Investments

748Portfolio Exits

171Funds

7Partners & Customers

7About Qualcomm Ventures

Qualcomm Ventures operates as the venture capital arm of Qualcomm, focusing on investments in the technology sector. The company provides funding and support to mobile technology companies, focusing on internet of things (IoT), connected automotive, artificial intelligence (AI), consumer, enterprise, and cloud. Qualcomm Ventures connects entrepreneurs with resources and relationships. It was founded in 2000 and is based in San Diego, California.

Expert Collections containing Qualcomm Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Qualcomm Ventures in 5 Expert Collections, including AR/VR.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Qualcomm Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

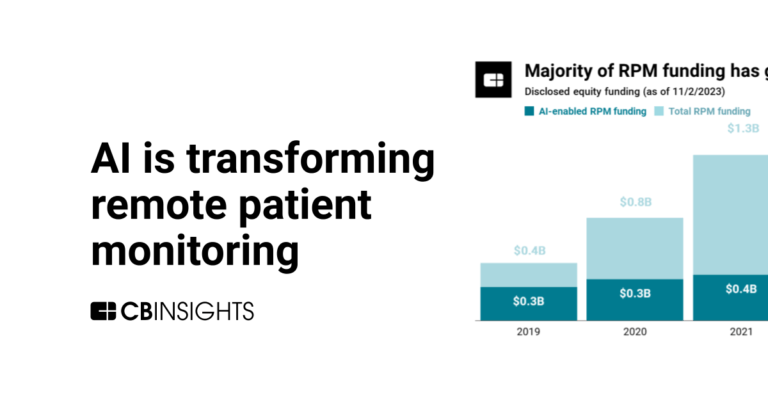

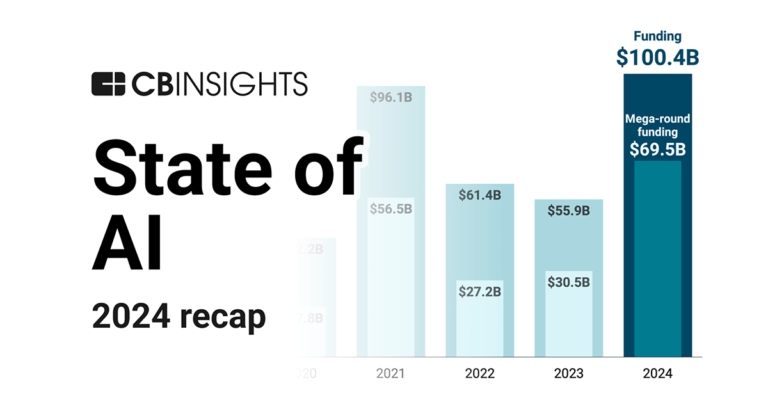

CB Insights Intelligence Analysts have mentioned Qualcomm Ventures in 4 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

State of CVC Q1’25 Report

Jan 30, 2025 report

State of AI Report: 6 trends shaping the landscape in 2025

May 29, 2024

483 startup failure post-mortemsLatest Qualcomm Ventures News

Nov 14, 2025

AMD Ventures の責任者 Sagi Paz 氏 「今回の Classiq への投資は、異種混合(ヘテロジニアス)コンピューティングの未来を加速するという当社の重点領域を体現するものです。ハイレベルな量子ソフトウェアは、量子と従来型HPC システムをシームレスに統合するうえで重要な役割を果たすと考えており、Classiq と協力することで、この融合を支えるソフトウェア エコシステムをさらに強化していくことを期待しています。」 Qualcomm Ventures Israel and Europe のマネージングディレクター Boaz Peer氏 「量子技術が進化する中で、業界全体でイノベーションをスケールさせていくためには、ソフトウェアレイヤーが不可欠です。Classiq のプラットフォームは、高度な処理を行うエッジと、クラウドと連携して動作するシステムの実現という当社のビジョンに合致しています。量子開発をよりアクセスしやすく、モダリティ依存度が低く、多様なワークロードに最適化されたものにする同社の取り組みを支援できることを大変嬉しく思います。」 IonQのQuantum Networking, Sensing, and Security 部門 プレジデント兼ゼネラルマネージャー Jordan Shapiro氏 「IonQ の量子コンピュータは世代を重ねるごとに業界をリードし続けていますが、ブレークスルーとなるアプリケーションの構築において量子ソフトウェアの役割はますます重要になっています。IonQ の Classiq への投資と協業により、顧客と共に最先端のアプリケーションを構築し、複雑な量子アルゴリズムを実用的でエンタープライズ対応のソリューションへと変換し、当社の世界記録を更新し続けるハードウェアの価値を最大化できます。」 Mirae Asset Capital ベンチャー投資部門のシニアマネージャー Jinwoo Lee 氏 「韓国では量子技術への勢いが加速しており、研究を現実のアプリケーションにつなげていくうえでソフトウェアは不可欠です。Classiq の成長に参加できることを嬉しく思います。Classiq のプラットフォームは量子アルゴリズムの設計と実行を大幅に簡素化し、エコシステム全体での迅速かつ広範な採用を実現すると信じています。」 今後の展望 Classiq は、グローバルなGTM(Go-To-Market)活動の強化、主要な企業および公的機関との連携拡大、そして増大する需要に合わせたサポートと導入支援強化を通じて、さらなるスケールアップを目指します。 量子コンピューティングの力を引き出すための「業界スタンダードのソフトウェアプラットフォーム」として、Classiq はクライアントの量子チーム立ち上げにおける迅速なトレーニング・オンボーディング・スケーリング、高度な専門家向けの実装・最適化、量子ハードウェアリーダーやクラウドプロバイダ、高性能計算(HPC)環境との密接な統合を組み合わせて提供しています。このアプローチにより、さらに多くの企業が量子実験段階から実用化・価値創出の段階へと移行することを引き続き支援します。 NVIDIA、Microsoft、AWS といったテクノロジーリーダーとの連携や、BMW Group、Comcast、Rolls Royce、SoftBank などの顧客との取り組みを踏まえ、Classiq は実用的でスケーラブルな量子コンピューティングのためのソフトウェア基盤としての地位を確立しつつあります。アルゴリズム設計、ソフトウェア最適化、導入・展開を世界最先端の計算基盤に橋渡しする存在となっています。 *本件は、東部標準時2025年11月13日にイスラエル・テルアビブにて発表されたプレスリリースの抄訳です。英語原文は こちら をご覧ください。 このプレスリリースには、メディア関係者向けの情報があります

Qualcomm Ventures Investments

748 Investments

Qualcomm Ventures has made 748 investments. Their latest investment was in Classiq as part of their Series C - III on November 13, 2025.

Qualcomm Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/13/2025 | Series C - III | Classiq | $30M | Yes | AMD Ventures, Bank Leumi, IonQ, Mirae Asset Capital, and Quantum Eretz | 3 |

10/29/2025 | Series B | Vammo | $45M | Yes | 2150, Construct Capital, Ecosystem Integrity Fund, Endeavor Catalyst, Maniv Mobility, MONASHEES, and Undisclosed Angel Investors | 3 |

9/17/2025 | Seed VC | Upscale AI | $100M | Yes | Celesta Capital, Cota Capital, Maverick Silicon, Mayfield, MVP Ventures, Stanford University, Stepstone Group, and Xora Innovation | 4 |

9/17/2025 | Seed VC - II | |||||

9/16/2025 | Series C |

Date | 11/13/2025 | 10/29/2025 | 9/17/2025 | 9/17/2025 | 9/16/2025 |

|---|---|---|---|---|---|

Round | Series C - III | Series B | Seed VC | Seed VC - II | Series C |

Company | Classiq | Vammo | Upscale AI | ||

Amount | $30M | $45M | $100M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | AMD Ventures, Bank Leumi, IonQ, Mirae Asset Capital, and Quantum Eretz | 2150, Construct Capital, Ecosystem Integrity Fund, Endeavor Catalyst, Maniv Mobility, MONASHEES, and Undisclosed Angel Investors | Celesta Capital, Cota Capital, Maverick Silicon, Mayfield, MVP Ventures, Stanford University, Stepstone Group, and Xora Innovation | ||

Sources | 3 | 3 | 4 |

Qualcomm Ventures Portfolio Exits

171 Portfolio Exits

Qualcomm Ventures has 171 portfolio exits. Their latest portfolio exit was Locus on October 07, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/7/2025 | Acq - Fin | 5 | |||

9/25/2025 | Acquired | 4 | |||

7/1/2025 | Acquired | 2 | |||

Date | 10/7/2025 | 9/25/2025 | 7/1/2025 | ||

|---|---|---|---|---|---|

Exit | Acq - Fin | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 5 | 4 | 2 |

Qualcomm Ventures Fund History

7 Fund Histories

Qualcomm Ventures has 7 funds, including Qualcomm BNDES Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/13/2020 | Qualcomm BNDES Fund | $19.31M | 2 | ||

11/28/2018 | Qualcomm AI Fund | ||||

9/27/2015 | Qualcomm India Startup Fund | ||||

7/1/2015 | Qualcomm South Korea Startup Fund | ||||

1/11/2015 | Qualcomm Life |

Closing Date | 1/13/2020 | 11/28/2018 | 9/27/2015 | 7/1/2015 | 1/11/2015 |

|---|---|---|---|---|---|

Fund | Qualcomm BNDES Fund | Qualcomm AI Fund | Qualcomm India Startup Fund | Qualcomm South Korea Startup Fund | Qualcomm Life |

Fund Type | |||||

Status | |||||

Amount | $19.31M | ||||

Sources | 2 |

Qualcomm Ventures Partners & Customers

7 Partners and customers

Qualcomm Ventures has 7 strategic partners and customers. Qualcomm Ventures recently partnered with Arriver on January 1, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

1/5/2022 | Partner | United States | 1 | ||

1/4/2022 | Partner | ||||

3/23/2021 | Partner | ||||

2/4/2021 | Partner | ||||

1/9/2017 | Partner |

Date | 1/5/2022 | 1/4/2022 | 3/23/2021 | 2/4/2021 | 1/9/2017 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | ||||

News Snippet | |||||

Sources | 1 |

Qualcomm Ventures Team

13 Team Members

Qualcomm Ventures has 13 team members, including current Senior Vice President, Quinn Li.

Name | Work History | Title | Status |

|---|---|---|---|

Quinn Li | IBM, Broadcom, and Lucent Technologies | Senior Vice President | Current |

Name | Quinn Li | ||||

|---|---|---|---|---|---|

Work History | IBM, Broadcom, and Lucent Technologies | ||||

Title | Senior Vice President | ||||

Status | Current |

Compare Qualcomm Ventures to Competitors

Samsung Ventures operates as the venture investment arm of Samsung Group, focusing on technologies and industries through venture capital. The company invests in anticipatory technologies and industries to support the growth of a venture ecosystem. Samsung Ventures aims to contribute to society and the group. It was founded in 1999 and is based in Seoul, South Korea.

Sony Innovation Fund operates as a venture capital initiative focused on investing in early-stage companies within the technology, content, and services sectors. The fund provides investment and access to Sony's global network, fostering business creation and innovation in various areas of interest to Sony, including entertainment, health, and emerging technologies. It primarily targets seed to Series B funding stages for consumer and enterprise-facing businesses. It was founded in 2016 and is based in Tokyo, Japan.

Samsung NEXT operates as a venture capital firm investing in technology sectors, including artificial intelligence, healthtech, consumer services, and frontier technology. The company focuses on funding founders who are developing innovations and applying technologies to various use cases, improving health management and consumer experiences. It primarily invests in startups that are active in the technology landscape. Samsung NEXT was formerly known as Samsung Global Innovation Center. It was founded in 2012 and is based in Mountain View, California.

Toyota Ventures operates as an early-stage venture capital arm of Toyota, focusing on frontier and climate technologies. The company invests in artificial intelligence, autonomy, mobility, robotics, cloud technology, smart cities, digital health, fintech, materials, and climate technologies aimed at carbon neutrality. Toyota Ventures provides support to its portfolio companies, utilizing Toyota's expertise and resources. Toyota Ventures was formerly known as Toyota AI Ventures. It was founded in 2017 and is based in Los Altos, California.

Andreessen Horowitz invests in technology companies across various stages and sectors, including consumer, enterprise, bio/healthcare, crypto, fintech, and games industries. It was founded in 2009 and is based in Menlo Park, California.

Hitachi Ventures operates as the global venture capital arm of Hitachi Group. It scouts for startups in industries of strategic relevance for Hitachi, such as healthcare, environment, and future social businesses. It invests invest in Europe, Israel, and North America. It was founded in 2019 and is based in Munich, Germany.

Loading...