Investments

414Portfolio Exits

48Funds

3Partners & Customers

4About M12

M12 operates as Microsoft’s corporate venture capital fund focused on investing in early-stage companies across various sectors. The fund seeks to invest in companies that are developing business solutions. M12 primarily engages with the technology sector, looking for startups that match Microsoft's interests. M12 was formerly known as Microsoft Ventures. It was founded in 2016 and is based in San Francisco, California.

Expert Collections containing M12

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find M12 in 1 Expert Collection, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Research containing M12

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned M12 in 10 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

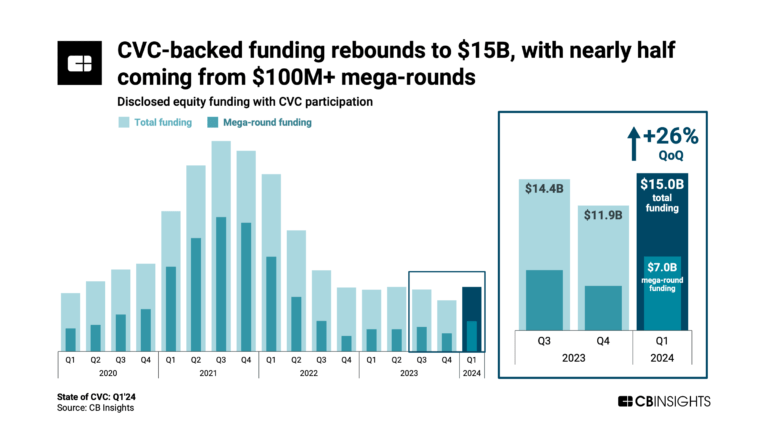

State of CVC Q1’25 Report

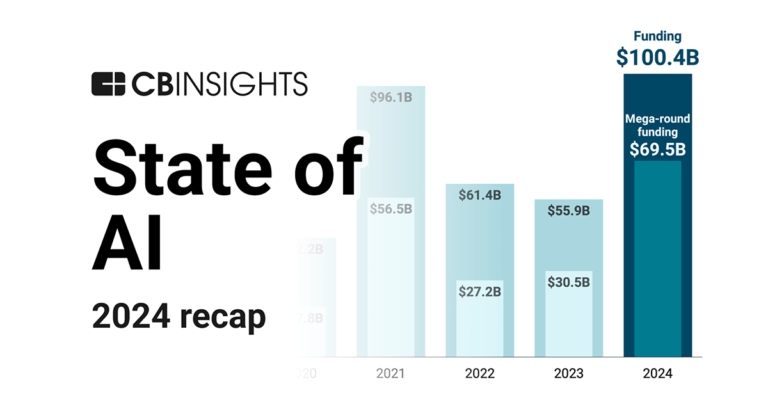

Jan 30, 2025 report

State of AI Report: 6 trends shaping the landscape in 2025

May 16, 2024 report

State of CVC Q1’24 Report

Mar 26, 2024

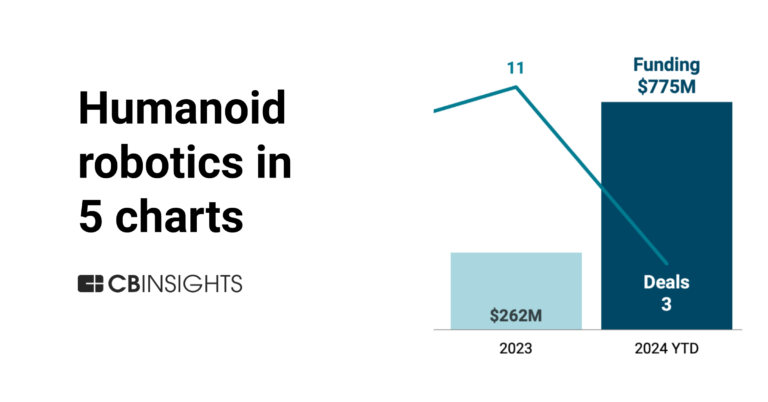

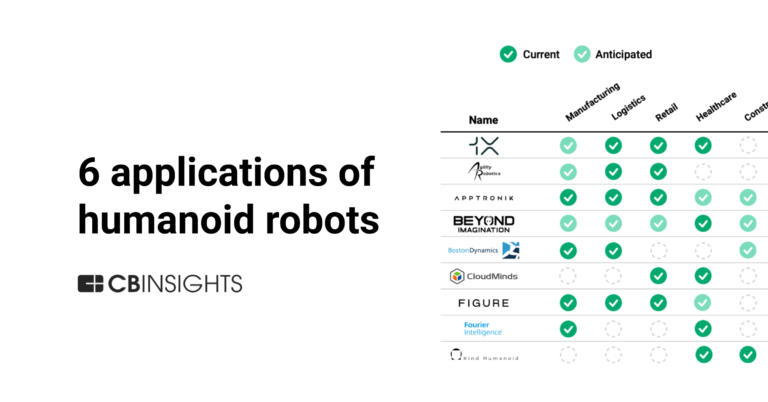

6 applications of humanoid robots across industries

Feb 5, 2024

6 cybersecurity markets gaining momentum in 2024Latest M12 News

Nov 7, 2025

Du joins Microsoft’s VC investment arm Nov 7, 2025 • Kim Moore Alan Du has worked in venture, operations and advisory in the tech ecosystem. Alan Du, former partner at PayPal Ventures, has joined M12, Microsoft’s corporate venture unit, as an investment partner. Du had worked at PayPal Ventures, the investment unit of the US payments tech company, since 2020. While there, he made several notable investments including in Cart.com, Skipify, Arkose Labs and Deep Instinct. He is also an angel investor. Before PayPal, Du worked at VC firms and in investment banking. He also helped launch app developer Docker’s first office in Asia. Du will work as a partner in M12’s early-stage investing team. Kim Moore Kim Moore is the editor of Global University Venturing and deputy editor of Global Corporate Venturing and produces video for the website.

M12 Investments

414 Investments

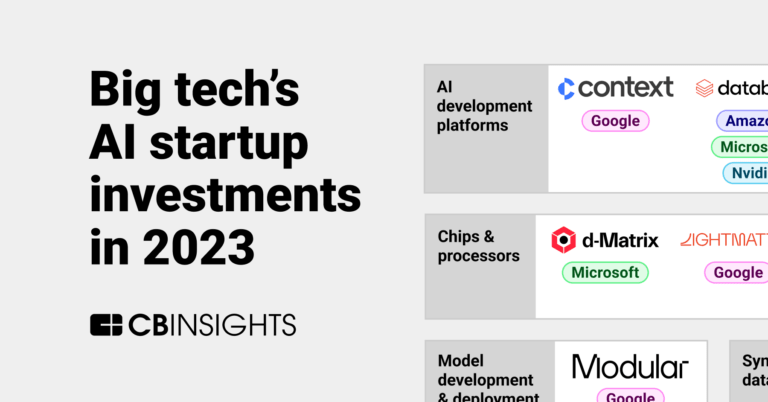

M12 has made 414 investments. Their latest investment was in d-Matrix as part of their Series C on November 12, 2025.

M12 Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/12/2025 | Series C | d-Matrix | $275M | No | Bullhound Capital, EDBI, Industry Ventures, Mirae Asset Financial Group, Nautilus Venture Partners, Qatar Investment Authority, Temasek, and Triatomic Capital | 3 |

11/6/2025 | Seed VC - II | Inception Labs | $50M | Yes | Andrej Karpathy, Andrew Ng, Databricks Ventures, Innovation Endeavors, Mayfield, Menlo Ventures, NVentures, Snowflake Ventures, and Undisclosed Investors | 5 |

10/21/2025 | Series A - II | etalytics | $9.29M | Yes | Alstin Capital, BMH Beteiligungs-Managementgesellschaft Hessen, and ebm-papst | 3 |

9/11/2025 | Series B | |||||

9/4/2025 | Series A |

Date | 11/12/2025 | 11/6/2025 | 10/21/2025 | 9/11/2025 | 9/4/2025 |

|---|---|---|---|---|---|

Round | Series C | Seed VC - II | Series A - II | Series B | Series A |

Company | d-Matrix | Inception Labs | etalytics | ||

Amount | $275M | $50M | $9.29M | ||

New? | No | Yes | Yes | ||

Co-Investors | Bullhound Capital, EDBI, Industry Ventures, Mirae Asset Financial Group, Nautilus Venture Partners, Qatar Investment Authority, Temasek, and Triatomic Capital | Andrej Karpathy, Andrew Ng, Databricks Ventures, Innovation Endeavors, Mayfield, Menlo Ventures, NVentures, Snowflake Ventures, and Undisclosed Investors | Alstin Capital, BMH Beteiligungs-Managementgesellschaft Hessen, and ebm-papst | ||

Sources | 3 | 5 | 3 |

M12 Portfolio Exits

48 Portfolio Exits

M12 has 48 portfolio exits. Their latest portfolio exit was Nextbillion.ai on October 01, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/1/2025 | Acquired | 2 | |||

8/22/2025 | Acquired | 7 | |||

5/14/2025 | Acquired | 12 | |||

Date | 10/1/2025 | 8/22/2025 | 5/14/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 7 | 12 |

M12 Fund History

3 Fund Histories

M12 has 3 funds, including Microsoft Ventures AI Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

Microsoft Ventures AI Fund | 1 | ||||

M12 Europe Fund | |||||

GitHub Fund |

Closing Date | |||

|---|---|---|---|

Fund | Microsoft Ventures AI Fund | M12 Europe Fund | GitHub Fund |

Fund Type | |||

Status | |||

Amount | |||

Sources | 1 |

M12 Partners & Customers

4 Partners and customers

M12 has 4 strategic partners and customers. M12 recently partnered with Incentive on April 4, 2015.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

4/21/2015 | Vendor | United States | LOS ANGELES -- April 21 , 2015 -- Incentive , a leading provider of a complete , socially powered enterprise collaboration platform for mid-market organizations and enterprise teams , today announced it has joined Microsoft , a global initiative empowering entrepreneurs around the world on their journey to build great companies . | 1 | |

11/3/2013 | Partner | ||||

Partner | |||||

Partner |

Date | 4/21/2015 | 11/3/2013 | ||

|---|---|---|---|---|

Type | Vendor | Partner | Partner | Partner |

Business Partner | ||||

Country | United States | |||

News Snippet | LOS ANGELES -- April 21 , 2015 -- Incentive , a leading provider of a complete , socially powered enterprise collaboration platform for mid-market organizations and enterprise teams , today announced it has joined Microsoft , a global initiative empowering entrepreneurs around the world on their journey to build great companies . | |||

Sources | 1 |

M12 Team

17 Team Members

M12 has 17 team members, including current Chief Operating Officer, Oriona Spaulding.

Name | Work History | Title | Status |

|---|---|---|---|

Oriona Spaulding | Chief Operating Officer | Current | |

Name | Oriona Spaulding | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Operating Officer | ||||

Status | Current |

Compare M12 to Competitors

Google Ventures operates as a venture capital firm investing in various sectors, including life sciences, consumer, enterprise, cryptocurrency, climate, and frontier technology. The firm provides financial backing and resources to startups and connects them with Google. It was founded in 2009 and is based in Mountain View, California.

Bosch Venture operates as a venture capital firm focused on early-stage companies in the technology sector. It provides financial investment and mentorship. It was founded in 2007 and is based in Gerlingen-Schillerhohe, Germany.

SoftBank Investment Advisers engages in technology investment within the venture capital industry. The company invests in hardware, infrastructure, and applications that are part of the artificial intelligence (AI) technology ecosystem. Its portfolio includes companies that utilize AI across various sectors. It was founded in 2017 and is based in London, United Kingdom.

Hitachi Ventures operates as the global venture capital arm of Hitachi Group. It scouts for startups in industries of strategic relevance for Hitachi, such as healthcare, environment, and future social businesses. It invests invest in Europe, Israel, and North America. It was founded in 2019 and is based in Munich, Germany.

Next47 focuses on investing in early and expansion-stage companies within the technology sector. The firm specializes in providing capital, domain expertise, and strategic resources to founders developing software as a service (SaaS), artificial intelligence (AI), and enterprise solutions. Next47 primarily serves the technology startup ecosystem, offering support to companies that are innovating and creating new categories in enterprise technology. Next47 was formerly known as Siemens Venture Capital. It was founded in 2016 and is based in Palo Alto, California.

Allumia Ventures operates as a healthcare venture capital firm investing in digital health and technology-enabled healthcare services. The company seeks to align with its limited partners and serves sectors requiring healthcare ecosystem solutions. Allumia Ventures was formerly known as Providence Ventures. It was founded in 2015 and is based in Seattle, Washington.

Loading...