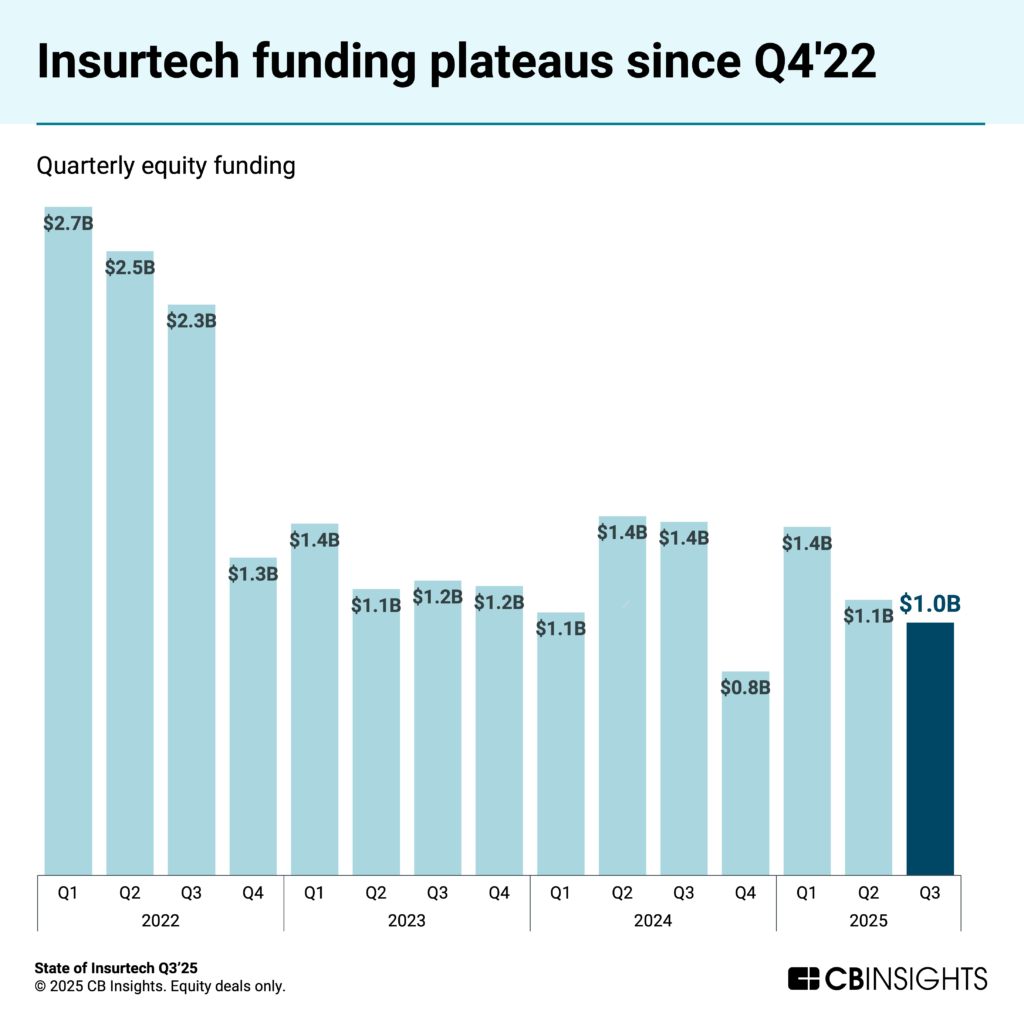

Insurtech dealmaking is consolidating, marked by fewer investors and startups in recent quarters. At the same time, insurtech funding has plateaued over the past 12 quarters, including $1.0B in funding raised by insurtechs in Q3’25.

Even so, the industry’s strongest startups face favorable business conditions, as insurtech M&A exits reached a recent high in Q3’25.

Even so, the industry’s strongest startups face favorable business conditions, as insurtech M&A exits reached a recent high in Q3’25.

Below, we break down the key takeaways from this quarter’s report, including:

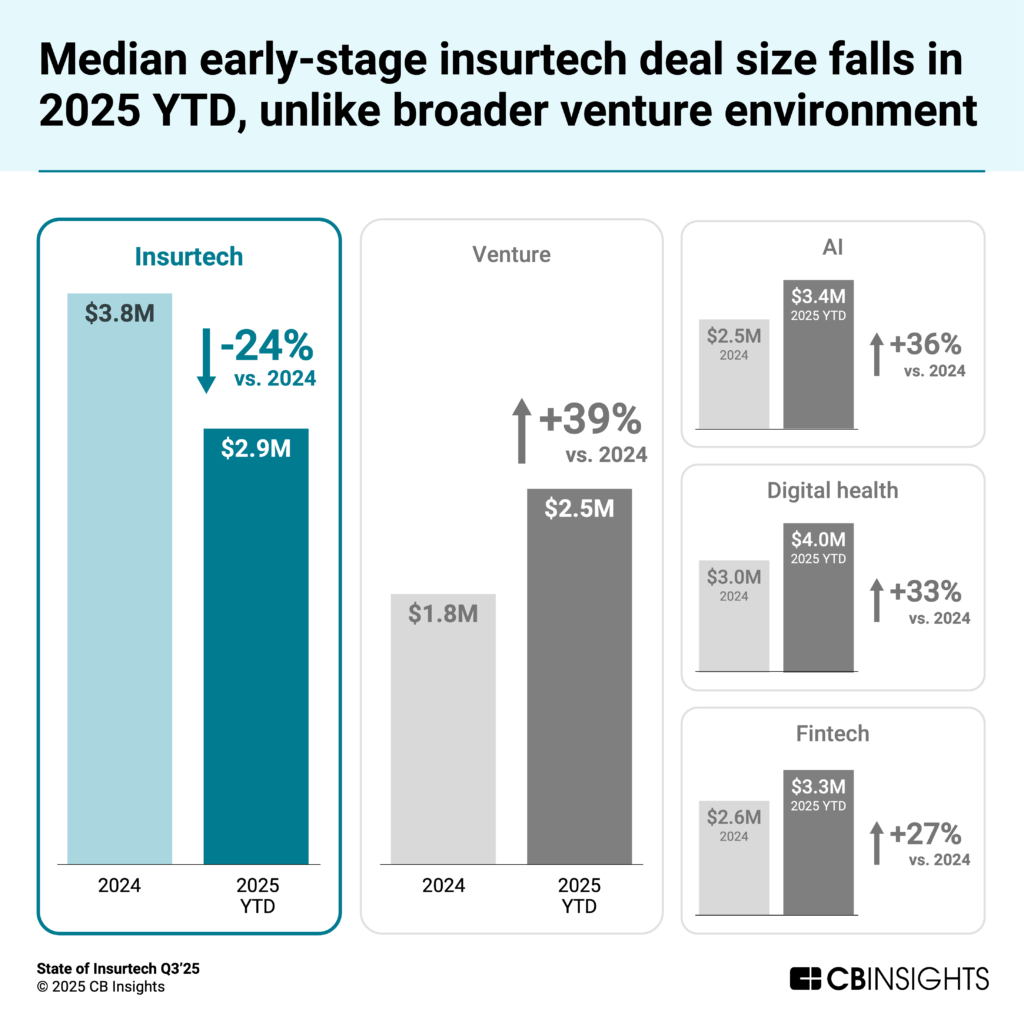

- Median early-stage insurtech deal size shrinks, thinning innovation pipeline

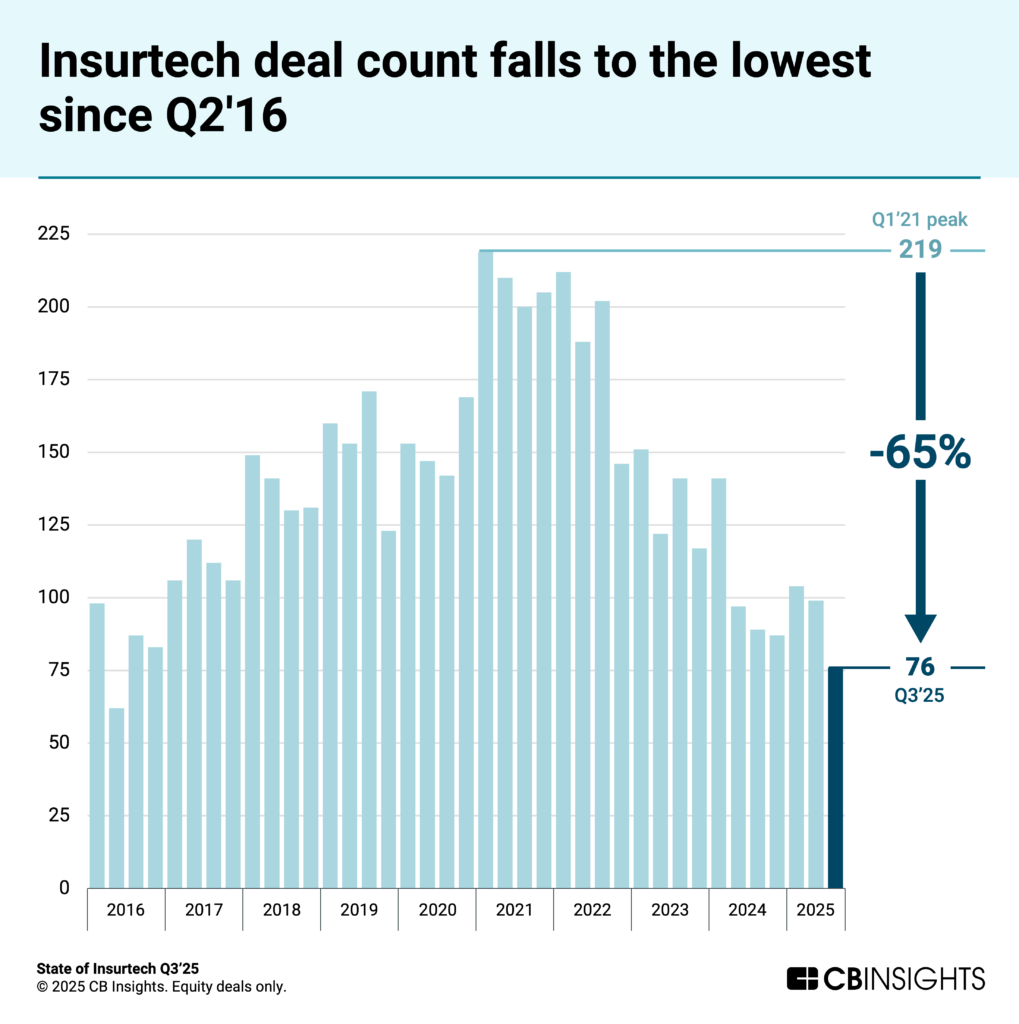

- Insurtech deal count hits 9-year low

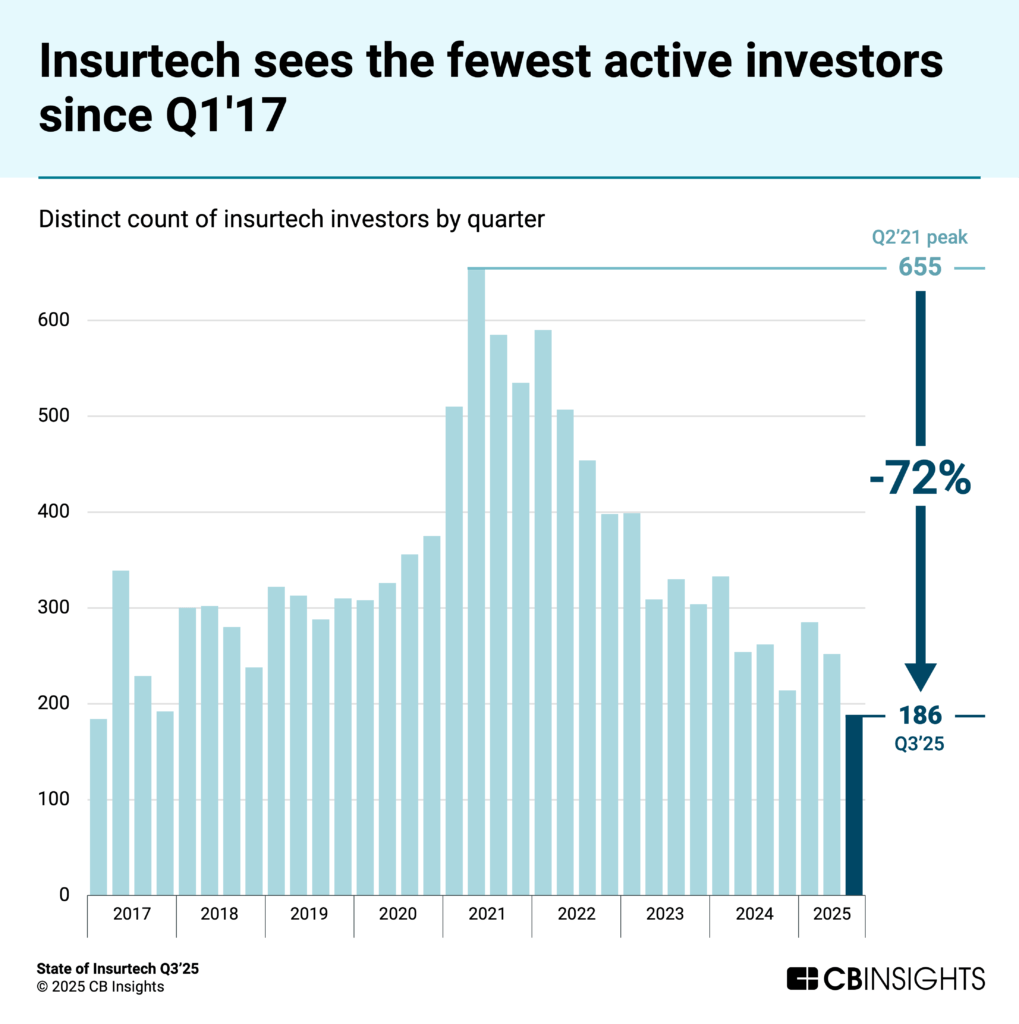

- Insurtech sees the fewest active investors since Q1’17

- Insurtech M&A activity reaches a 3-year high

Download the full report to access comprehensive data and charts on the evolving state of insurtech.

Median early-stage insurtech deal size shrinks, thinning innovation pipeline

Insurtechs are scaling with less capital as median early-stage insurtech deal size fell 24% year-over-year (YoY), from $3.8M in 2024 to $2.9M year-to-date (YTD) in 2025. The drop reverses much of the early-stage growth seen between 2023 and 2024, signaling a tougher environment for seed-stage insurtechs looking to raise Series A and B funding.

In contrast, the broader venture environment has seen median early-stage deal size increase 39% YoY as investors redirect capital to more AI-driven sectors, including capital-intensive markets like humanoid robots.

Insurtech’s early-stage pipeline continues to narrow. In 2025 YTD, only 60% of all deals have gone to early-stage startups — the lowest share since 2011 and down from 72% in 2022, 66% in 2023, and 64% in 2024.

Future implication: Reduced early-stage insurtech dealmaking weakens the pipeline for potential acquirers, who will increasingly need to identify and assess promising acquisition targets earlier than the competition.

Insurtech deal count hits 9-year low

Insurtech deal count fell to just 76 in Q3’25 — the lowest level since 2016 and 65% below the Q1’21 peak of 219 deals. Both property and casualty (down from 65 to 56 deals) and life and health (34 to 18) saw quarter-over-quarter declines, reflecting a broader slowdown in the venture environment.

Despite fewer deals, insurtech funding is generally stable, averaging $1.2B per quarter since Q4’22, suggesting a more selective environment. Unless there is a significant surge in deal activity or a resurgence of $100M+ mega-rounds, funding levels are likely to remain close to $1B per quarter.

Future implication: Incumbents should closely monitor recently-funded insurtechs, as many exhibit operational strength. Insurtechs with 10+ employees that raised in Q3’25 grew headcount 15.8% over 12 months, signaling capital flows to companies with measurable traction.

Insurtech sees the fewest active investors since Q1’17

Investor count peaked in Q2’21 at 655 and has since fallen by 72% to hit 186 in Q3’25, mirroring the broader venture pullback that leaves insurtechs competing in a smaller funding pool.

Commitment to the sector is also waning. In Q3’25, only 4 investors made 2 or more insurtech investments: American Family Ventures, ManchesterStory Group, Munich Re Ventures, and OperaTech Ventures — the fewest in over 10 years, and down sharply from the 13 last quarter.

Future implication: Established insurance companies (and tech vendors) have a rare opportunity to engage more closely with emerging insurtechs given reduced competition for attention from investors.

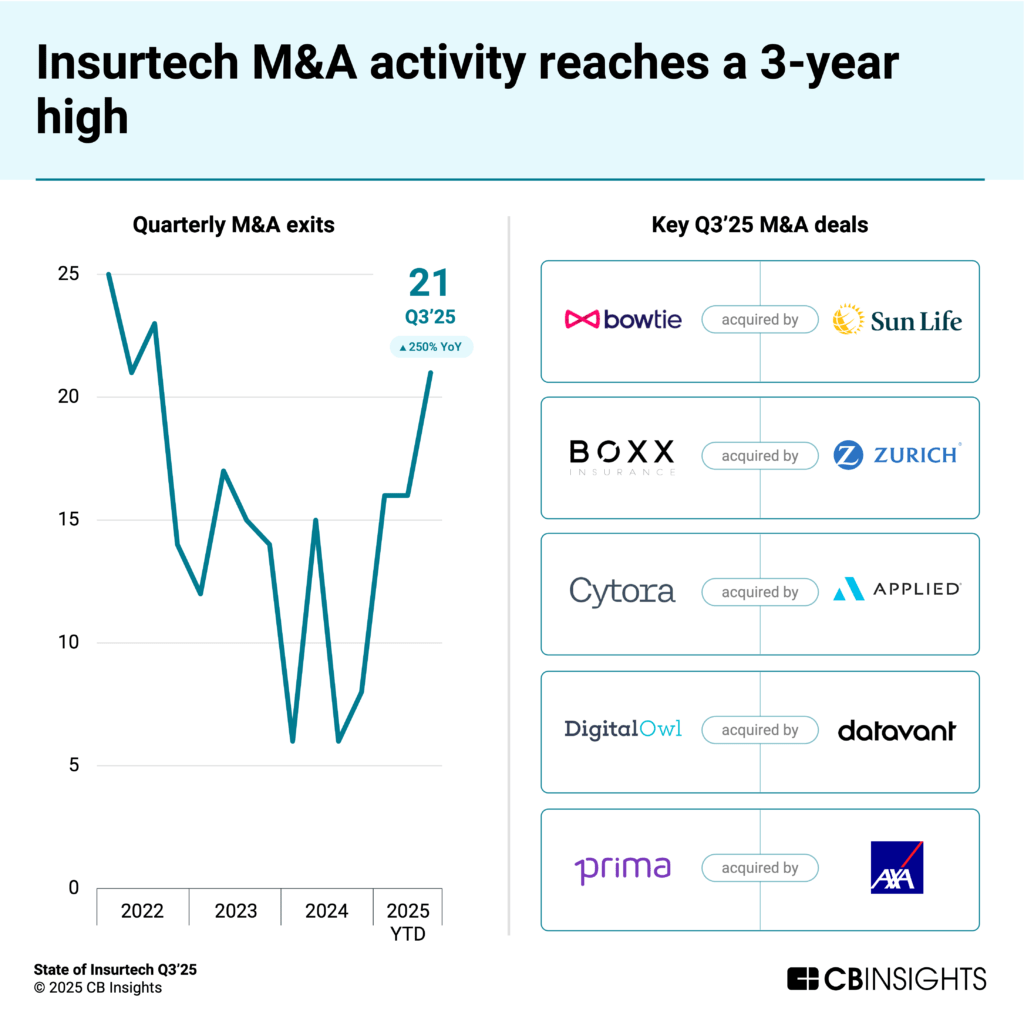

Insurtech M&A activity reaches a 3-year high

Insurtech M&A increased from 16 in Q2’25 to 21 in Q3’25, the most since Q3’22 (23). The increase reverses the trend of decreasing M&A activity within insurtech between 2022 and 2024, signaling increased confidence in the industry’s startups.

5 key acquisitions occurred in Q3’25:

- Hong Kong-based health insurer and 2024 Insurtech 50 winner Bowtie was acquired in a corporate majority deal by Sun Life.

- Canada-based cyber MGA BOXX Insurance was acquired by Zurich Insurance Group.

- Cytora, an AI claims and underwriting processing platform, was acquired by Applied Systems.

- DigitalOwl, an AI medical review platform and 2024 Insurtech 50 winner, was acquired by Datavant.

- Italy-based Prima Assicurazioni, a personal lines MGA, was acquired in a corporate majority deal by AXA at a $1.1B valuation.

In addition, risk transfer exchange Accelerant raised $0.7B in its IPO. The company was a 2023 and 2024 Insurtech 50 winner, placing it among the world’s most promising insurtech startups globally. 2025 is the first time since 2021 that insurtech has seen two consecutive quarters of IPO activity.

Future implication: None of the five listed acquisitions nor Accelerant completed a Series C+ round before exit, indicating that many successful insurtechs are favoring M&A or IPOs over late-stage fundraising.

MORE INSURTECH RESEARCH FROM CB INSIGHTS

- Insurtech 50: The most promising insurtech startups of 2025

- Book of Scouting Reports: 2025’s Insurtech 50

- Book of Scouting Reports: ITC Vegas 2025

- The insurance affordability outlook: Opportunities to alleviate insurance’s affordability problem with technology

- 100 real-world applications of genAI across financial services and insurance

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.