The insurance industry does not exist in a vacuum — neither do its top startups.

CB Insights has unveiled the 2025 Insurtech 50 list of the world’s most promising insurtech startups. The winners have a success probability among the global top 3% of private companies, signaled by a median CB Insights’ Mosaic score of 734 out of 1,000 (as of 9/30/2025). This benchmark is important because broader forces — such as AI agent commercialization and extreme weather events — influence the industry’s tech and underwriting considerations.

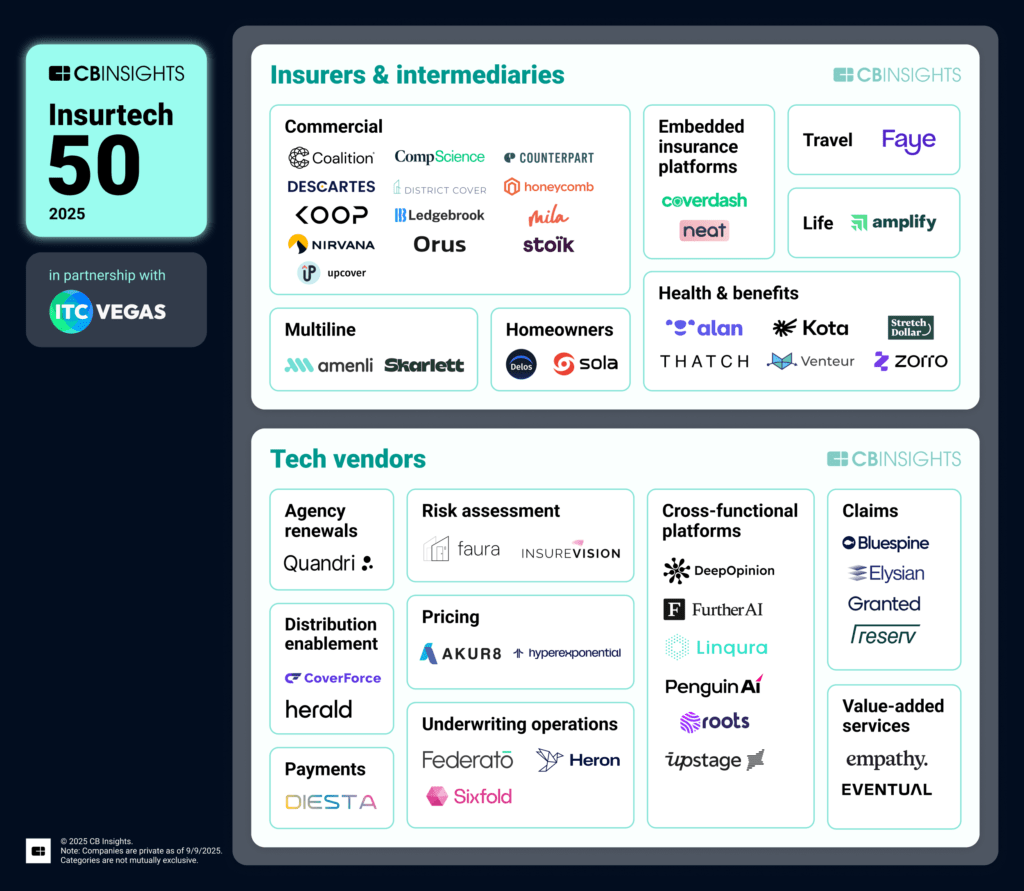

The 2025 Insurtech 50 includes 27 insurers and intermediaries and 23 tech vendors, which have collectively raised $3.6B in funding. 60% of the winners are early-stage insurtechs, a 20-percentage point increase from last year’s list. Nearly three-quarters of the winners were not in business at the start of the decade, signaling the opportunity for new entrants to shape the industry’s innovation landscape.

Utilizing CB Insights’ Strategy Terminal, the 50 winners were selected based on several factors, including CB Insights’ data and predictive signals on deal activity, industry partnerships, investor strength, hiring momentum, and outlook indicators like Commercial Maturity and Mosaic Scores. We also reviewed Analyst Briefings submitted directly to us by startups, and leveraged Scouting Reports powered by CB Insights’ Team of Agents.

Below, we map out the 50 winners, classifying them across 16 categories based on their core offering.

Please click to enlarge.

Key takeaways

1. Small and mid-sized businesses fuel growth opportunities for most insurers and intermediaries.

The winners include 13 insurtechs in the commercial category and 6 in the health and benefits category, which are primarily focused on small and mid-sized businesses (SMBs).

Most commercial-focused insurtechs offer coverage for specific SMB segments, like a16z-backed District Cover, which serves small businesses based in cities. Proactive risk management is also a focus for some of these companies. For instance, CompScience uses computer vision technology to reduce the likelihood of workplace injuries that could lead to workers’ compensation claims.

Four of the insurtechs in the health and benefits category are ICHRA (individual coverage health reimbursement arrangement) platforms: Stretch Dollar, Thatch, Venteur, and Zorro. ICHRA is an alternative to traditional employer-selected health plans in the US, where employers instead allocate money for their employees to select their preferred qualified plan individually. These plans are particularly attractive to SMBs. Chris Ellis, Founder and CEO of Thatch, highlighted the benefits for both employees and employers with us:

“…with Thatch, a defined contribution, employees get to choose [what] works best for them. It’s easier for employees to manage [and] it’s easier for employers to administer.”

Broadly, the ICHRA platforms market has seen favorable market development over the past year, with Mosaic scores (success probabilities) for market leaders steadily increasing.

2. Many tech vendors build products for insurers seeking to deploy AI agents.

AI agents are a widespread focus among tech vendors, which are loosely mapped across the insurance value chain — distribution, underwriting, operations, and claims. Examples of AI agent-focused companies include:

- Quandri, which offers AI agents to support insurance agency renewals.

- Sixfold, whose agents include an underwriting referral agent in October 2025.

- PenguinAi, a platform for payers (and providers) founded by the former Chief Data Officer of Kaiser Permanente and UnitedHealthcare.

- Elysian, a claims TPA with a focus on AI agent orchestration.

Workflow improvements to support decision-making are the primary focus for agentic AI deployment among the winners. Kasey Roh, US CEO of Upstage, shared the company’s near-term objective:

“Over the next 12 months, our focus is expanding [the] AI space from document extraction to workflow automation, transforming every step from intake and classification to data extraction, generation, and insight delivery through an agentic workflow.”

The focus on AI agents aligns with insurance companies’ broader appetite for the technology, with AIG Chairman and CEO Peter Zaffino repeatedly highlighting the company’s “agentic ecosystem” as an example on earnings calls. Broadly, revenue opportunities for AI agents are increasing for tech vendors, and the market momentum spans industries. For instance, professional services firms like Accenture, KPMG, and McKinsey are actively forming agentic AI partnerships.

3. Personal lines P&C trails commercial among the winners.

Just 7 Insurtech 50 winners have a primary focus on P&C personal lines. 4 of the companies are focused on homeowners insurance:

- Delos, a California-based managing general agent with differentiated wildfire risk models.

- Eventual, whose “Premium Lock” product offers reimbursement for potential premium increases.

- Faura, which offers models to support underwriting for climate- and weather-related risks.

- Sola, which offers parametric insurance for wind and hail events.

Otherwise, Faye is focused on travel insurance while Quandri is focused on insurance agencies. Just one company — State Farm Ventures-backed InsureVision — focuses on auto.

Broadly, auto and homeowners insurance face the greatest affordability pressure across P&C lines of business, so startups with differentiated, strong solutions in these spaces — like the Insurtech 50 winners — face favorable market conditions. As an example, Matt Perlman, Partner at IA Capital Group, notes Delos’ market strength:

“Delos brings a true paradigm shift in using advanced data analytics to understand wildfire behavior, not based solely on historical occurrence but dynamically as conditions change on the ground. … Their performance in the highly dislocated California market speaks for itself, and they have gained the trust of capital markets, rating agencies, and regulators as an innovator on behalf of homeowners and businesses in California and beyond.”

The 2024 Insurtech 50: Where are they now?

In the 12 months since publication, the 2024 Insurtech 50 winners posted notable accomplishments, including:

- 15 equity funding rounds.

- $422M in equity funding (i.e., 9% of global insurtech funding).

- 26% median headcount growth, directly resulting in 1,600+ new jobs.

- 4 exits — Accelerant, Bowtie, EvolutionIQ, and Next Insurance.

- 21-point increase in median Mosaic scores.

Mosaic scores from the 2025 Insurtech 50 winners

| Group | Category | Company | Mosaic |

|---|---|---|---|

| Insurers & intermediaries | Commercial | Coalition | 875 |

| Insurers & intermediaries | Commercial | CompScience | 841 |

| Insurers & intermediaries | Commercial | Counterpart | 677 |

| Insurers & intermediaries | Commercial | Descartes Underwriting | 757 |

| Insurers & intermediaries | Commercial | District Cover | 567 |

| Insurers & intermediaries | Commercial | Honeycomb | 813 |

| Insurers & intermediaries | Commercial | Koop Technologies | 601 |

| Insurers & intermediaries | Commercial | Ledgebrook | 827 |

| Insurers & intermediaries | Commercial | Mila | 712 |

| Insurers & intermediaries | Commercial | Nirvana | 837 |

| Insurers & intermediaries | Commercial | Orus | 683 |

| Insurers & intermediaries | Commercial | Stoik | 638 |

| Insurers & intermediaries | Commercial | Upcover | 747 |

| Insurers & intermediaries | Embedded insurance platforms | Coverdash | 688 |

| Insurers & intermediaries | Embedded insurance platforms | Neat | 701 |

| Insurers & intermediaries | Health & benefits | Alan | 787 |

| Insurers & intermediaries | Health & benefits | Kota | 790 |

| Insurers & intermediaries | Health & benefits | StretchDollar | 650 |

| Insurers & intermediaries | Health & benefits | Thatch | 855 |

| Insurers & intermediaries | Health & benefits | Venteur | 792 |

| Insurers & intermediaries | Health & benefits | Zorro | 707 |

| Insurers & intermediaries | Homeowners | Delos | 731 |

| Insurers & intermediaries | Homeowners | Sola | 560 |

| Insurers & intermediaries | Life | Amplify | 622 |

| Insurers & intermediaries | Multiline | Amenli | 516 |

| Insurers & intermediaries | Multiline | Skarlett | 692 |

| Insurers & intermediaries | Travel | Faye | 840 |

| Tech vendors | Agency renewals | Quandri | 700 |

| Tech vendors | Claims | Bluespine | 654 |

| Tech vendors | Claims | Elysian | 725 |

| Tech vendors | Claims | Granted Health | 617 |

| Tech vendors | Claims | Reserv | 785 |

| Tech vendors | Cross-functional platforms | DeepOpinion | 665 |

| Tech vendors | Cross-functional platforms | Further AI | 826 |

| Tech vendors | Cross-functional platforms | Linqura | 716 |

| Tech vendors | Cross-functional platforms | Penguin Ai | 726 |

| Tech vendors | Cross-functional platforms | Roots | 779 |

| Tech vendors | Cross-functional platforms | Upstage | 937 |

| Tech vendors | Distribution enablement | CoverForce | 746 |

| Tech vendors | Distribution enablement | Herald | 682 |

| Tech vendors | Payments | Diesta | 716 |

| Tech vendors | Pricing | Akur8 | 856 |

| Tech vendors | Pricing | Hyperexponential | 773 |

| Tech vendors | Risk assessment | Faura | 712 |

| Tech vendors | Risk assessment | InsureVision | 550 |

| Tech vendors | Underwriting operations | Federato | 829 |

| Tech vendors | Underwriting operations | Heron Data | 792 |

| Tech vendors | Underwriting operations | Sixfold | 762 |

| Tech vendors | Value-added services | Empathy | 892 |

| Tech vendors | Value-added services | Eventual | 746 |

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.