delivery | Neurology | Isaac Health | 777 |

| Care delivery | Neurology | Sevaro | 792 |

| Care delivery | Nutrition | Fay | 875 |

| Care delivery | Nutrition | Nourish | 885 |

| Care delivery | Women’s health | Delfina | 817 |

| Clinical workflow automation | Ambient documentation | Ambience | 895 |

| Clinical workflow automation | Ambient documentation | Freed | 790 |

| Clinical workflow automation | Ambient documentation | Nabla | 909 |

| Clinical workflow automation | Care delivery infrastructure | CalmWave | 761 |

| Clinical workflow automation | Care delivery infrastructure | hellocare | 784 |

| Clinical workflow automation | Chart review & abstraction | Carta Healthcare | 743 |

| Clinical workflow automation | Chart review & abstraction | Layer Health | 830 |

| Clinical workflow automation | Clinical intelligence & support | Atropos Health | 832 |

| Clinical workflow automation | Clinical intelligence & support | Guidehealth | 808 |

| Clinical workflow automation | Clinical intelligence & support | Hippocratic AI | 888 |

| Clinical workflow automation | Clinical intelligence & support | XUND | 695 |

| Diagnostics & imaging | At-home testing | PocDoc | 708 |

| Diagnostics & imaging | At-home testing | Teal Health | 659 |

| Diagnostics & imaging | Cancer prognosis | Ataraxis | 846 |

| Diagnostics & imaging | Cardiac diagnostics | Anumana | 797 |

| Diagnostics & imaging | Interventional imaging | Mendaera | 800 |

| Diagnostics & imaging | Workflow automation | Gestalt Diagnostics | 776 |

| Diagnostics & imaging | Workflow automation | Rad AI | 863 |

| Drug discovery & development | Persist AI | 733 | |

| Drug discovery & development | PhaseV | 835 | |

| Drug discovery & development | Variational AI | 771 | |

| Health insurance | Fortuna Health | 705 | |

| Health insurance | Thatch | 846 | |

| Patient communication & engagement | Assort Health | 789 | |

| Patient communication & engagement | Ellipsis Health | 796 | |

| Patient communication & engagement | Hyro | 839 | |

| Patient communication & engagement | Kouper Health | 738 | |

| Senior care | August Health | 849 | |

| Senior care | Inspiren | 848 | |

| Senior care | SafelyYou | 866 |

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.